Stay Up to Date

Submit your email address to receive the latest industry and Aerospace America news.

How the U.S. became dependent on RD-180 engines from a strategic foe

The long odyssey that has left the U.S. worrisomely dependent on Russia’s RD-180 rocket engines for national-security satellite launches should serve as a cautionary tale as the Pentagon attempts to end that reliance by awarding millions of dollars in contracts to American engine and rocket companies. A key lesson from the RD-180 saga is this: While sound designs and performance are critical to success, other matters must also be considered when selecting launch suppliers, including the viability of a launch company’s business plan, the long-term health of the U.S. space-launch industrial base and geopolitics.

1995: A turning point

The Air Force in 1995 started the Evolved Expendable Launch Vehicle, EELV, program after years of studies and false starts. Seeing predictions that the commercial launch market was about to boom, and to address Air Force requirements, McDonnell Douglas (now Boeing) developed today’s medium and heavy-lift Delta 4 rockets from elements of the short-lived Delta 3 rocket. Meanwhile, Lockheed Martin refined the Atlas 2 into the Atlas 5 fleet.

The Air Force invested $1 billion to encourage Boeing and Lockheed Martin to modernize, in the belief that these contractors would flourish and compete well in the competitive international commercial market. Success there would reduce the cost of launching satellites, including U.S. military and intelligence-community satellites. To make it happen quickly, the Atlas 5 would need a powerful first stage, and the U.S. government agreed to allow Lockheed Martin to import the RD-180s, provided the engines were eventually manufactured in the U.S. through what was called coproduction.

The U.S. failed to follow through on that requirement, setting the stage for today’s dependence on RD-180s. Complicating matters, the envisioned robust commercial launch market had not materialized. Instead, the EELV program encountered an anemic market, one that threatened the financial viability of Boeing and Lockheed Martin space-launch programs. The erstwhile competitors formed a join venture, United Launch Alliance, in 2006 to sell launch services. That move left the Air Force with two rockets from a single U.S. launch provider. That was the state of affairs when Russian geopolitical aggression, including annexing Crimea in 2014, uncorked long-suppressed concerns in Congress about U.S. dependence on the RD-180.

Beginning in 2015, as directed by Congress, the Air Force began creating a palette of technology options for weaning the U.S. off RD-180s and promoting competition in the government launch market. Early this year the service awarded a total of $242 million in contracts to Aerojet Rocketdyne, Orbital ATK, SpaceX and United Launch Alliance. The agreements require at least one third of the total cost of each prototype project be paid by other than the federal government. These Rocket Propulsion System prototype agreements are just initial steps. By eschewing foreign suppliers, by investing in partnerships with domestic industry without fully funding its development efforts and by encouraging competition from multiple launch service providers, the Air Force shows it has learned from the decades-long arc of the EELV experience.

Searching for consensus

There is a wide consensus in the U.S. that reliance on an increasingly antagonistic foreign power should end. But there is less agreement on just how to phase out the Russian engines.

According to its 2017 budget request, the Air Force plans to spend $1.2 billion over the next five years “in the development of new or upgraded domestic launch systems with domestic launch providers.”

A variety of engines and one booster are in play: Aerojet Rocketdyne’s AR1; Blue Origin’s BE-4; the already-flying Merlin and the future Raptor from SpaceX; and Orbital ATK’s Common Booster Segment solid rocket motor. Each rocket provider will design its proposed vehicle around whichever engine it selects, an engineering process never as easy as simply dropping in a new engine.

Conflicting legislation from Congress has clouded the Air Force plans. Authorization and appropriations committees have clashed over the number of future RD-180 imports needed to add to the existing stockpile to last until replacement launch services are available, with proposed limits ranging from zero to 18 new engines.

Earlier National Defense Authorization Acts also insisted money be spent only on a replacement engine. The Air Force has pushed for flexibility to address the whole launch system and would get some relief if the fiscal 2017 Authorization Act, based on versions passed by the House in May and the Senate in June, becomes law and paves the way for actual budget appropriations. Current authorization language would permit new engine imports through 2022 but cap the number at 18 and would allow up to 31 percent of fiscal 2017 funds made available to be spent on other portions of new launch vehicles, not just engines.

Learning from history

To fully understand how we got to this point, look back to the start of the EELV program in 1995. U.S.-produced rocket engines represented only incremental modifications to those designed in the 1960s, the exception being the space shuttle main engines. This was intentional. In 1972, the U.S. had settled on the space shuttle architecture of Solid Rocket Boosters and liquid hydrogen-fueled main engines as the way of the future. National Space Policy in 1982 then declared the shuttle as “the primary space launch system for both United States national security and civil government missions.” Production of other launch systems was slated to end. Even after the Challenger accident, years of studies and several aborted programs had yielded no new U.S. engine programs or launch systems.

