Stay Up to Date

Submit your email address to receive the latest industry and Aerospace America news.

Fifty years after a British rocket last launched a satellite, the U.K. Space Agency is bringing the country back into the space launch business. Paul Marks explores the race to open three new spaceports this year.

Small satellites are regularly launched into low-Earth orbit from spaceports including those in Kodiak Island in Alaska, the Mahia Peninsula in New Zealand, Wallops Island in Virginia and Mojave in California. This year, the list of potential smallsat launch sites is set to swell, not because of a newcomer to the launch business but because of a nation whose first launch occurred decades ago: the United Kingdom.

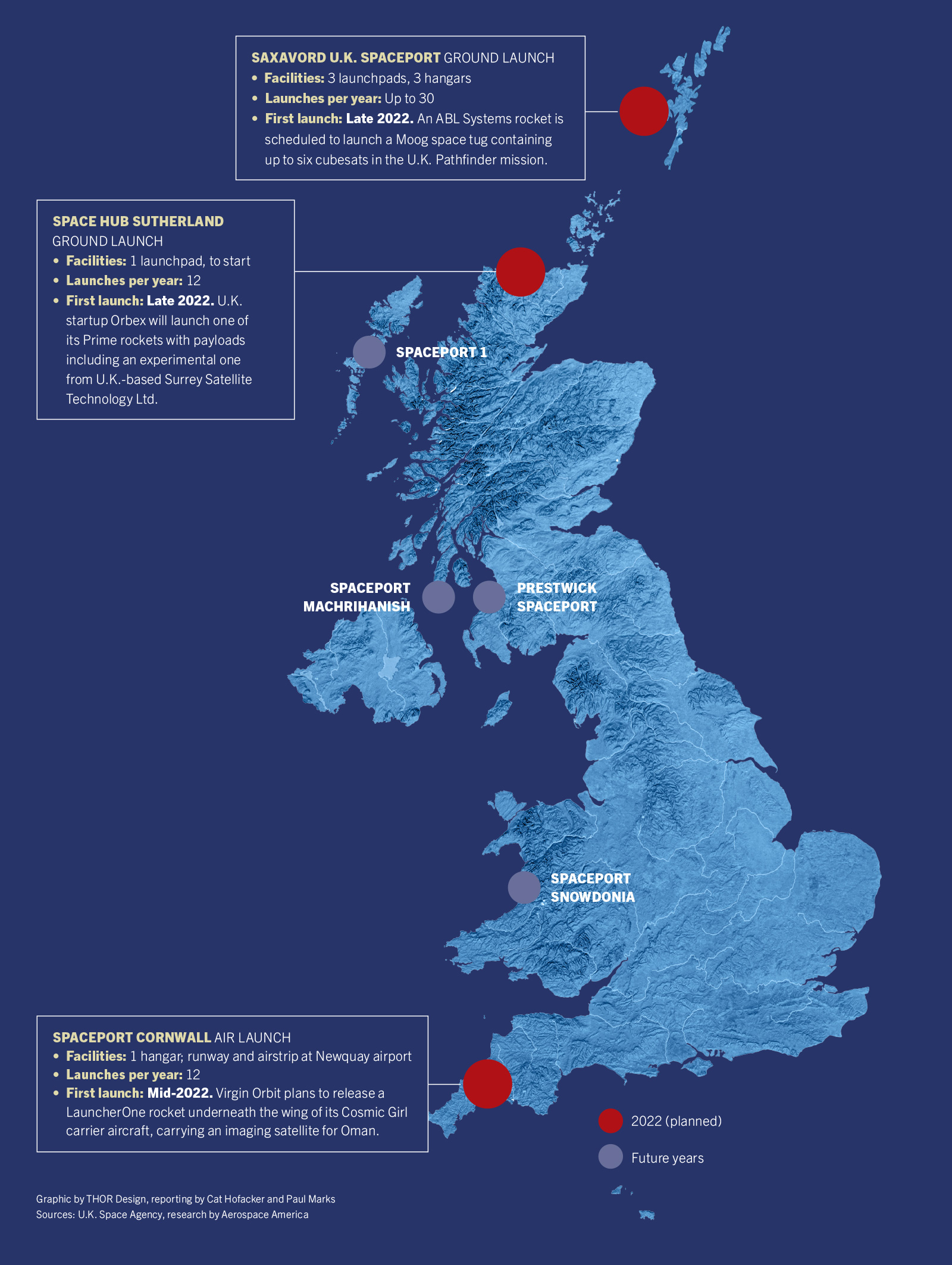

The U.K. is set to license at least three new privately owned smallsat launch sites in 2022, with others to follow, in locations from Cornwall on England’s most southwesterly tip to the most northerly of Scotland’s Shetland Islands. On top of that, a crop of U.K.-based rocket startups are scheduled to be among the first customers.

For customers wanting vertical rocket launch, plans call for beginning construction of launch pads this year in two locations. The SaxaVord Spaceport would be created at Lamba Ness on the island of Unst in the Shetlands and Space Hub Sutherland on the Moine Peninsula on the northern coast of the Scottish mainland. For those seeking air launch capabilities, some 8 kilometers from Britain’s storied surfing capital, Newquay, developers are adding a hangar and ground support facilities for rocket carrier planes to part of the existing passenger airport — a former Royal Air Force base with a 2,700-meter-long runway — to create Spaceport Cornwall.

With all three spaceports hoping to conduct their first launch in 2022, the race is on to be the first to get a rocket in orbit. But there’s no clear frontrunner, given that all three are still awaiting regulatory approval and covid-19 lockdowns have played havoc with everyone’s timelines.

Those delays haven’t hampered the plans of the U.K. Space Agency, UKSA, to put the three sites on the global smallsat launch map alongside the likes of Kodiak and Mojave. The agency has awarded tens of millions of pounds in grant money to help build some of the first spaceports and is also funding the development of future sites.

