Stay Up to Date

Submit your email address to receive the latest industry and Aerospace America news.

The possibility for a larger commercial role in U.S. military and government satcom

Shortly after Doug Loverro became U.S. deputy assistant secretary of defense for space policy in 2013, he was shocked to find that military communications were coursing over Apstar 7, a geosynchronous communication satellite operated by APT Satellite Holdings. Among APT’s top shareholders was a company operated by the Chinese government. In Loverro’s view, communications via Apstar 7 ran the risk of being decrypted by China. Within a month, he was on Capitol Hill explaining to a congressional subcommittee how this situation came about.

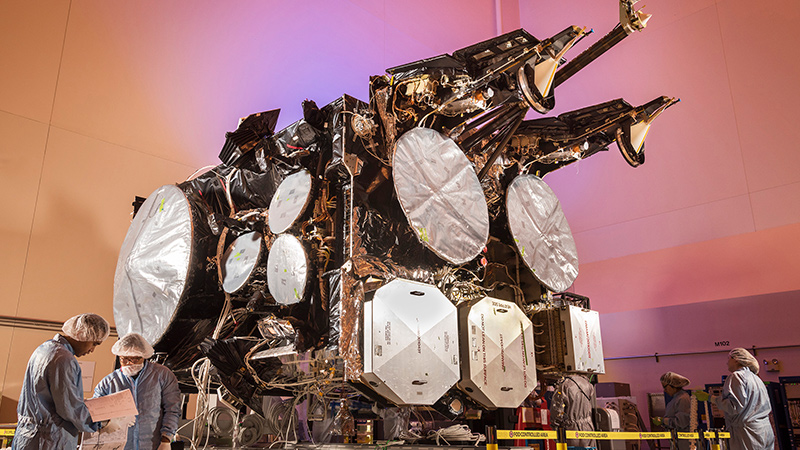

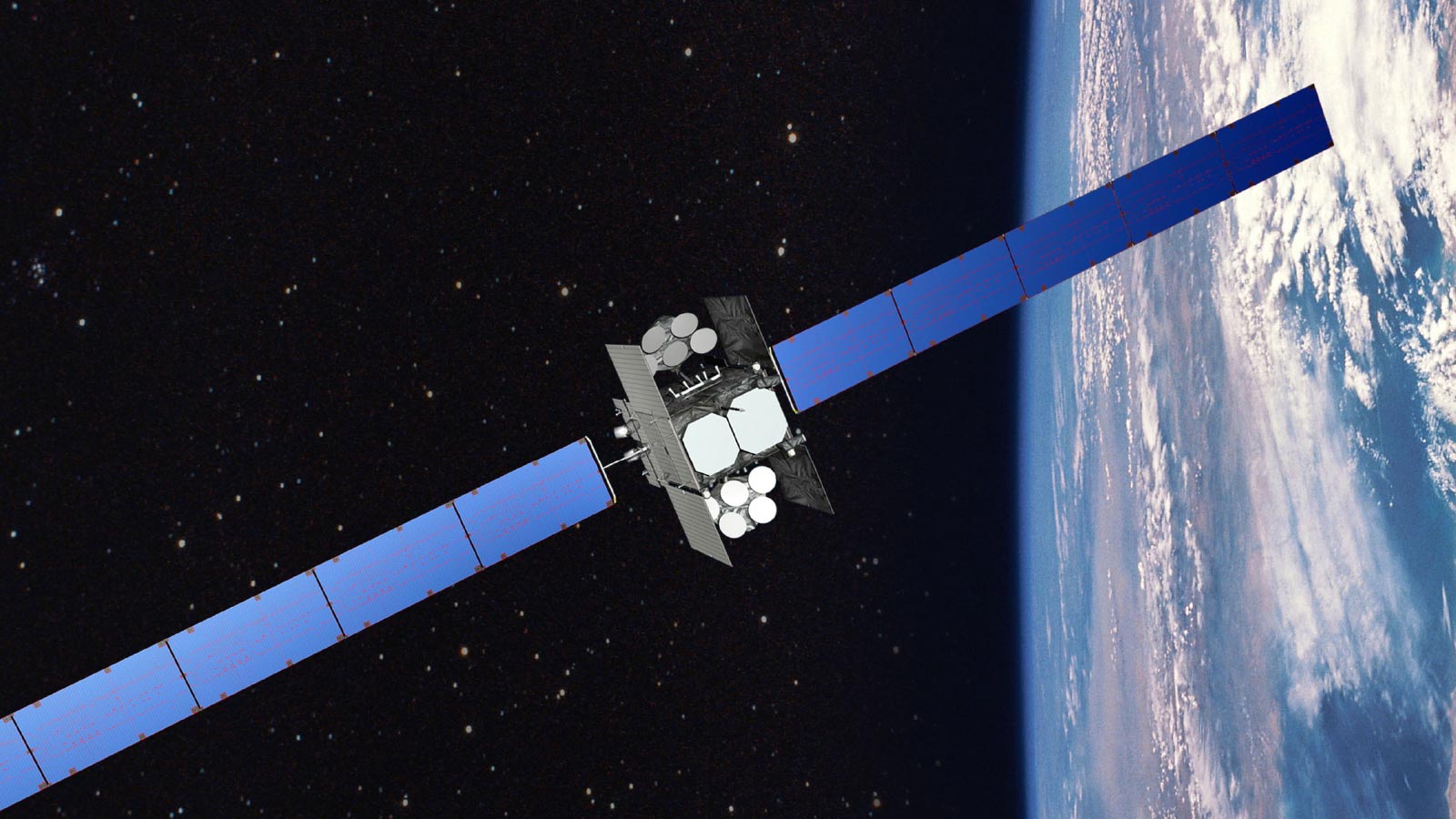

In 2012, the Pentagon needed satellite communications for troops in North Africa. Bandwidth from the usual commercial suppliers was all booked up. The Air Force-operated Wideband Global Satcom constellation, a network of school-bus-size satellites built by Boeing specifically for broadband communications, was busy supporting other missions. The new constellation, which at the time was not complete, was being tugged in many directions, from sending intelligence dossiers to far-flung stations to presenting commanders with battlefield maps layered with data to sending diplomatic cables for the State Department.

So the Defense Information Systems Agency, which leases bandwidth from companies to supplement military constellations, saw that Apstar 7 was perfectly positioned over the Indian Ocean to serve North Africa and had bandwidth to spare. DISA signed a contract with Hong Kong-based APT.

Looking back, Loverro, who left government in January, says the Pentagon could have avoided the predicament by establishing partnerships with fully vetted satellite operators based in allied nations that would commit to providing additional bandwidth on short notice. The predicament was eye-opening too, because Loverro, in another Pentagon role in 1996, had advocated creating what we now call WGS. Even this powerful new constellation could not handle the demands of a growing mission in Africa.

