Stay Up to Date

Submit your email address to receive the latest industry and Aerospace America news.

The space domain’s new status as a promising field for investment is shaking up long-standing relationships among governments, startups and corporations. Debra Werner chronicles the seismic shifts underway in the satellite market.

Startups and established players in the global space industry are vying for big dollars. Specifically, $1 trillion or more a year. That’s how high the annual value of goods and services produced globally by the industry is expected to grow by 2040, according to independent estimates by Bank of America, Merrill Lynch, Goldman Sachs and Morgan Stanley.

In the U.S. specifically, that growth potential is forcing entirely new relationships to form among governments, commercial players and potentially millions of consumers involved in satellite communications and imaging.

“We are in the middle of a very significant transformation from a time when government was responsible for almost everything happening in space to private industry playing an increasingly important role,” notes George Nield, who retired last year as the head of the FAA’s Commercial Space Transportation Office, which licenses rocket launches by U.S. companies and flights from U.S. spaceports.

Radar startups

Consider a market such as the nascent one for commercially produced radar imagery. This kind of imagery was pioneered by government agencies including the Canadian Space Agency, the U.S. Air Force, the National Reconnaissance Office spy satellite agency and NASA. Aircraft, oceans, storm-damaged islands and a host of phenomena can be observed through clouds or darkness. Startups in the field often like to woo investors by emphasizing new commercial markets over these traditional government ones.

Occasionally, reality creeps into the discussion, such as in an exchange I witnessed at a space industry conference in Paris last year.

In a Westin hotel ballroom, a reporter asked panelist Rafal Modrzewski, the CEO of Iceye of Finland, about customers for its synthetic aperture radar satellite. When Modrzewski said government agencies around the world would be the biggest customers for the radar imagery, another radar entrepreneur, Capella Space CEO Payam Banazadeh, said in mock surprise: “Oh, are we telling the truth? That’s OK, the investors aren’t here.”

The joke was a reference to the sector’s bold predictions that insurance companies will want to assess millions of claims with the aid of radar imagery, and multinational corporations will decide to keep tabs on far-flung facilities day and night. These predictions could prove to be right, but in reality commercial markets for radar imagery are just starting to develop. At this year’s World Satellite Business Week last month, Banazadeh acknowledged as much to an audience, saying, “We are now openly talking about the elephant in the room,” he said. “You can’t be in this business unless you are doing serious business with the government.”

A challenge for nongovernment customers is that radar images require expert analysis or sophisticated software to make them easier to decipher. For now, military and intelligence agencies remain the world’s largest consumers of radar satellite data.

Like the forthcoming commercial customers, those government customers are eager to take advantage of the low cost and high revisit rate of small commercial satellites. Until now, radar satellites have tended to be large and expensive. The NRO in 2009 declassified the fact that it conducts radar satellite reconnaissance. The Canadian Space Agency launched a trio of car-size satellites in June for its Radarsat Constellation Mission as a successor to the Radarsat-1 satellite launched in 1995 and to join Radarsat-2 launched in 2007.

