Stay Up to Date

Submit your email address to receive the latest industry and Aerospace America news.

No longer the sole purview of government space agencies and researchers, methane monitoring from space is emerging as a private-sector enterprise, with potential benefits for industry as well as climate science. Adam Hadhazy checks in with the market leaders.

This story has been updated to clarify the relationship between MethaneSAT and the Environmental Defense Fund.

In the fight against climate change, carbon dioxide looms as the top villain, but the baddest guy in any story often has a formidable top lieutenant — like Darth Vader to Emperor Palpatine in “Star Wars,” or Saruman to Sauron in “The Lord of the Rings.” For carbon dioxide, the accomplice is methane.

Colorless and odorless, methane is familiar to many of us as the principle component of natural gas. The largest single-sector contributor to global methane emissions from human activity is production of oil and gas, stemming from leakage during drilling and fracking, and the vast pipeline infrastructure that transports liquid and gaseous petroleum products, spanning 4.2 million kilometers in the U.S. alone. Other key methane sources include landfills, wastewater treatment plants and the agricultural industry, of which an infamously major component is burps from cattle and other livestock. All told, climate scientists deem methane responsible for about a quarter of the human-caused global temperature increase of 0.9 degrees Celsius (1.6 degrees Fahrenheit) since the late 19th century, with carbon dioxide accounting for the remaining 75%.

While carbon accordingly grabs the headlines, methane is increasingly getting its due. A flurry of new satellites custom-built to detect the gas in the atmosphere highlight the rising interest in better comprehending methane’s contribution and inspiring leakers to see the economic value in cleaning up their acts.

Historically, methane monitoring from orbit has been the purview of national and international governmental space agencies. Now for the first time, the private sector — namely Bluefield Technologies, a Silicon Valley startup, and Montreal-based GHGSat — as well as the nonprofit sector, led by the Environmental Defense Fund in New York, is getting involved. Though helping save the planet from a climatic catastrophe is certainly one motivation, for the private-sector entrants, profit motive is another. Oil and gas could, in the case of the for-profit companies, subscribe to the monitoring because of their economic incentives to rein in product loss, along with meeting new and future regulatory mandates, for instance in jurisdictions such as California. As for the regulators themselves, they could parse the satellite data to identify facilities in need of physical inspection or closer monitoring moving forward, as well as check against any self-reporting of emissions by industry.

The science case for remote methane monitoring from space, meanwhile, rests on the significant uncertainty still surrounding the relative contributions from methane’s various sources, both natural and artificial. Ballpark, humans are estimated as being responsible for 60% of global methane emissions, with natural sources — such as wetlands — spewing out the remainder, though with significant variability over spans of years. To wit, and adding to the mystery: a leveling-off of atmospheric methane concentrations numbers that, according to global ground-based measurements, lasted from about 2000 to 2006, followed by a resumption of methane’s historically steep, year-on-year rise since.

“We want to understand the global methane budget,” says Riley Duren, a research scientist at the University of Arizona and an engineering fellow at NASA’s Jet Propulsion Laboratory in California, which has developed methane sensors for use on terrestrial aircraft, as well as on rovers on Mars. “The jury’s still out on what the exact causes are of the observed changes in the methane growth rate, which is important for understanding the future trajectory of the planet.”

Bringing methane into focus

Pound-for-pound, methane is actually the more potent of the nefarious greenhouse gas duo, trapping around 80 times as much heat as carbon dioxide over a 20-year time span. Yet because carbon dioxide molecules outnumber methane in the atmosphere by 200 to 1 and persist for longer, CO2 remains the substance of greater concern versus CH4.

Over the past million years or so, the global average atmospheric methane concentration has cycled between about 400 and 800 parts per billion. Today, that figure has skyrocketed to about 1,860 ppb and is still going up by about 10 ppb annually, according to the Global Greenhouse Gas Reference Network established by NOAA.

