Stay Up to Date

Submit your email address to receive the latest industry and Aerospace America news.

Science and manufacturing prospects on-orbit

Next year, the International Space Station turns 20. Just how many more birthdays the station will celebrate is up for debate. Congressional funding for ISS via NASA will continue through at least fiscal 2024, but the agency has made clear it wants to transition its portion of ISS to the private sector as soon as practicable. Doing so would free up an annual $3 billion-$4 billion in ISS operational costs for other pursuits, such as a crewed mission to Mars. If stakeholders cannot reach a new arrangement, they will be forced to deorbit ISS, scuttling by way of a fiery atmospheric re-entry terminating in the Pacific Ocean.

Helping NASA prepare humans for deep space exploration will be one probable revenue stream for the inheritors or successors of ISS. An admittedly shakier selling point, though, is delivering revolutionary advances in science and technology to people back on Earth. In his 1984 State of the Union address, President Ronald Reagan set the bar, appropriately enough, sky-high: “A space station will permit quantum leaps in our research in science, communications, in metals, and in lifesaving medicines which could be manufactured only in space.”

Even ISS’ most enthusiastic backers would agree this vision hasn’t been realized — or, at least, not yet. That could soon change. After fits and starts, research is now humming along, with government agencies, universities and Fortune 500 companies all lining up at the launch pad with their experiments. Particularly promising areas include drug development by pharmaceutical firms and the manufacturing of new materials. Station advocates are counting on big developments ahead.

“Significant breakthroughs in science and technology from the ISS that could come to fruition over the next few years will be a significant part of the justification for future investment and whether we maintain the ISS, a private space station, or possibly several public and private space stations,” says Eric Stallmer, the president of the Commercial Spaceflight Federation, a trade association representing more than 70 companies in the commercial space industry.

NASA intends to offer the certainty that the blooming private space industry will require. “We want to ensure continuity in U.S. human spaceflight and America’s leadership in space and technology innovation as we look to the commercial sector to play a stronger role in low-Earth orbit, and as we focus on our efforts on deep space exploration.,” says Bill Gerstenmaier, the NASA associate administrator for human exploration and operations. “The agency is engaged with the private sector to foster both commercial demand and supply for services.”

Congress has taken a keen interest as well. In the NASA Transition Authorization Act of 2017, signed into law in March earlier this year, the agency must begin producing biennial reports — the first of which is due in December 2017 — on the future of the ISS, including the steps NASA is taking in wielding the station to promote the commercialization of near-space and ultimately repositioning the agency as just one of low-Earth orbit’s many customers.

Private station aspirants, such as Axiom Space, are already placing their bets on this imminent viability of low-Earth orbit. Co-founded in 2016 by a former NASA ISS program manager and the leader of the private aerospace services firm that operates ISS, Axiom plans to launch a module to the station in 2020. That module would then detach from the decommissioned ISS in 2024, forming the nucleus for a new, commercial station. The company thinks that, besides revenue from governmental space agencies and thrill-seeking space tourists, research and the manufacturing it eventually leads to will become the top moneymaker. “Manufacturing of products for use on the ground and in space is expected to overtake all these revenue streams,” says Amir Blachman, the company’s vice president in charge of strategic development.

Although critics have assailed the ISS program for its debatable returns on investment, having cost United States taxpayers north of $80 billion, according to the NASA Office of Inspector General, private firms and venture capitalists still seem more than willing to bankroll commercial development in the final frontier.

“ISS has been the base where humanity ‘learned how to learn’ in space,” Blachman says. “Now, at the latter portion of ISS’ lifespan, on-orbit research is starting to gain the capability and robustness that is attractive to industry, including biomedical, biopharma and materials companies.”

A sea change in space

The recent flourishing of ISS research stems in large part from vastly improved access. The commercial space sector has filled the gap left by the 2011 phaseout of NASA’s space shuttle. SpaceX’s Dragon capsule and Orbital ATK’s Cygnus spacecraft are rubbing elbows with spaceships from the Russian, European and Japanese space agencies, toting experiments on their cargo runs to ISS.

“We’ve never had more opportunities to go up and down from the station,” says Ken Shields, the director of operations at CASIS, the Center for the Advancement of Science in Space, the nonprofit manager of the United States National Lab on ISS for non-NASA-related experiments.

