Stay Up to Date

Submit your email address to receive the latest industry and Aerospace America news.

The Communications Systems Technical Committee is working to advance communications systems research and applications.

This year may be remembered as one of the most challenging, if not paradoxical years for the communications satellite industry. Despite several satellite communications service operators facing overcapacity, pricing pressures and flat to declining revenues, record amounts of additional capacity will be launched before the second quarter of 2017, and even greater capacity is under development for deployment by the end of the decade. Moreover, an incredible venture capital infusion of $1.8 billion into the industry in 2015 — far more than invested over the prior decade — has enabled “New Space” ventures, including low Earth orbiting, or LEO, and other planned nongeosynchronous orbit broadband constellations, to add even more capacity.

In geosynchronous orbit, Intelsat and NBN Co. each launched additional high throughput satellites, while Hughes Network Systems and ViaSat plan to launch their second-generation high throughput satellites, EchoStar 19 — also known as Jupiter-2 — and ViaSat-2, late this year and early next year, respectively.

Through mid-September, 11 contracts were awarded for geostationary communications satellites: Four to Space Systems Loral, three each to Boeing and Thales Alenia Space, and one to Lockheed Martin. This award pace suggests 16 satellite awards by the end of 2016, a 33 percent decline from the average of slightly over 24 awards during each of the past four years. The dramatic decline might be attributable to operator sensitivity to near- and intermediate-term challenges, including over-capacity, pricing pressures and flat to declining revenues.

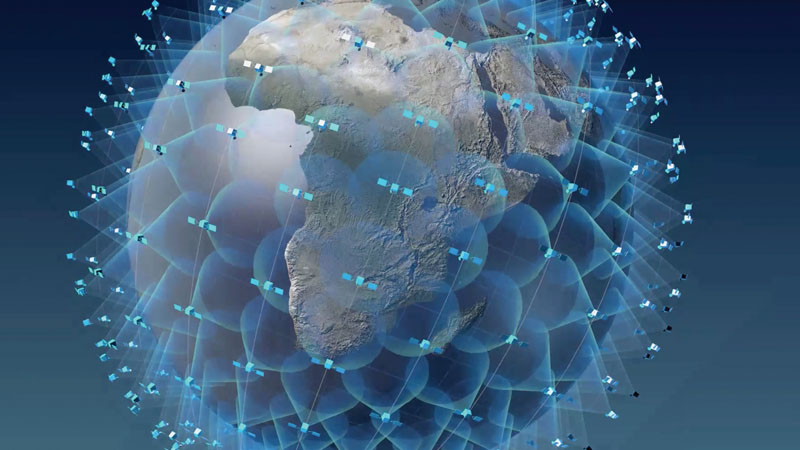

Despite these challenges, many geostationary and large LEO (known as Mega Big LEO) high throughput satellite constellations have been proposed and are under development. ViaSat began development of two of three 1-terabit-per-second-capacity geostationary ViaSat-3 satellites for launch by 2020. The capacity of each will be greater than the total capacity of all communications satellites currently on-orbit. Hughes also is planning its third-generation high throughput satellite, Jupiter-3. Motivated perhaps by the International Telecommunication Union’s estimate that 3.9 billion people remain unconnected to the internet, Boeing, LeoSat, OneWeb, SpaceX and others have proposed or are developing broadband Mega Big LEO constellations. Several of these are due to go into service by 2020.

The year also saw further progress in reusable rocket technology that might someday lower launch costs by 30 percent or more. In April, SpaceX achieved a first when a Falcon 9 first stage landed on an unmanned barge in the Atlantic Ocean, after boosting a Dragon cargo capsule toward the space station. Previously, SpaceX had only achieved a vertical landing on dry land. Blue Origin demonstrated reusability for the first time in January when the same booster that launched its New Shepard capsule to space in November 2015 launched New Shepard again. The European Commission advised the European Space Agency to invest more in reusable technology, citing the American achievements. Ariane 6, under development for first launch in 2020, is unlikely to incorporate reusability before 2030, while the Khrunichev State Research and Production Space Center in Moscow believes its expendable Angara A5 can win 60 percent of the commercial market.

SpaceX’s Sept. 1 prelaunch explosion of a Falcon 9 destroyed the Amos-6 satellite and delayed Facebook’s plans to provide internet access to sub-Saharan Africa. Prior to the loss, Falcon 9 demonstrated eight launches with six first-stage recoveries.

All-electric and hybrid electric-chemical propulsion are becoming the norm, facilitating cost-saving dual launches and greater satellite capacities.

Eutelsat and Space Systems Loral conducted Q/V band transmissions using an experimental payload on Eutelsat 65 West A. The companies are assessing the potential of the 40-50 gigahertz band for enabling terabit-per-second high-through-put satellites.

ESA’s European Data Relay System-hosted laser communications payload launched on Eutelsat 9B in late January to transmit and receive data at 1.8 gigabits per second.

In June, a United Launch Alliance Atlas 5 launched the U.S. Navy’s Mobile Objective User System-5 satellite, but MUOS-5’s primary orbit-raising system failed before achieving geo-synchronous orbit. The Navy began analyzing alternative means of correcting the orbit. ★

Contributors: Roger Rusch and Joe Pelton

Stay Up to Date

Submit your email address to receive the latest industry and Aerospace America news.