Along with similarly stunning increases in carbon dioxide concentrations, efforts are ongoing by governments and private industry to slow or even reverse the methane trend. Satellites can significantly aid in this objective by providing global coverage of methane plumes, capturing broad-scale, natural phenomena as well as (often human-made) point sources. Satellites can see into countries and unpopulated regions without adequate conventional monitoring by ground sensors or aircraft. These conventional methods, while highly accurate, are ultimately costlier than satellites, because they must be tended to by human workers. Manual methane checking also has poorer temporal coverage, argues Yotam Ariel, CEO of Bluefield, one of the satellite monitoring startups. As a result, Ariel says that three out of every four methane leaks are missed by oil and gas operators. With adequate-sized constellations, however, satellites could provide scientists, regulators and clients with daily reports on methane emissions at pre-selected sites of interest, helping all parties identify where and when emissions are happening, and thus how to curtail them.

Toward this end, Bluefield is developing a roughly backpack-sized microsatellite targeted for launch in 2020, with goals for more spacecraft to follow. “With about eight satellites, that will get us to daily measurements pretty much anywhere in the world,” says Ariel.

Bluefield’s competitor, GHGSat, has similar goals. The Canadian company, founded in 2011, pioneered private-sector methane monitoring in 2016 by launching a proof-of-concept, 15-kilogram, microwave oven-size satellite — nicknamed Claire. Two more satellites, dubbed Iris and Hugo, are slated for launch in 2020, with more to come to match projected demand.

“We have clear demand for at least 10 satellites, and that’s our next step,” says company president Stephane Germain.

Both companies plan to collaborate with MethaneSAT, the independent subsidiary created by the Environmental Defense Fund to build and operate the satellite, targeted for launch in 2022. Unlike the data gleaned by the Bluefield and GHGSat spacecraft, which will be available only to subscribing organizations, MethaneSAT data — and eventually image-processing algorithms and other technical details — will be publicly available for free. The specific purpose of MethaneSAT is to document methane emissions from oil and gas facilities, enabling operators to reduce their emissions, and for regulators and the public to keep track. “Our goal is to quantify emissions from the entire oil- and gas-production sector, which has never been done before,” says Ritesh Gautam, a senior physical scientist working on MethaneSAT. In that vein, the Environmental Defense Fund hopes that its satellite will prompt the industry to slash global methane pollution from the oil and gas industry by 45% come 2025.