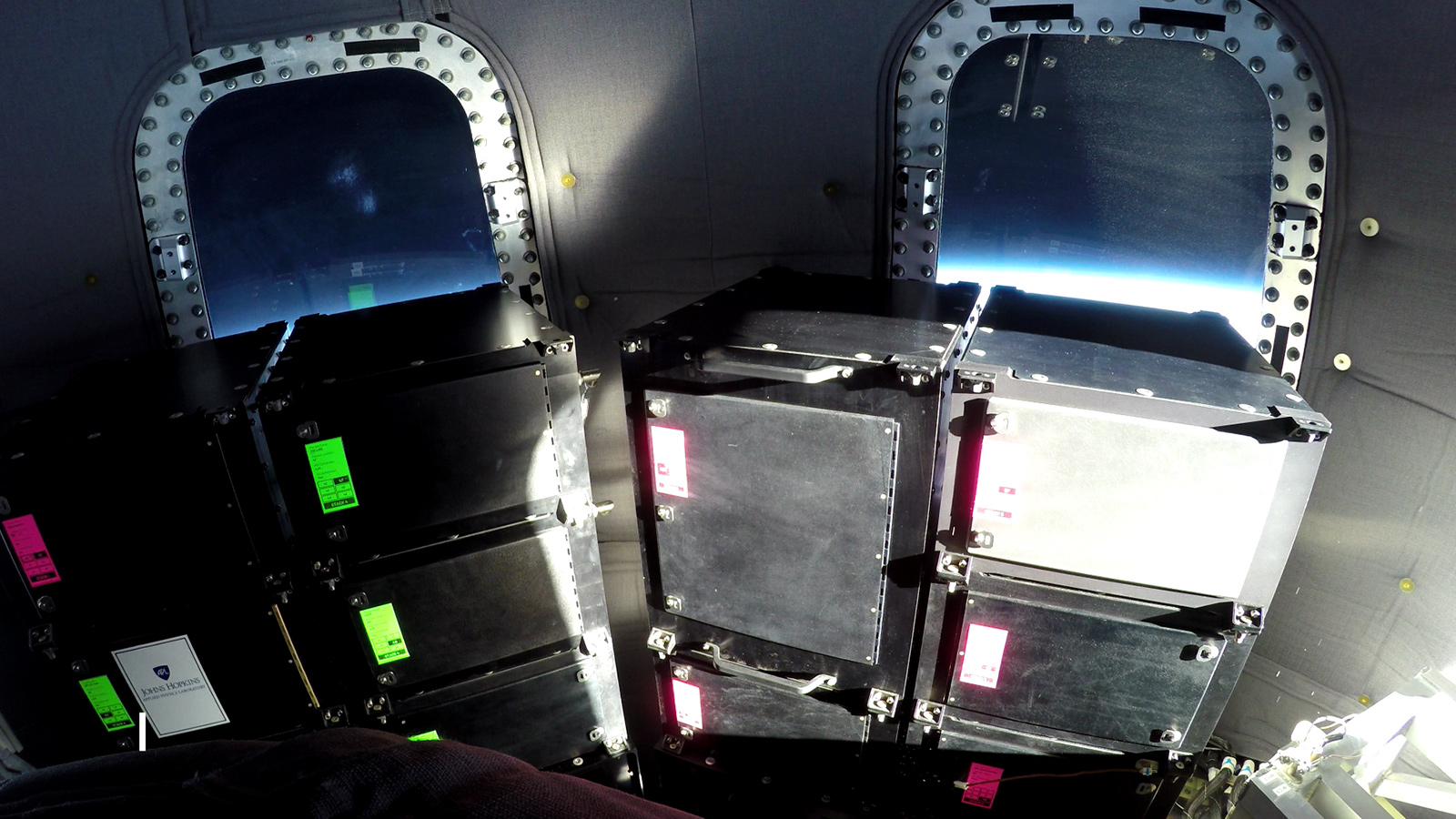

By contrast, the commercial radar satellites are closer to the size of miniature refrigerators and can cost as little as $3 million to build and launch, said U.S. Air Force Col. Steve “Bucky” Butow, at the Space Tech Expo in Pasadena, California, earlier this year. Butow is the space portfolio director for the Defense Innovation Unit, a Pentagon agency focused on solving national security problems with commercial technology. “The idea is that as we migrate to smaller, less expensive satellite buses, we can build larger constellations and look at patterns of life changes,” Butow said.

While the consumer side of the radar market is evolving, companies aren’t always upfront with potential investors about the fact that governments will remain important customers because of their deep pockets and familiarity with the product.