What’s behind all these moves? Encouraged by the runaway success of Britain’s satellite production and space services sector, which generated £16.4 billion ($22.1 billion) in revenue in 2019 (NASA’s budget is $22.6 billion by comparison), UKSA wants to offer satellite builders the additional incentive of fast, responsive, smallsat launches.

In fact the U.K. government wants nothing less than to “capture” the European market, proclaiming in its latest National Space Strategy the goal of by 2030 becoming “the leading provider of commercial small satellite launch” among European countries, whether their launch sites are in Europe or elsewhere. Why, runs the Brits’ sales pitch, should Europeans schlep all the way to the Guiana Space Center in Kourou to place their smallsats on, say, an Arianespace Vega rideshare when the U.K. offers at least three spaceports on their doorstep?

However, the U.K. will not be without European competition: The Swedish-owned Esrange Space Center, previously a venue for suborbital sounding-rocket launches, is this year planning to establish an orbital smallsat launch capability, launching 150-kg smallsats to orbit up to four times per year.

Reviving space launch

What’s helping make Britain’s grand plans a reality is the legislative foundation of its National Space Strategy: the Space Industry Act of 2018, which, for the first time, put in place a licensing regime allowing entrepreneurs to take advantage of the smallsat revolution by operating government-licensed orbital and suborbital spaceports in the U.K.

And to get British satellites in orbit as soon as this year, UKSA has awarded grant funding to “kick-start commercial activity, igniting a fast-paced U.K. spaceflight sector,” says Matthew Archer, UKSA’s director of commercial spaceflight.

Specifically, the space agency has awarded a $31.8 million contract to the British arm of Lockheed Martin Space Systems for a mission dubbed the U.K. Pathfinder Launch. The contract covers establishing and running launchpad operations at the SaxaVord Spaceport and purchasing a launch vehicle, in this case an RS1 rocket from spaceflight newcomer ABL Space Systems of California. The 27-meter-tall RS1 would loft a space tug built by Moog of the U.K. to orbit, where it would deploy up to six 6U cubesats.