In 2017 alone, 120 new experiments have flown, a record that gets broken with each passing year. Around 300 experiment-driven investigations happen over a typical six-month period nowadays — a far cry from the couple of dozen over a similar stretch circa 2004, says Julie Robinson, NASA’s chief scientist for the ISS Program. The number and variety of research facilities and instruments on ISS has also expanded, offering scientists the chance to study a range of areas with potential terrestrial commercial applications. Educational outreach by CASIS has brought many new researchers and funding pipelines into the space fold.

ISS science is set for another boost starting in 2018 through NASA’s Commercial Crew Program, provided the latest schedule holds. For the first time since the shuttle’s retirement, American spacecraft — the Boeing CST-100 Starliner and SpaceX’s Crew Dragon — will ferry astronauts to space. With reduced costs from flying people on these vessels versus buying seats on Russia’s Soyuz, NASA’s program will be able to afford posting an additional crew member on ISS, bringing the station’s full-time crew complement to seven. That single extra person on board will actually double the amount of time available for conducting science experiments, thanks to re-apportioning of crew duties. “We’re still on an ever-increasing trajectory,” says Robinson.

“The growing demand for access to the space station enables the establishment of robust U.S. commercial crew and cargo capabilities,” says Gerstenmaier. “Both of these aspects will help establish the U.S. market in low-Earth orbit beyond the current NASA requirements.”

Pristine micro-g

The allure of conducting many experiments aloft is the microgravity environment. The station’s continuous freefall toward Earth, which is overcome by the lab’s orbital velocity, renders everything onboard essentially weightless. This eliminates nearly all the pull of gravity that affects molecular movement at our planet’s surface. “There’s a set of experiments that scientists have been doing on Earth forever, and they can’t do the one controlled experiment [they’re] supposed to do,” says Robinson. “You can’t control gravity, because every experiment you do on Earth has it in it.”

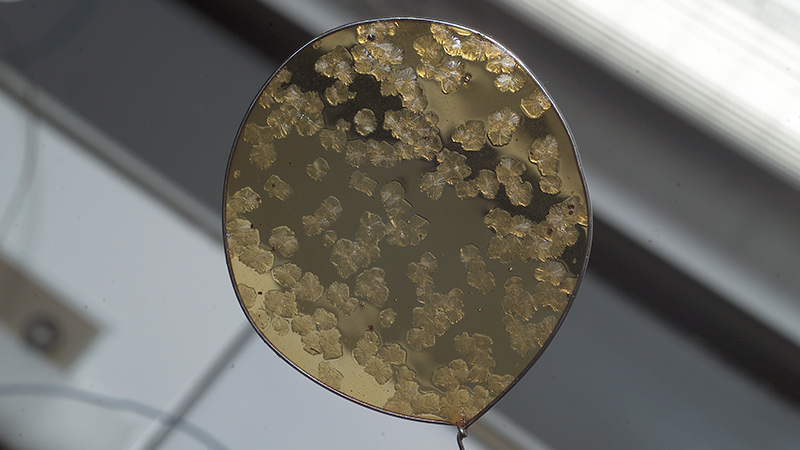

Microgravity can pay dividends when crystallizing proteins. New Jersey-based pharmaceutical company Merck has long recognized this potential, having sent crystallization experiments to space since 1993 aboard the space shuttle and continuing with ISS. Out from under gravity’s thumb, crystals can grow larger, purer and more uniform in size. On Earth, proteins sediment out of crystalline structure or further disorder themselves through movement caused by internal heat currents. The higher quality of the crystals from space is easy to see, says Paul Reichert, an associate principal scientist at Merck leading the ISS investigation. “You can hold two of the bottles up and tell the difference right away between crystals from flight versus ground,” he says.

Merck’s principal interest in those crystals is for developing concentrated suspensions of its anti-cancer compound, Keytruda. Newly formulated in this manner, a dose of the drug could be administered through a syringe at a doctor’s office, instead of burdensome, expensive, hours-long infusions at outpatient clinics or hospitals. The research could also lead to improved purification of the drug during manufacturing, reducing costs.

Keytruda works by inhibiting a “checkpoint” protein, PD-1, which blocks a patient’s immune system from otherwise attacking cancerous cells. The medication belongs to a class called biologics that represent some of the fastest-growing and top revenue-producing drugs on the market. As part of Merck’s agreement with CASIS, Reichert says the research will be published publicly for other companies and their patients’ benefit.