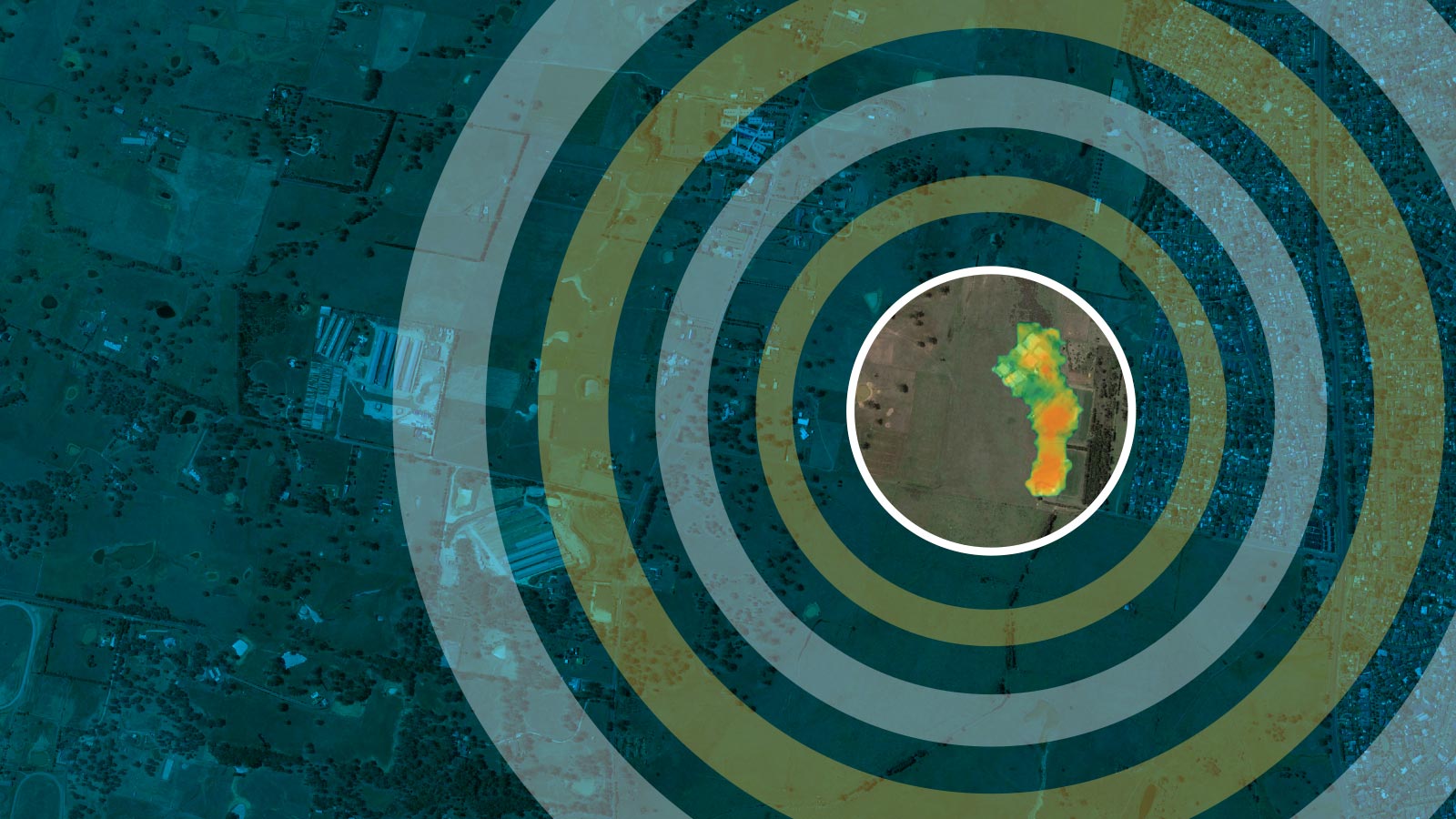

MethaneSAT will canvass the planet in approximately 200-kilometer-wide swaths, targeting areas of oil and gas production. The satellite’s spatial resolution will be about 1 kilometer by 1 kilometer — sufficient to localize a methane “hot spot,” though not enough to narrow the source to a specific plume from an oil and gas well pad, say, or an exact site of a pipe leak.

