Stay Up to Date

Submit your email address to receive the latest industry and Aerospace America news.

Its all-electric, regional aircraft will fly in and out of Florida’s busiest airport

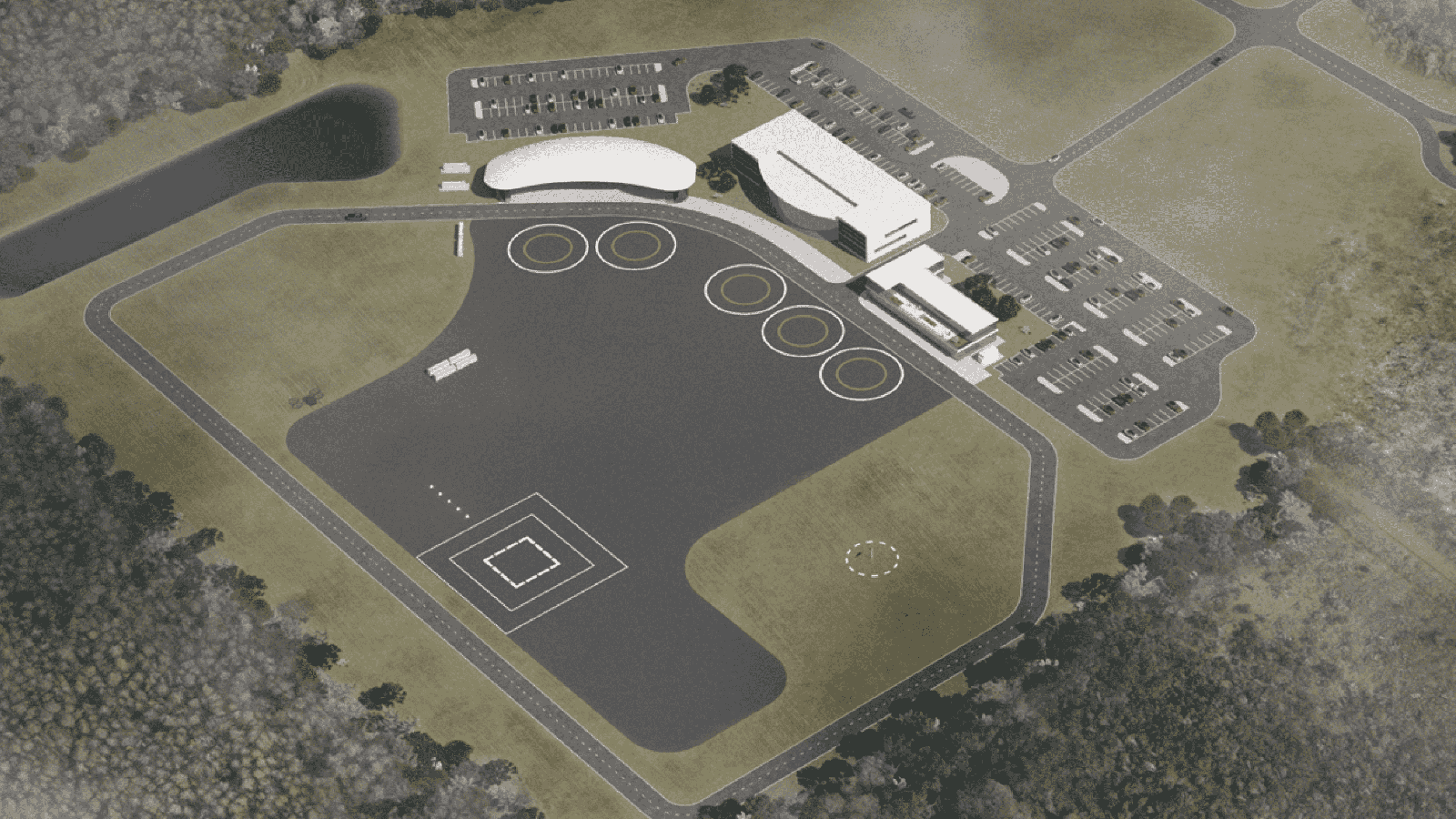

Electric aircraft maker Lilium intends to locate one of its hubs inside the grounds of Orlando International Airport, rather than a few kilometers away in the Lake Nona community, as the company announced in 2020.

The move, announced Feb. 8 by Munich-based Lilium, was the latest under its strategy of collaborating with local authorities to create a network of 11 vertiports for customers in Florida. The state was selected years ago by the company as a promising early market for its all-electric Lilium Jets, designed to take off and land vertically propelled by 36 ducted fans on swiveling wings. Plans call for initial flights to be conducted with Pioneers, the four-passenger, single-pilot variant. Customers would buy the aircraft and maintenance services from Lilium for charter or private flight services.

