Communications satellites proliferate into an expanding multi-orbit domain

By RABINDRA “ROB” SINGH|December 2023

The Communications Systems Technical Committee is working to advance communications systems in space applications.

This year continued the expansion of satellite launches across multiple orbits. In August, BryceTech of Virginia reported that 2,500 satellites were launched in 2022, up from 1,800 in 2021 and 1,300 in 2020. Communications was the primary mission for 80% of those satellites.

For low-Earth orbit, constellations comprised the majority of launches. As of October, SpaceX launched 1,600 satellites for its Starlink broadband constellation, Eutelsat OneWeb of the U.K. launched 132 broadband satellites, Planet Labs of California 36 satellites, Swarm Technologies of California 12 and Spire Global of Virginia three. In October, the first two prototypes for Amazon’s planned Project Kuiper constellation were launched. Plans call for launching 1,800 satellites by mid-2026 and deploying all 3,236 by 2029.

There were a number of developments for emerging LEO direct-to-device service, in which satellites would provide communications directly to and from cellphones. Apple announced in February that it financed MDA of Canada to manufacture 17 Globalstar satellites, scheduled to be launched in 2025 to support iPhone SOS emergency services already rolling out via the existing Globalstar network. In January, Inmarsat of the U.K. announced an agreement with California-based Viasat to develop satellite connectivity for smartphones; Inmarsat of the U.K. and Viasat of California announced a similar agreement in April. In May, Texas-based AST SpaceMobile announced successful demonstrations with its BlueWalker3 prototype, proving that the satellite can relay calls in 4G and 5G. In August, Lynk Global of Virginia began direct-to-device 5G service via its three satellite “cell towers.” SpaceX committed to offering direct-to-smartphone service starting in 2024 with text and then voice and data in 2025.

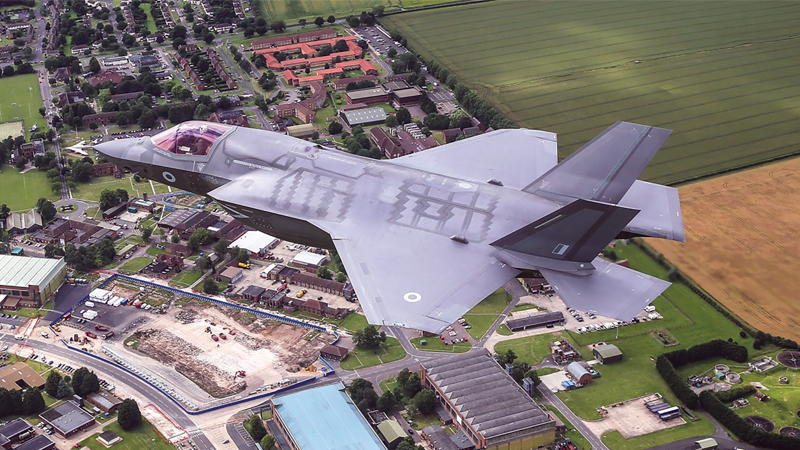

In April and September, a combined 28 Tranche 0 satellites were launched for the Space Development Agency’s Proliferated Warfighter Space Architecture. Following the 2022 awards for 126 transport and 35 tracking Tranche 1 satellites, SDA in August awarded contracts for a combined 72 Tranche 2 Transport Layer satellites to Northrop Grumman and Lockheed Martin and in October awarded contracts for another 100 Tranche 2 satellites to York Space Systems and Northrop Grumman.

In June, the European Commission selected a consortium made up of Airbus Defence and Space, Eutelsat, Hispasat, SES and Thales Alenia Space to build spacecraft for its planned IRIS2 multi-orbit constellation.

For medium-Earth orbit, the third and fourth SES O3B mPower satellites were launched in April. Electrical issues discovered shortly after launch prompted SES in October to announce that Boeing will build two additional O3B satellites for launch in 2026. The fifth and six O3B satellites were launched in November. In September, Intelsat reported that it will decide early next year whether to develop its own MEO constellation to provide communications services starting in 2027.

For geosynchronous equatorial orbit, large satellite builders continued to compete for orders. Fewer than 10 orders were placed this year, down from the average of 20 in past years. In July, Maryland-based Hughes Network Systems’ Jupiter 3 was launched, marking the heaviest communication satellite in orbit. The satellite, built by Maxar Technologies of Colorado, provides 500 gigabits per second for broadband services. Viasat struggled, announcing in August that its Viasat-Inmarsat-6 F2 launched in February suffered a total power loss. Also, its Viasat-Americas-3 satellite launched in May experienced partial loss due to an antenna failure. Fewer awards for flexible software-defined satellite solutions were made, including for Airbus Onesat and Thales Inspire satellites designed to provide operators flexibility and hedges against unpredictable market shifts. Fortunately, there was an increase in smaller, 1-2-kilowatt-class micro-GEO satellite awards for reduced services: The first Astranis satellite launched in May, and the company secured additional awards. Also in May, Inmarsat ordered three satellites from SWISSto12 of Switzerland.

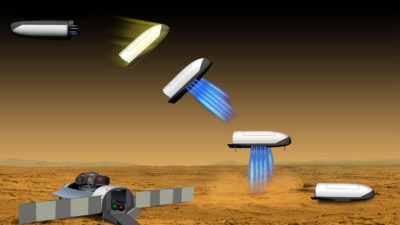

These advances in LEO, MEO and GEO pave the way for expanding applications into cislunar and lunar orbits, and the coalescence of nonterrestrial networks demonstrates this emerging integrated multi-orbit space domain and suite of communications services.