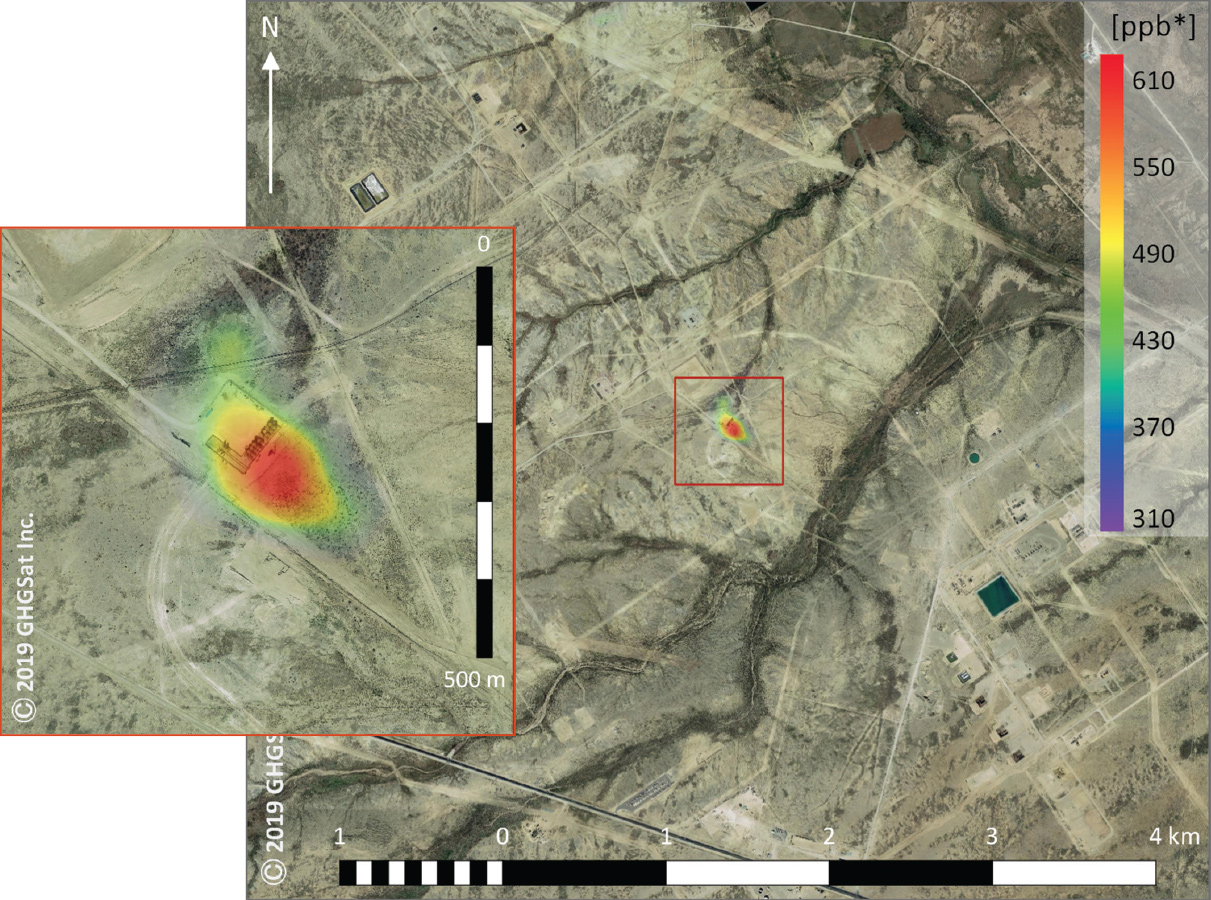

That is where Bluefield and GHGSat come in. “GHGSat and us, we can zoom in even further and be very granular and specific about what is emitting,” Ariel says. The companies have announced their intended spatial resolutions as 20 and 20 meters and 25 by 25 meters, respectively. This level of resolution is sufficient for clients keen on quickly diagnosing and sealing leaks. “A client just needs to know about which well pad or wellhead or storage tank is emitting, and then someone has to go there anyway to fix it,” he says.

In effect, MethaneSAT will serve as a wide-angle lens, while Bluefield and GHGSat spacecraft serve as zoom lenses. In this way, all three satellites’ makers believe they can continue the positive trend of refining spatial resolution, demonstrated over the brief history of methane detection from space. Timeline-wise, Duren of JPL groups methane detection satellite instrumentation into three generations. The first generation was the SCanning Imaging Absorption spectroMeter for Atmospheric CHartographY, or SCIAMACHY, part of the payload aboard the European Space Agency’s ENVISAT satellite that launched in 2002 and which offered a coarse resolution of 30 km by 60 km. The second generation of instruments is on satellites still flying. These include the Japan Aerospace Exploration Agency’s Greenhouse Gases Observing Satellite, or GOSat, launched in 2009 and which has 10 km by 10 km resolution, as well as TROPOMI, short for TROPOspheric Monitoring Instrument, aboard ESA’s Sentinel-5 Precursor, launched in 2017 and whose pixel sizes are 7 km by 7 km. “Today, TROPOMI is the state-of-the-art for methane monitoring from space,” says Duren.

One destination, different paths

Engineers at MethaneSAT, Bluefield and GHGSat all believe they can monitor methane even better than the satellites that have come before in part due to advances in machine vision and learning algorithms. The three parties are predictably mum on the specifics about their particular algorithms for sorting the methane signal from the noise of other atmospheric gases and especially aerosols, the particulates often associated with methane plumes from oil and gas production. The algorithms additionally factor in variables such as cloud cover and ground reflectivity.

The three satellites also share in common a basic sensing principle of collecting sunlight — specifically, infrared-wavelength light — reflected from Earth’s surface that then passes through methane and whatever else happens to be in the air column between the ground and the sensor. Yet all three go about this passive sensing differently.

MethaneSAT will rely on spectroscopy, splitting apart the received light via a grating to tease out the telltale infrared absorption signature of methane. The sensitivity goal for MethaneSAT is to measure a 0.1% increase in methane concentrations in the column atmosphere — the equivalent of 2 ppb. (For comparison, TROPOMI is sensitive to a 12-ppb increase and SCIAMACHY 30 ppb, Gautam says.) The Environmental Defense Fund contracted Ball Aerospace last September to build the detector instrument, the raison d’être of the approximately 350-kg (770-pound) satellite, whose bus manufacturer will be Blue Canyon Technologies.

