Stay Up to Date

Submit your email address to receive the latest industry and Aerospace America news.

The Communications Systems Technical Committee is working to advance communications systems research and applications.

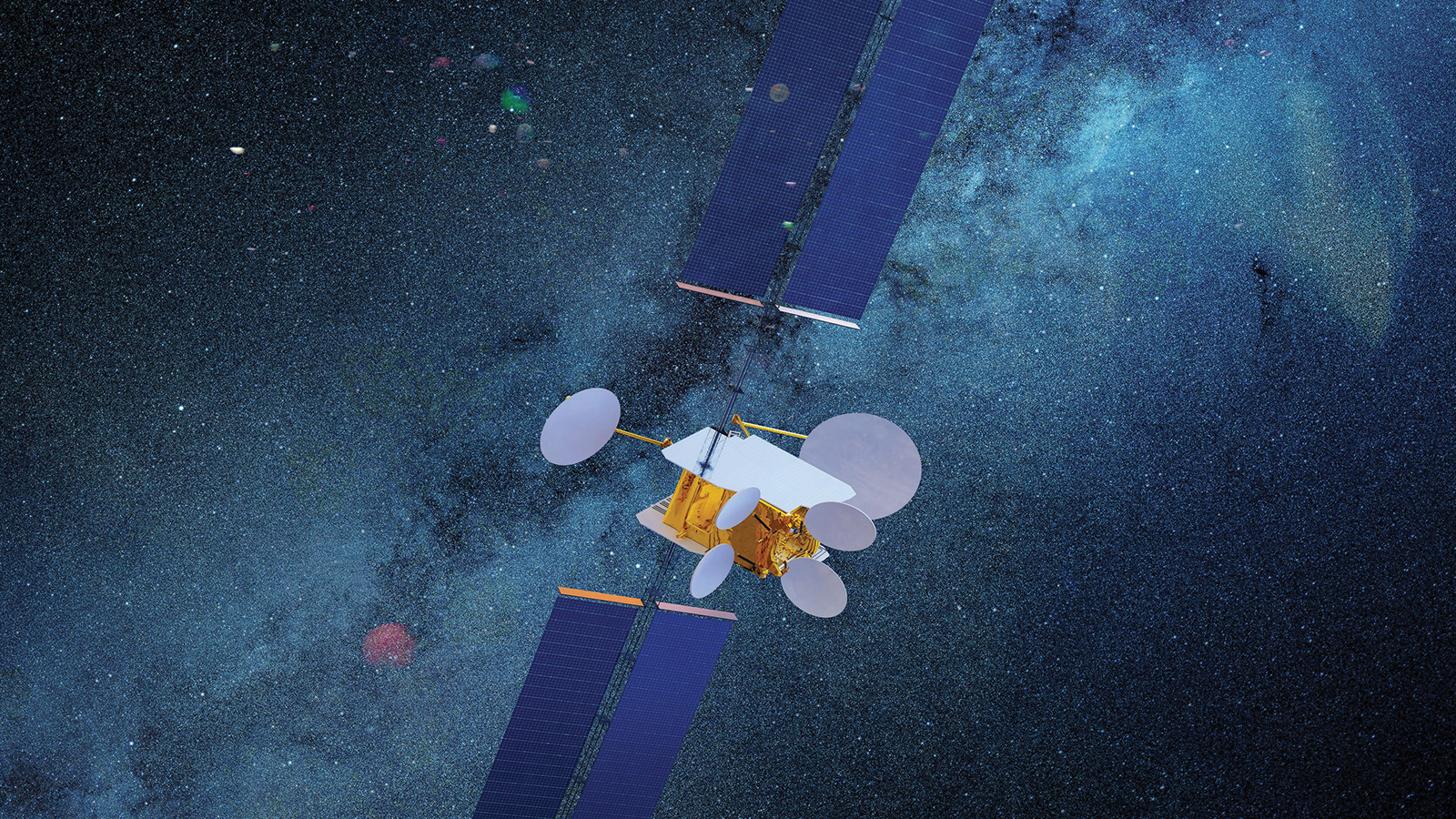

The satellite communications “crises in direction” continued this year. The availability of innovative low-cost launchers, the development of digital and photonic payloads, and the well-funded private enterprise potential to provide low-Earth orbit constellation-based global services were promising. At the same time, the traditional service industry waited for direction, and manufacturers struggled to survive to reap the benefits of a promised tomorrow that never seems to arrive.

Continued communications satellite overcapacity, falling market prices, ongoing advances and additions to planned nongeosynchronous orbit megaconstellations, and persistent market uncertainties caused operators to limit geostationary orbit satellite orders again this year. Covid-19’s impact did not help, and OneWeb’s sudden bankruptcy in March, less than a week after launching 34 satellites, bolstered dire “I told you so” predictions regarding unrealistic LEO constellation promises.

Meanwhile, SpaceX increased to 895 in-orbit Starlink satellites as of October and announced the imminent start of broadband service. The British government purchased a controlling OneWeb share in July, apparently an alternative to its previously announced Global Navigation constellation. Other constellation announcements, including the LEO expansion of SES’ O3b medium-Earth orbit constellation in May, looked feasible, but Canada-based Telesat continued postponing the selection of a manufacturer for its LEO venture.

Intelsat and SES, both based in Luxembourg, ordered a total of 13 C-band satellites from Colorado-based Maxar Technologies, Northrop Grumman, Boeing and Thales Alenia Space this year, paid for by the terrestrial 5G industry through the Federal Communications Commission. Those and seven other orders of geosynchronous Earth orbit satellites as of October were a shot in the arm for the industry. In terms of GSO technologies, in June, Australia-based Optus selected Airbus’ OneSat digital platform, which provides flexible and repeatable designs that overcome geographic distribution of users and specific orbit and coverage constraints. This was Airbus’ second sale of OneSat following the award of three satellites by United Kingdom-based Inmarsat in 2019. The increased streaming digital video presence and the disappearance of satellite dishes in suburbs due to fiber-optic internet to homes and wireless access expansion indicated a general contraction of the direct broadcast industry. This year saw the introduction of reliable laser intersatellite links, developments in phased array antenna technologies, early developments in photonic payloads and ongoing development in digital onboard processing — although the latter was still hampered by flexibility limits, long development cycles and uncertainties in driving application requirements. In ground technology, the holy grail for LEO constellations continued to be elusive; no company had yet to demonstrate low-cost fully electronic user terminals.

The terrestrial wireless industry introduction of 5G broadband wireless services, seen by some as an opportunity and others as a threat, highlighted a perennial disappointment in the industry: better integration of satellite solutions within the global terrestrial network. Satellites have much to bring by expanding access to 5G services. Despite the proliferation in content by companies such as Facebook and Google, cost of access still dominates availability of broadband services. Satellite and terrestrial service operators producing a common network expansion road map, where each technology is accommodated on merit, will solve many of these problems.

One bright spot, as the program for the 38th International Communications Satellite Systems Conference — which was delayed until late next year — highlighted, was interest in expanding space exploration communications. The trends of internationalization, privatization and standardization, and the resulting concept of extending the social media world and internet to the moon and beyond, excited and galvanized the industry. NASA’s Artemis and the European Space Agency’s proposed Moonlight programs endorsed these trends this year. The resulting business volume will not replace the commercial sector but will provide continuity of expertise and innovation within the industry.

Contributors: Thomas Butash and Chris Hoeber

Related Posts

Stay Up to Date

Submit your email address to receive the latest industry and Aerospace America news.