Parallel research is also leveraging better-quality protein crystals for discovering entirely new drugs. An imaging technique called X-ray crystallography allows scientists to obtain three-dimensional pictures of a protein’s shape. Knowing the shape opens the door to tweaking a protein so it effectively binds to target molecules. Or, oppositely, the approach can reveal “druggable” sites where a protein of interest may be targeted. An example is LRRK-2, a gene whose protein product is implicated in triggering the neurodegenerative disorder Parkinson’s, and which the Michael J. Fox Foundation sent to the station back in August 2017 having struggled to crystallize it on Earth. [See “Space station experiment targets Parkinson’s” in Aerospace America’s September issue.]

The future is bright for these modes of research because of their unique insights, Reichert says, but he urges patience. “Before you discover a new drug, it may be 10 years of research to get to that point — and that’s on Earth,” he says. “I can do a hundred experiments here [at Merck] a day,” whereas on ISS, “I have the opportunity to do one experiment a year.”

Should pharmaceutical breakthroughs in microgravity prove nontransferable to drug-making on terra firma, a strong case could emerge for constructing on-orbit specialty drug factories.

Exotic fiber optics

Another promising materials science effort, focusing on fiber optic cables, could also buttress arguments for commercial space station manufacturing.

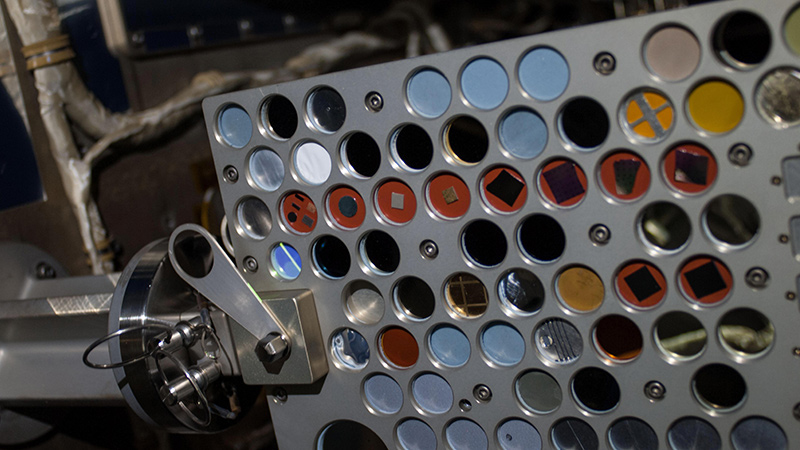

One company exploring the possibility is California-based Made In Space. Known for building the first 3-D printers ever used off-Earth (aboard ISS), the company plans to send up a new type of machine in December. Dubbed the Fiber Payload, it’s slated to generate 100 meters of fiber optic cable composed of a specialized glass called ZBLAN, named after its constituent heavy metal fluorides. In Earth’s gravity, pulling ZBLAN out into threads introduces bubbles and crystallizations that limit the material’s light transmission efficiency, making it no better at conveying data than conventional, silica fibers.

In theory, however, extremely pure, clear ZBLAN manufactured in microgravity would experience 100 times less light power loss over its length than silica. That would slash the expense associated with needing a lot of optical communications repeaters, which receive a weak signal and retransmit it in amplified form, to send telecommunications data over long distances. Plus, ZBLAN conveys infrared light better than silica, so bandwidth could increase, too. Though the space-fashioned fiber would cost considerably more on its own, lower total installation expenses should make it competitive while offering greater performance, says Jan Clawson, the Made In Space fiber optics program manager.

Clawson says he can’t give away how the Fiber Payload works exactly. But he allows that the automated, locker-sized piece of equipment will include a miniaturized fiber draw tower, similar to conventional manufacturing setups on Earth, operating in a contained, inert environment. Made In Space has big hopes for the experiment; if high quality is achievable, it “could result in complete large-scale adoption in long-haul communications,” says Clawson, “and potentially open up a multibillion-dollar market segment for a space-based product.”

Axiom Space, the private space station developer, has taken notice. The two firms announced a partnership in January to pool their knowledge and skills and establish a genuine manufacturing base in orbit.

More than microgravity

Many other commercial applications do not exploit the station’s freefall, but rather its vantage point 400 kilometers above Earth in the desolation of space. The Houston company NanoRacks helps clients with ISS utilization and is best known for deploying inexpensive cubesats. These tiny spacecraft run experiments in areas including Earth observation and exposing materials to space’s hard vacuum and radiation.