It wouldn’t, however, be much of a U.K. launch venture without some British rockets, too. So UKSA in 2018 also awarded Scotland-based rocket startup Orbex a £5.5 million ($7.4 million) grant to help develop a 19-meter-high, two-stage smallsat launcher called Prime. Made from carbon fiber and with additively manufactured rocket motors, Prime rockets would launch payloads up to 150 kgs from Space Hub Sutherland starting in late 2022, if all goes as planned. Orbex has funding from the European Space Agency, too, as well the EU, highlighting interest in their services across Europe. UKSA also is partially funding the construction of the spaceport itself, with a £2.5 million ($3.4 million) grant to Highland and Islands Enterprise, the regional economic development agency that owns the Sutherland spaceport.

Also, a startup called Skyrora in Edinburgh received a €3 million ($3.4 million) European Space Agency grant toward developing its 22-meter-high, three-stage rocket called Skyrora XL for launching smallsat payloads up to 315 kg. Skyrora says its rockets will begin orbital launches from the SaxaVord Spaceport after some initial “derisking” suborbital flights with smaller rockets.

Timing wise, Lockheed Martin says a launch of the ABL rocket some time in 2022 remains possible, despite a mid-January explosion of an ABL second stage during a ground test at their Mojave facility. Both Skyrora and Orbex are aiming for the end of the year or early 2023.

For air-dropped launches, meanwhile, UKSA in 2019 provided a £7.35 million ($9.9 million) grant to the British branch of satellite launcher Virgin Orbit to build the necessary ground systems to fly its LauncherOne rocket and Cosmic Girl carrier plane from Spaceport Cornwall. It does not end there, however: Some $3.2 million is also going to study the possibility of equipping former military airstrips at Prestwick and Machrinhanish in Scotland, and Llanbedr in Wales, and possibly other sites for horizontal launches.

But will this multipronged approach work in the rocket launch arena? It’s looking promising, says Greg Sadlier, cofounder of know.space, a London-based space industry consultancy.

“The U.K. has adopted a market-creation approach which fits with its overall attitude to the space sector, which is that it should be properly supported to get it started, but be commercially led,” he says. “In launch and rocketry, they’re creating new players and letting them compete, potentially capturing different parts of the market and fostering innovation.”

That’s not to say out-and-out success is guaranteed, Sadlier adds: “With a number of U.K. spaceports in development, arguably it’s likely that not all them are going to reach full commercial sustainability.”

Repeating history?

Not reaching commercial sustainability, however, is something with which those with long memories in British rocketry will be all too familiar. To understand why, we need to rewind to Thursday, Oct. 28, 1971.

Just after 4 a.m. Greenwich Mean Time, the U.K. Royal Aircraft Establishment’s three-stage Black Arrow rocket lifted off from the Woomera Test Range in the South Australian desert atop the almost invisible plume characteristic of its novel hydrogen peroxide and kerosene fuel mix. Staging went perfectly and, some 11 minutes later, the Black Arrow’s solid-rocket-powered third stage placed the 66-kg science satellite Prospero into an elliptical low-Earth orbit, where it functioned for 25 years.

For Britain, that launch was of profound significance: This was the first U.K. space launch, and it was with a British satellite. It was a feat only five other countries had previously accomplished, and could have propelled the U.K. permanently into the ranks of launch-capable spacefaring nations — but it did not.

Three months before the Prospero launch, then Aerospace Minister Frederick Corfield announced to Parliament that the British government, mired in an economic crisis, had decided to cancel the Black Arrow program because “the maintenance of a national programme for launchers of a comparatively limited capability absorbs a disproportionate share of the resources available.”

The Prospero launch proceeded only because the rocket and satellite were at Woomera already — and almost all the costs involved were by then already sunk. In the future, Corfield said, British satellites would instead fly on launchers like NASA’s Scout, a multistage, all-solid-rocket design that flew from the 1960s to the mid-90s.

