Hypersonics manufacturing scales up and international allies engage

By Liz Stein and Davide Viganò|December 2023

The Hypersonic Technologies and Aerospace Planes Technical Committee works to expand the hypersonic knowledge base and promote continued hypersonic technology progress through ground and flight testing.

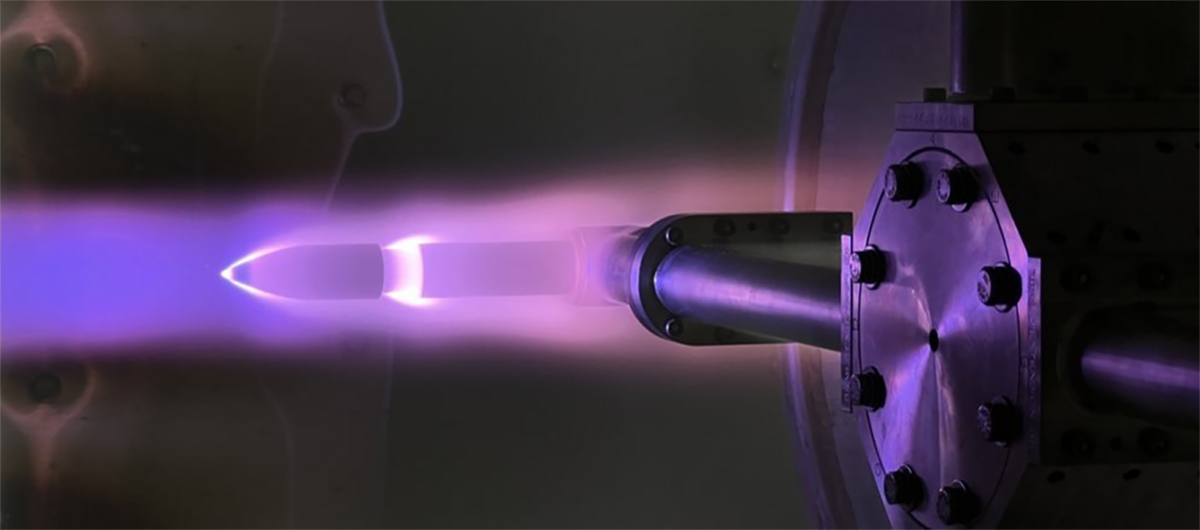

In academia, March saw the inauguration of the Plasmatron X facility at the University of Illinois Urbana-Champaign. The 350-kilowatt plasma wind tunnel is the largest in its class in the U.S. In May, the National Natural Science Foundation of China announced the opening of its JF-22 hypervelocity facility. This 167-meter-long shock tunnel can replicate flows up to Mach 30 with nozzle exit diameters of 2.5 meters. In June, Purdue inaugurated the Hypersonics and Applied Research Facility. The 6,000-square-meter building is home to the Mach 8 quiet wind tunnel and the hypersonic pulse reflected shock/expansion tunnel. In July, the University of Colorado Boulder broke ground for the construction of its plasma wind tunnel. Over the last four years, an average of three new academic hypersonic wind tunnels have opened annually.

The biggest standout trend in hypersonics this year was related to shoring up the U.S. supply chain and scaling up of manufacturing for expendable hypersonic systems. In March, President Joe Biden signed a presidential determination to rebuild and expand the nation’s domestic hypersonics industrial base. In May, the National Defense Industrial Association released a report outlining the needs of the industry and workforce. In July, Raytheon was awarded an $81 million contract for the Hypersonic Air-breathing Weapon Concept, and Dynetics of Alabama was awarded a $428 million contract to develop the Common Hypersonic Glide Body prototypes. In August, Northrop Grumman opened a new hypersonic propulsion system manufacturing factory. Also that month, Huntington Ingalls outfitted Zumwalt-class destroyers with the U.S. Navy’s Conventional Prompt Strike missiles.

Internationally, several new hypersonics programs were announced by allied democratic nations. In April, Japan awarded Mitsubishi Heavy Industries a $2.8 billion contract to develop a series of missiles, and South Korea approved a $2 billion investment to develop hypersonic interceptors. In July, the U.K. announced it would invest approximately $1 billion to develop hypersonic strike capability. In August, the U.S. and Japan announced a cooperative agreement to begin a Glide Phase Interceptor Cooperative Development program.

In February, China reportedly conducted a flight test of its DF-27 intermediate range ballistic missile, in which the vehicle flew 2,100 kilometers in 12 minutes equipped with a hypersonic glide vehicle. In May, the trial began for three Russian hypersonics scientists charged with sharing classified information with China. On the battlefield, Ukrainian forces claimed to have downed a Russian Kinzhal missile, via U.S. Patriot missile intercept. In June, Iran reported that it has developed a Mach 15 hypersonic missile. In August, North Korea conducted its 18th missile test of the year. Additionally, hackers reportedly working for the North Korean government breached systems at NPO Mashinostroyeniya, a Russian maker of hypersonic missiles and satellites.

In the commercial realm, progress by hypersonics startups spanned new funding to flight tests. In May, Stratolaunch released the first prototype of a Talon-A hypersonic testbed from the Roc carrier plane. June saw progress from three startups: Swiss company Destinus flew its Jungfrau prototype with a hydrogen afterburner for the first time; Airbus Ventures announced an investment in Venus Aerospace of Texas; and Massachusetts-based Specter Aerospace completed full-scale testing of its plasma-igniter augmented scramjet engine. In August, Australia-based Hypersonix announced an exclusive teaming agreement with Kratos to market the DART AE hypersonic test platform. In September, Castelion announced a $14 million seed round; this California startup is working on low-cost hypersonic weapons. In November, Hermeus of Georgia received a multiyear contract from the U.S. Defense Innovation Unit to mature its hypersonic aircraft subsystem and mission system technology. For the first year of the contract, Hermeus will receive $23 million.

Contributors: Felipe Gomez del Campo, Sassie Duggleby, Matt Leibowitz, Frank Lu, Francesco Panerai and AJ Piplica