The San Francisco-based firm Planet, meanwhile, relies on NanoRacks’ ISS-mounted launcher to add cubesats, nicknamed Doves, to its constellation of satellites that constantly photograph the world below. Clients are involved in areas such as disaster relief, civil government, crop monitoring and deforestation tracking.

CASIS’ Shields says numerous startup companies with real commercial potential will be making a go on ISS over the next year. Cynthia Bouthot, the director of commercial innovation at CASIS, says economics factor into those proposals ultimately getting the green light. “We look at the economic benefit, the innovation-in-science benefit, and the humankind and social impacts as we evaluate projects,” she says.

A crowded space

Dick Rocket, CEO and co-founder of NewSpace Global, a business intelligence firm focused on space commercialization and technology, offers a telling statistic on how fast the sector is growing. “When we started in 2011, we were tracking a hundred companies for their commercial space interests,” he says of his company, located on Florida’s Space Coast. “Since then, it’s gone up one order of magnitude to over a thousand.”

The ISS has been the reliable hub and destination for much of this burbling entrepreneurial activity in space. But for the ISS to remain relevant over its remaining lifetime and pave the way for a privately owned station or stations, Rocket says commercialization must kick into a higher gear. “The ISS will end up becoming just an orbiting piece of infrastructure not being used by anyone unless it becomes very capitalistic,” he says. Just as Kennedy Space Center in Florida now has the logos for private companies including SpaceX, Boeing and Blue Origins adorning launch infrastructure previously operated by NASA, so, too, should the space station’s American modules be leased and branded accordingly, Rocket argues.

One logo up on ISS already is that of Bigelow Aerospace. The Las Vegas-based company in May 2016 deployed an inflatable, room-sized module on ISS that has become a popular nook for astronauts. Bigelow intends for these foldable, fabric, vinyl and aluminum modules to serve as living quarters and workspaces on private stations to come. The company wants to send up a much larger module in about 2020, potentially vying with Axiom Space for access to the last unused port on ISS. Meanwhile, a third group called Ixion — comprised of NanoRacks, Space Systems Loral of California and United Launch Alliance, the joint venture of Lockheed Martin and Boeing — also has plans to dock an Atlas 5 rocket’s spent Centaur upper stage to the ISS. The effort would gauge the feasibility of linking together mostly pre-built, refurbished components for a potential new extraterrestrial outpost.

With more infrastructure space-bound, people will follow. The Commercial Space Federation’s Stallmer suggests corporate researchers might soon serve stints on ISS, bringing their expertise and training rather than relying on generalist astronauts to conduct experiments. Such an approach would hearken back to the payload specialists of the shuttle days. “I could see companies like Pfizer sending engineers up to do experiments,” says Stallmer.

Inevitably, the ISS and post-ISS orbital economy will have to deal with accidents and losses of life, not just costly ships and cargo. “Spaceflight will always be expensive for humans,” says Sam Scimemi, the division chief for the space station at NASA headquarters in Washington, D.C. “It will always be a riskier business than driving a car or flying an airplane. There will continue to be accidents in flight because our understanding of this technology is not perfect.”

NASA’s Robinson offers an analogy of the history of oceanic travel for how she sees the science and commercial landscape evolving for low-Earth orbit. “If you go clear back to Magellan, exploring the ocean was pretty deadly,” she says. His voyage in 1519 that circumnavigated the globe for the first time started from Spain with 270 crewmembers and retuned home with 18, Magellan not among them. Three centuries later, the voyage of the HMS Beagle brought along scientists, including a young Charles Darwin, on a multi-year expedition, and still some deaths occurred. Nowadays, science vessels ply the waters, but so do cruise ships for pleasure, and most of the traffic on the high seas is commercial container ships. Maritime accidents are infrequent and few people bat an eye at the concept of gigantic vessels exposed to the dangers off of land, instead enjoying the fruits of science and technology strewn by worldwide seafaring.

“The oceans are part of our economic sphere on Earth,” says Robinson. “And we want low-Earth orbit to be part of the sphere.”

“ISS has been the base where humanity ‘learned how to learn’ in space. Now, at the latter portion of ISS’ lifespan, on-orbit research is starting to gain the capability and robustness that is attractive to industry, including biomedical, biopharma and materials companies.”

Amir Blachman of Axiom

About Adam Hadhazy

Adam writes about astrophysics and technology. His work has appeared in Discover and New Scientist magazines.

Related Posts

Stay Up to Date

Submit your email address to receive the latest industry and Aerospace America news.