Global internet services

The interplay between governments and corporations in the satellite communications field shows a slightly different dynamic from that of space-based radar. Half a dozen companies plan to launch or have begun launching constellations to provide internet access to consumers anywhere on the globe. Unlike the case with radar, private-sector entities are the pioneers. Leading the way are SpaceX and the OneWeb startup based in London. They have begun launching rival constellations that will serve commercial customers in the long term even if U.S. government agencies could be among their anchor customers. The U.S. military is eager to explore, for example, whether soldiers could make telephone calls and access the internet from mobile devices on distant battlefields with the help of these commercial satellites that are also about the size of mini refrigerators.

U.S. government agencies also are providing early research dollars and experiment opportunities for one of the dozen or so companies that are competing to create a cubesat-based internet of things. The constellations would track or link cars, trucks, computers and a host of other objects anywhere in the world. The National Science Foundation, for example, is aiding Swarm Technologies, a Silicon Valley startup, with tests of its tracking and messaging service over the four hockey-puck-size SpaceBee satellites the company launched in 2018. Each SpaceBee is a one-quarter cubesat so that four can be launched from a standard cubesat dispenser. On the ground, smartphone-sized messaging devices and trackers would be attached to cars, trucks, computers or anything else a consumer might want to link to the internet. For its part, the National Science Foundation wants to learn whether scientists in Antarctica could share their data with far-flung scientists over Swarm’s network.

Cultural shifts

This dynamic in the communications and imaging markets is requiring U.S. government agencies to reboot their acquisition culture. For decades, government agencies described in detail the capabilities they wanted from their next satellite before turning to a stable of government contractors to produce them. Managers tended to load on requirements and secondary payloads on satellites destined for orbit, which meant the satellites often were the size of cars, trucks or even school buses. Inevitably, the government customer had to wait years for delivery.

Now, in addition to weighing service options, agencies are experimenting with ordering the same mini-refrigerator-size satellites that their commercial brethren buy. The U.S. Army Space and Missile Systems Command launched in May a commercial radar satellite built by York Space Systems. York is a Denver startup preparing to mass manufacture satellites that sell for $1.2 million.

It’s all part of a new strategy of buying commercial products and services instead of products designed specifically for government customers.

The U.S. Defense Innovation Unit, or DIU, talks about problems military units face and asks companies to propose commercial solutions to solve them. Then, DIU has “the flexibility of combining commercial solutions from different companies to achieve a solution more rapidly than if we tried to invent it ourselves,” Butow said by email.

Meanwhile, DARPA is holding a competition to see who in the private sector can launch small satellites on commercial rockets rather than those built to government specifications. If all goes according to plan, companies will attempt two launches weeks apart in 2020 from different launch sites as part of the DARPA Launch Challenge.

The NRO is evaluating commercial electro-optical satellite imagery gathered by BlackSky, Planet and Maxar with the idea of sharing the imagery with U.S. defense and intelligence agencies. “These companies are very dynamic,” Peter Muend, director of NRO’s Commercial Systems Program Office, said at the GEOINT conference in San Antonio in June. “They are bringing on new capability all the time.”

NASA Administrator Jim Bridenstine offered a similar message in August while touring Made in Space, a Silicon Valley startup focused on additive manufacturing in orbit. “NASA doesn’t want to be the purchaser, the owner and the operator of all of the hardware and the equipment,” Bridenstine said. “We have a vision, especially in low Earth orbit where NASA is … one of many customers.”

Ample investment dollars

The U.S. government no longer wants to call all the shots partly because private investment is flooding the space industry. In 2018 alone, investors provided $3.2 billion to startups around the world, with U.S. firms accounting for about 80% of the money, according to “Start-Up Space: Update on Investment in Commercial Space,” a report published in April by Bryce Space and Technology, an Arlington, Virginia, engineering and analysis firm.

Space companies also are benefiting from investments by car and mobile phone companies on technologies for shrinking electronics and increasing automation. This has created a dynamic marketplace with new space companies popping up weekly to offer everything from shoebox-sized weather satellites to methane monitoring sensors and techniques for pinpointing ships by homing in on their radio frequency signals.