The EELV program was the Pentagon’s response to a seminal 1994 congressionally directed study conducted after all the previous studies and false starts failed to modernize space launch. Industry’s four initial competing EELV booster proposals each relied on a different solution for its first stage; either solid rocket motors, recoverable Space Shuttle Main Engines, a new hydrogen-fueled engine — the RS-68 — for the Delta 4s, or the imported RD-180 for the Atlas 5. The Air Force ultimately decided to retain two rockets, selecting the McDonnell Douglas Delta 4 and Atlas 5 families of launch vehicles.

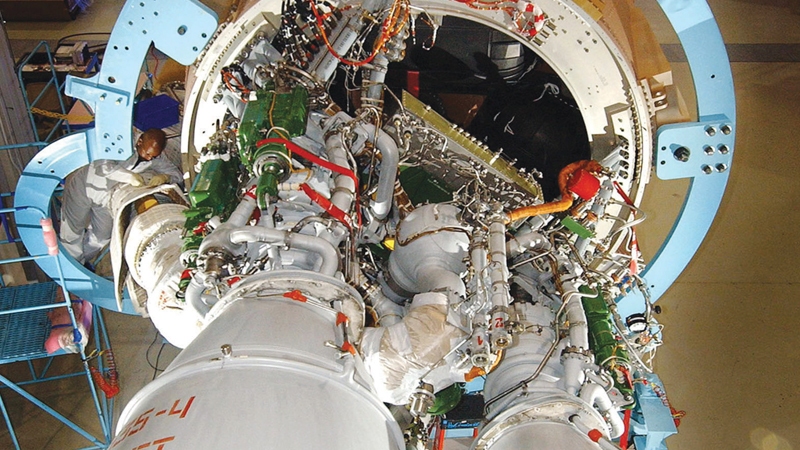

For the Atlas 5, the RD-180 was attractive to Lockheed Martin and the Air Force because it was comparatively “off-the-shelf” and fueled with rocket-grade kerosene, a hydrocarbon, called RP-1, in a high performance, staged combustion design the U.S. lacked. In fact, RD-180 was the only hydrocarbon engine among the initial EELV proposals. Given fiscal constraints, the huge national investment in the space shuttle program, and the relatively easy access to the Russian engines, it is not surprising that the U.S. did not have a new hydrocarbon-fueled engine quickly available.

Furthermore, U.S. engineers would be able to get their hands on the former Soviet Union’s long-rumored staged-combustion technology that burns an oxygen-rich propellant mixture while preventing coking, or carbon residue, in the engine machinery. Russia had mastered this unique technology that delivered a roughly 25 percent specific impulse increase over other available hydrocarbon engines.

Generating options

When the U.S. began steps to move away from RD-180s, the initial alternatives were limited. One was the Delta 4 family of vehicles, which are more expensive than Atlas 5 and consequently slated by ULA to be phased out, with the exception of the heavy variant. The other possibility was the SpaceX Falcon rockets — the Falcon 9 propelled by a cluster of nine then-relatively unproven Merlin engines, and the yet to be flown Falcon 9 Heavy. The Air Force had not yet certified Falcon rockets for military launches. After the Air Force agreed to expand the number of competitive opportunities for launch services and SpaceX dropped its lawsuit claiming it had been shut out of Air Force launch contracts, the Air Force certified the Falcon 9 in May 2015.

The limited available alternatives and promising developments in private industry efforts are the reasons the Air Force has decided to support the industry’s work on a variety of new engines. Two of them, the Aerojet Rocketdyne AR1 and Blue Origin’s BE-4, will combine staged combustion with hydrocarbon fuel, something never tried in a production U.S. rocket engine. Even the Apollo program’s giant, powerful F-1 engines, though hydrocarbon-fueled, did not use staged combustion, nor does the Merlin.

A new hydrocarbon fuel, methane, commercially available as Liquified Natural Gas, is coming into play in the BE-4 and Raptor. While studied and tested as rocket fuel, methane has never been used in a production engine. Many of methane’s properties fall between those of the RD-180’s RP-1 and hydrogen. It can be stored at warmer temperatures than hydrogen, although not at ambient temperatures like RP-1. It burns more cleanly than RP-1, according to Blue Origin, but not as cleanly as hydrogen.

The Air Force hasn’t given up on its 1995 vision of a commercially competitive U.S. launch industry.

“Having two or more domestic, commercially viable launch providers that also meet national security space requirements is our end goal,” Lt. Gen. Samuel Greaves, the Air Force’s program executive officer for space and commander of the Space and Missile Systems Center, was quoted in a January 2016 Air Force press release. The propulsion awards made earlier this year “are essential in order to solidify U.S. assured access to space, transition the EELV program away from strategic foreign reliance, and support the U.S. launch industry’s commercial viability in the global market.”