The hub designation for Orlando International, MCO, means that the vertiport would be one of the home bases for aircraft owned by Lilium’s customers and their pilots. Airport authorities also plan to make the vertiport available to other companies.

Lilium made the decision to locate its Central Florida hub at MCO instead of Lake Nona after considering how most passengers will use the aircraft, Matt Broffman, head of partnerships and public relations for Lilium in the Americas, tells me.

“Proximity to the terminal and connecting through to the terminal is ideal for passenger experience. The closer the vertiport is, the better,” Broffman says. “By being part of the airport, we can also extend the Orlando airport experience to the vertiport” and possibly connect via a people mover or similar means of transport, he says.

The Orlando vertiport will be on the property of the Greater Orlando Aviation Authority, known as GOAA and pronounced “GO-uh”, which operates MCO and the nearby Orlando Executive Airport.

As for who will own and operate the vertiport, GOAA did not provide an answer when I asked that question, saying by email that officials have “not fully developed vertiport operations and are still exploring how operators will integrate on-airport.”

Lilium did offer that “operators of the Lilium Jet who use the facility would either lease, or have a use agreement, with the vertiport operator or the airport.”

GOAA has supported state legislation that would recognize MCO as the state’s center of advanced air mobility testing. Lilium said in its press release that “all parties,” including the company, the airport authority and City of Orlando, agreed that the vertiport should be located “on airport property.”

But the vertiport will not be part of MCO’s Fixed Base Operator location on its west side, which houses maintenance and other ground services for privately owned aircraft and charter services, Broffman says.

“We want the vertiport to have its own independent operations, so we don’t have to integrate into the flow of traffic coming into a hub like Orlando or its FBO; that’s been key for us,” he says, adding that provisions will be made to provide safe passage to and from the vertiport, which may be on the airport’s east or south sides.

Where exactly the vertiport will be is still subject to GOAA’s ongoing planning, he says.

“The closer you get to the runways, the more complicated the airspace, of course,” Broffman says. “So it is a tradeoff, and these are the conversations that we’ve been having. GOAA is leading the nation in having this level of conversation, willing to participate and help solve some of these challenges, because it takes the airport, FAA, operators, OEMs [original equipment manufacturers] and infrastructure partners to all come together to integrate this new technology.”

Lilium has a set price of $10 million for one of its four-passenger Pioneer aircraft, including aircraft maintenance, service and technical support. It intends to sell the aircraft to operators who will either own and operate it themselves, manage the aircraft for fractional owners or provide a charter service.

While Lilium’s network may also include large cities like Tampa or Miami, the hub in Orlando would also be a connection for smaller destinations, such as retirement mecca The Villages or Gainesville, home of University of Florida, Broffman says. Lilium’s focus is on regional service of up to 300 kilometers.

According to a GOAA press release in January, the agency has spent “close to $20M to plan for and accommodate onsite amongst its 12,000-acre campus for AAM integration on-airport and to support other emerging aerospace technologies,” including an economic development study, airspace review, site planning, stakeholder outreach, utility planning and an update to its overall airport layout plan.

Florida likely will be among the first markets for AAM in the U.S., with Orlando at its center, says Basil Yap, vice president of Hovecon, a North Carolina aviation consultancy.

AAM startups “need to go to a place with population density, large cities and good weather, and Florida has those things,” he says.

The move from Lake Nona to the MCO property likely also reflects potential community concerns over noise and air traffic that could arise when siting a vertiport, Yap says, even though electric aircraft are designed to be quieter than conventional fossil-fueled craft.

Electric aircraft maker eyes manufacturing in Florida

A company that’s “in early-stage development of a hybrid electric two seat plane for training” is considering Florida as the home for its manufacturing plant, according to Space Florida, a state agency that promotes aerospace projects and coordinates incentives for them. The agency’s board in January granted its management staff authority to negotiate with a company it referred to only as “Project Louis” on potential “conduit financing” to build a 46,000-square-meter factory with runway access by 2030 that would employ 1,500 people and produce 150 aircraft per year. Florida Today first reported the news.

About paul brinkmann

Paul covers advanced air mobility, space launches and more for our website and the quarterly magazine. Paul joined us in 2022 and is based near Kennedy Space Center in Florida. He previously covered aerospace for United Press International and the Orlando Sentinel.

Related Posts

Stay Up to Date

Submit your email address to receive the latest industry and Aerospace America news.