Space industry entrepreneurs see dozens of current and potential markets developing. In addition to launching satellites and transporting cargo and crew to the International Space Station, companies are raising money to build private space stations, where customers could conduct pharmaceutical research and 3D print materials. Firms are testing technologies to refuel or repair satellites in orbit and, in some cases, move defunct satellites out of orbit. Virgin Galactic and Blue Origin plan to send tourists on suborbital flights in 2020 with spacecraft that could eventually transport passengers into Earth orbit or on quick flights from the United States to Asia. Decades from now, space companies may even be collecting water from the moon or asteroids and turning it into rocket fuel.

In the near term, the majority of commercial space products and services focus on Earth observation and communications. Consumers around the world spent $124.4 billion on satellite communications last year, including telephone, television, radio and broadband. They spent another $2.1 billion on remote sensing, such as Earth imagery to gauge crop health, track wildfires and forecast the weather, according to “2019 State of the Satellite Industry,” an annual review of the global market published by the Satellite Industry Association in Washington, D.C. Companies are selling small satellites to perform those jobs as well as cameras, synthetic aperture radars, batteries and technology to relay communications and imagery between satellites and from satellites to the ground.

The space industry’s most famous entrepreneurs, SpaceX/Tesla founder Elon Musk and Amazon/Blue Origin founder Jeff Bezos, are betting heavily on communications. Bezos is preparing to send thousands of satellites into low Earth orbit to establish multibillion-dollar constellations offering global telephone and internet access.

Gordon Roesler, who retired from DARPA last year and established Robots in Space, an Annapolis, Maryland, consulting firm, says if demand for communications bandwidth keeps climbing as it has for years, it will take all those satellites and then some “to support higher definition television, communications in developed countries and simple internet in developing nations.” Plus, U.S. government agencies want to take advantage of the new constellations to address their own surging demand for global voice, video and text communications.

At DARPA, Roesler led the Robotic Servicing of Geosynchronous Satellites program, an effort to develop and demonstrate technologies in orbit. DARPA’s goal is to prove the technology and then hand it off to a company that will begin inspecting and repairing satellites for government and commercial customers. Bringing new technologies to the point where the private sector can “take the technology and run with it” is an important government mission, Roesler says.

The U.S government also remains a valuable customer for space startups, particularly when it signals clear and consistent priorities, says Dylan Taylor, a space industry investor and co-founding partner of Space Angels Network, a New York company that invests in early stage space companies. “Where the market struggles a bit is when it’s trying to figure out what clients want,” he says. “Obviously the government is a big client.”

Nield, the former FAA official, sees government as an investor and partner for the commercial space industry, helping to maintain national security and public safety and establishing regulations that give investors and spacecraft operators confidence in the market. Much of that already happens. The FAA licenses rocket launches and satellite reentries. The Federal Communications Commission establishes rules for radio broadcasts from space, and NOAA licenses remote sensing satellites.

When it comes to space traffic management, outside experts and government managers in the U.S. continue to argue among themselves about which roles government and industry should play. For now, the U.S. military tracks satellites and warns operators of potential collisions. The Trump administration and Congress are eager to transfer that job to a civil agency, either the FAA or the Commerce Department, but can’t agree on which one.

Even if the U.S. and other space-faring nations fail to come up with a clear plan for managing space traffic, Roesler is confident industry could solve the problem on its own. In an industry solution, “perhaps not all the i’s would be dotted, and the t’s crossed, but it would be workable,” he says.

The world’s largest satellite fleet operators already share information on the location of their satellites and contact one another before taking evasive maneuvers through the Space Data Association, an industry group established in 2009 in Luxembourg. “You can imagine that growing to deal with all of the space traffic,” Roesler says.

“We are in the middle of a very significant transformation from a time when government was responsible for almost everything happening in space to private industry playing an increasingly important role.”

George Nield, formerly of FAA

About Debra Werner

A longtime contributor to Aerospace America, Debra is also a correspondent for Space News on the West Coast of the United States.

Related Posts

Stay Up to Date

Submit your email address to receive the latest industry and Aerospace America news.