As a result, the rocket test pads in the U.K. and the British launch pads at Woomera were demolished, the designs destroyed and the Black Arrow engineers laid off.

“Black Arrow’s cancellation rendered the rest of the National Space Technology Programme vulnerable and that too was canceled a few years later,” says Douglas Millard, spaceflight curator at the Science Museum in London. “The cancellation eroded Britain’s capability in space research and development.”

Fast-forward to today, however, and Sadlier is among those who think the time is right for a rebirth.

“The U.K. now has an opportunity, with rocketry coming back, to catch up quite rapidly because it can take advantage of all the technology advances developed in its own strong space sector, and also in new space more broadly, to restart its rocket program,” he says. Such advances might include the move to 3D-printed hardware, software-defined avionics and the use of off-the-shelf components to reduce costs.

But is it a British launch industry if these burgeoning spaceports rely in part on importing and launching American rockets? Non-U.K. customers are a vital component, says Nik Smith, the regional director of Lockheed Martin Space in charge of the U.K. Pathfinder launch program and a former Royal Air Force milsat specialist.

“The U.K. left the launch industry after Black Arrow. So we have atrophied and lost a lot of skills, plus the corporate and institutional knowledge of how to do launch over the last 50 years,” he says. “So partnering with the U.S., or other nations, is a really good way for the U.K. to speed up its experience, gain expertise quickly, and start creating more indigenous opportunities. It’s just a way of accelerating everything.”

In Sadlier’s view: “There’s a timing element to all this: the space economy is developing very rapidly and if the U.K. wants to restart its launch capability as soon as possible, then buying in that capability initially is sensible, whilst pursuing U.K.-developed launch technologies.”

Different strokes

With their northern latitudes, all three of the first planned U.K. spaceports could offer customers rides to polar or sun-synchronous orbits, so each is making a point to illustrate its unique advantages.

Spaceport Cornwall has been slated since 2018 as a destination for the captive-carry combo of Virgin Orbit’s Boeing 747 Cosmic Girl carrier plane and LauncherOne rocket, but the English space hub has even bigger plans.

“Spaceport Cornwall will be a multi-user spaceport,” says Melissa Thorpe, who heads the operation. “We have signed a memorandum of understanding with Sierra Space” of Colorado, the developer of the Dream Chaser spaceplanes.

The MoU, she says, means that Dream Chaser — perhaps on its way back from one of the six International Space Station resupply missions scheduled to begin this year — could choose to land at Spaceport Cornwall, gliding back to its runway.

But Virgin Orbit is very much the spaceport’s high-profile anchor client, offering to launch up to 300-kg payloads into high inclinations from the two-stage LauncherOne. Virgin has a light ground footprint, with “essentially nothing by way of permanent infrastructure” needed at any spaceport it’s asked to launch from, says William Pomerantz, vice president of special projects for Virgin Orbit.

“To conduct launches, we require only a runway, a launch license and a set of ground support equipment designed to prepare the rocket for flight and to mount it on the wing of the aircraft,” he explains.

For the Cornwall spaceport, Oxford-based space company AVS is now building a Transportable Ground Operating System, used to prepare LauncherOne rockets for flight and help mount them on the spare engine pylon beneath the 747’s wing.

The system needs to be ready soon. Virgin announced in January that its first Cornish mission will be a smallsat launch for the Sultanate of Oman, scheduled for later this year, and a second U.K. launch is also likely this year, says a Virgin Orbit spokesperson.

Virgin Orbit’s arrangement with Cornwall is not exclusive, so if any of the other U.K. horizontal launch sites currently in the business planning stages need a flight to LEO, Pomerantz says Virgin Orbit will “consider customer requests to fly from any location.”

For the two vertical launch locations, there are some clear differences in physical accessibility and payload-to-orbit capability for spacecraft operators to consider, thanks to their respective geographies.