A larger U.S. share of the global market would translate into to more cost competitive options for the Air Force.

Indeed, according to a July 2016 Government Accountability Office report, the Defense Department and the Air Force are analyzing the business cases of potential launch providers and “information on the global launch market to help ensure multiple domestic launch providers can remain viable to compete for future launches.” History suggests this will be a challenge.

While the issue surrounding imported RD-180s appears to be coming to a resolution, the broader strategy for a replacement and future launch services is still unclear. The goal must be to avoid repeating mistakes from the last two decades: relying on overly optimistic commercial market projections and opting for near term expediency over follow through on established well-conceived long-term strategy to address engine supply risks. ★

Shotgun approach

The U.S. Air Force has turned to leading American rocket companies to find a solution to the country’s reliance on Russian RD-180 rocket engines. Congress wants the research funds to be applied to engine development only, the implication being that a new engine could be plugged into the Atlas 5s, each of whose first stage is powered by an RD-180. The Air Force and White House prefer to spend the money more broadly on rocket technology, but with an emphasis on propulsion. The Air Force has awarded $277 million in technology contracts since November with options that the figure could grow to $1 billion.

The bulk of the money has been allocated to four awardees under the Rocket Propulsion System prototype initiative that the Air Force started on orders from Congress. Each awardee must chip in its own money equal to at least a third of the total funds. These partnership arrangements are possible because of a federal acquisition mechanism called OTA, for “other transaction agreement.” The funds are paying for the following work.

- AEROJET ROCKETDYNE to continue development and testing of its AR1 kerosene-fueled main engine. The AR1 is a possible RD-180 replacement on Atlas 5 and is a backup candidate as the main engine for the new Vulcan rocket proposed by United Launch Alliance, the Boeing and Lockheed Martin venture that makes the Atlas 5s. Aerojet Rocketdyne has been testing the AR1’s preburner at NASA’s Stennis Space Center in Mississippi.

Value: $115 million from the Air Force; $536 million if all options are exercised. Plus $57 million from the company. - UNITED LAUNCH ALLIANCE for work on its proposed Vulcan rocket. Under current plans, the Vulcan first stage would be powered by a single Blue Origin BE-4 engine, but Aerojet Rocketdyne’s AR1 is a backup candidate. The BE-4 is unusual because it would be fueled by liquified natural gas. Blue Origin is conducting component testing on the BE-4, including preburner combustion tests, at its West Texas facility.

Value: $46 million from Air Force; $202 million if all options are exercised. Plus $40 million to be spent by ULA. - SPACEX for its planned methane-fueled engine called Raptor. This engine was originally conceived for the company’s planned human missions to Mars.

Value: $34 million from Air Force; $61 million if options are exercised. Plus at least $67 million to be spent by SpaceX. - ORBITAL ATK to develop two different solid-rocket boosters and an extendable nozzle for Blue Origin’s planned BE-3U upper stage engine. These could power a new rocket the company intends to develop to compete in the government and commercial marketplace.

Value: $47 million from Air Force; $180 million if all options are exercised. Plus $31 million to be spent by Orbital ATK.

Booster agreement

In addition to the prototype agreements, the Air Force allocated $35 million among eight companies and institutions to conduct research under its Booster Propulsion Maturation Broad Agency Announcement initiative. The awardees will explore additive manufacturing, advanced materials, non-destructive testing methods, and components such as ignition systems and thrust nozzles. The awardees are: Johns Hopkins University’s Whiting School of Engineering in Baltimore, two contracts totaling $1.48 million; Tanner Research of Monrovia, California, known for microelectronics research, $902,000; component maker Moog of East Aurora, New York, $728,000; Orbital ATK of Dulles, Virginia, $3.1 million; Aerojet Rocketdyne of Sacramento, California, $6 million; Northrop Grumman Aerospace of Redondo Beach, California, two contracts for $5.4 million and $7 million each; Boeing of Chicago, $6.1 million; Arctic Slope Regional of Beltsville, Maryland, an engineering services and information technology firm, $3.7 million.

Value: $34.5 million combined value.

WARREN FERSTER, [email protected]

About James Knauf

Sample biography information. Morbi arcu turpis, dignissim ut sodales at, rhoncus eu tortor. Nullam ac enim vehicula, hendrerit metus vel, aliquet quam. In id tempor risus. Curabitur ut consectetur est, a blandit augue. Cras at nunc dolor.

Related Posts

Stay Up to Date

Submit your email address to receive the latest industry and Aerospace America news.