GHGSat will also carry a spectrometer, but a newly patented type based on a Fabry-Perot interferometer. A common optical device, the interferometer consists of two parallel planes of reflective material between which incoming light bounces, with a portion of the light filtering through the material with each partial reflection. The upshot is a single beam of light turned into multiple beams that then interfere with each other, producing a distinctive pattern on a detector that indicates (in this case) the identity and quantity of the gas in question. In GHGSat’s version of the device, a wide angle of light is accepted, versus the typically isolated single wavelength. As a result, multiple absorption lines are registered by an infrared camera, boosting confidence in a methane detection, Germain says.

Bluefield takes a different approach. Instead of dispersing light, where there is some loss of spectral information, the company’s sensor channels reflect infrared light through two glass capsules: one empty and one filled with methane. Correlating the two resulting images allows for matching the methane signature, should it be present in the reflected light, across a complete methane spectral signature of some 20,000 absorption lines, versus the 20 or so lines of other methods, enabling detection of smaller leaks and cutting down on misidentifications, Ariel says. This so-called gas filter technique has a strong heritage, having already flown on a dozen NASA satellites for various gas detection applications. To miniaturize the sensor for a microsat, Bluefield tested prototypes on helicopters and high-altitude balloons. The sensor’s builder and the satellite bus manufacturer have yet to be announced.

Methaneconomics

All three satellite makers believe the economic motivation for their data will be high. The International Energy Agency, based in Paris, has estimated that the oil and gas industry can cut its global methane emissions by 75%, with as much as two-thirds of that drop achievable at zero net cost, based on the saving of saleable gas otherwise pointlessly lost to the atmosphere.

According to a 2018 Environmental Defense Fund-funded study in Science magazine, in which ground-based measurements were validated by aircraft observations, the leak rate from the oil and gas system within the United States stands at 2.3% — a volume of natural gas valued at $2 billion and enough to supply 10 million homes. Studies from NASA have put that dollar figure even higher, estimating losses from $5 billion to as much as $10 billion annually due to methane leakage.

Beyond the oil and gas sector, GHGSat and Bluefield anticipate numerous other customer opportunities. These include coal mining operations with methane venting and seepage; hydropower facilities accounting for methane rising from reservoirs; waste management companies seeking to place gas collectors at landfills; and again, the agricultural sector, from methane emissions-rich rice paddies to dairy producers rolling out new feeds to curtail bovine belching. As the marketplace for satellite-based methane monitoring matures and diversifies, Ariel expects that new sorts of clients will want access, including the investment banks and hedge funds that help finance oil and gas projects.

Climate scientists, meanwhile, will benefit from the deluge of data. Better constraining certain sector emissions could clarify if, as some researchers argue, increasing methane spewing from tropical wetlands — possibly due to feedback from increasing global temperatures — is behind the rising emissions since circa 2006, or whether the advent of fracking, which dramatically boosted natural gas production, is chiefly responsible.

More players will look to get in the game as well. One such interested organization is Planet, a San Francisco-based Earth-imaging company, which the University of Arizona’s Duren is advising. Last September, Planet announced, alongside Michael Bloomberg and the state of California, an initiative to develop a new generation of satellite technologies for detecting carbon dioxide and methane. Meanwhile, NASA is working on Geostationary Carbon Observatory, its first satellite to measure methane near Earth’s surface, penciled in for an early 2020s launch.

Bluefield’s Ariel and GHGSat’s Germain say they look forward to seeing increased competition, further stressing that they welcome it even with each other. “As we mature and they mature,” says Ariel, “we will see more and more companies go into methane detection. If you look, there are quite a few imaging satellite companies, and they’re not saturating the market.”

“In the end,” says Germain, “I think that all parties serving this market will need to both compete and collaborate in order to achieve the impact we all want: reductions in greenhouse gas emissions on a global scale.”

“Our goal is to quantify emissions from the entire oil- and gas-production sector, which has never been done before.”

Ritesh Gautam, MethaneSAT

About Adam Hadhazy

Adam writes about astrophysics and technology. His work has appeared in Discover and New Scientist magazines.

Related Posts

Stay Up to Date

Submit your email address to receive the latest industry and Aerospace America news.