Trajectories toward polar and sun-synchronous orbits from Space Hub Sutherland on the boggy Moine Peninsula of the Scottish mainland would intercept the populated areas of the Faroe Islands and Iceland. This means a launching rocket might need to undertake a dogleg maneuver to change its trajectory to avoid them, expending more fuel and so reducing overall mass-to-orbit. But the much more remote SaxaVord Spaceport — some 300 kilometers to the northeast, almost halfway to Norway in the middle of the frigid North Sea — has an absolutely clear shot at those same orbits.

As a result, Space Hub Sutherland is limiting itself to launching payloads of up to 500 kgs, says the spaceport’s project director Roy Kirk at Highlands and Islands Enterprise. But with its line-of-sight launch capability, SaxaVord Spaceport’s deputy CEO Scott Hammond says it can easily handle the 1,200-kg payload capability of ABL Space Systems’ RS1. But getting to SaxaVord on the Shetlands involves a sea crossing for the rocket, so some operators may see a logistical advantage to using Sutherland on the mainland.

But first, the new spaceports need to secure regulatory approval. Licences for U.K. launches will be issued by a new space regulation arm of Britain’s Civil Aviation Authority — and, if the rocket is American-made, an FAA licence will be needed, too. This export of U.S. spaceflight rocketry to the U.K. was made possible by the June 2020 signing of the U.K.-U.S. Technology Safeguards Agreement; this treaty ensures that exported U.S. rocket technology is securely protected in a counter-proliferation sense.

And in what is perhaps an encouraging sign of how close to reality a U.K. vertical launch is finally becoming, Orbex in February announced it had submitted its application for a launch license from the Sutherland spaceport, the first company to do so. Virgin Orbit also has its license application in for horizontal launch.

“Orbex already has six contracts for launch from Sutherland. So they are keen to start launching,” says Kirk of Highlands and Islands Enterprise. He expects that first Orbex orbital launch to happen “towards the very end of this year, or more likely, the first quarter of 2023.”

Getting that license application filed was a “major step” for the startup, says Orbex CEO Chris Larmour. As that licence grinds through the regulatory mill — CAA says it could take 9 to 18 months — the company is also preparing to run static fire tests of its Prime rocket motors on a test site under construction near Orbex headquarters. The tests won’t happen at Space Hub Sutherland because ground has not been broken there yet to start pad build-out.

One reason for the delay, says Kirk, is that Highlands and Islands Enterprise has yet to appoint a launch site operator for the complex. What they are hoping to appoint is an experienced company well versed in running orbital ranges safely. While Kirk would not say who their likely operator may be — just that HIE is in talks with a number of them — the companies operating in that arena include the Alaska-owned Alaska Aerospace Corp., which has branched out from running its Kodiak launch site to also running the pad operations for U.S. launcher Rocket Lab on the Mahia Peninsula in New Zealand.

Once Sutherland and SaxaVord have met the environmental conditions laid down as part of their planning permission, launchpad construction can begin. It is unclear, however, how long that might take. For instance, one of Sutherland’s conditions is that it has to protect a 76-hectare peat bog near its launch site — an important local CO₂ sink.

Much is being made over which of the three U.K. spaceports will be first to orbit a smallsat, but for Kirk, the bigger picture here is the chance to make up for the lost years of rocketry after Black Arrow was canceled.

“We now have a real opportunity for the U.K. to seize back what might have been,” he says.

Big plans for Small rockets

The U.K. wants to establish itself as the go-to launch location for anyone in Europe who wants to launch a small satellite. The three northernmost planned spaceports will be sufficiently remote for rockets to lift off from their pads and reach polar or sun-synchronous orbits without making extensive maneuvers to avoid populated areas. For the four southern sites, carrier aircraft will fly from new or repurposed runways and head out over the Atlantic Ocean or North Sea to release the launch vehicles.

About Paul Marks

Paul is a London journalist focused on technology, cybersecurity, aviation and spaceflight. A regular contributor to the BBC, New Scientist and The Economist, his current interests include electric aviation and innovation in new space.

Related Posts

Stay Up to Date

Submit your email address to receive the latest industry and Aerospace America news.