Today, the Pentagon’s long-term vision for broadband communications remains a work in progress. The Air Force, with a nudge from Congress, is working to change that. At issue is whether the Air Force will acquire, own and operate a multibillion-dollar successor to the WGS constellation, or whether the time has come to trust that commercial satellites will be available to take over all WGS’s duties, or some subset of them when that time comes years from now.

The service is in the midst of a congressionally ordered “analysis of alternatives” to gather and assess options for meeting the military’s broadband needs. The Air Force aims to transition to the resulting satellite communications strategy beginning in 2023, and have it up and running by 2028 when some of the WGS satellites reach the end of their 14-year design lives.

The satellite industry views the analysis as a chance to tackle some of the Pentagon’s bandwidth problems much sooner.

Air Force Maj. Gen. David Thompson says it’s “unlikely” that any future service that fills the WGS void will be purely owned by the military or by private companies. “The purpose of the [analysis of alternatives] is to look at the right mix of commercial and military systems,” he says.

Security considerations

An underlying question is whether the Air Force and others in the defense establishment can accept not owning and operating a critical piece of defense technology, in this case a satellite constellation. Thompson cautions against allowing this cultural factor to stand in the way of more effective partnerships with companies. Thompson, who advises Air Force Gen. John Raymond, commander of Space Command, on budget and strategy, says satellite security is a more practical concern than “this is the way we’ve always done it.”

Any commercial option would have to provide adequate security for defense, intelligence and diplomatic traffic. Indeed, defending satellite communications against signal jamming is perhaps the biggest security hurdle, Thompson says. Jamming can happen accidentally, such as when signals from two satellites are transmitted on a similar path and frequency and interfere with each other. Or a jamming signal can be sent intentionally with gear available in many electronics shops.

The WGS satellites aren’t entirely helpless when it comes to jamming. Each “has a little bit of extra jam resistance built in” compared to the average commercial satellite, Thompson says. A phased array antenna and onboard processor on each satellite determine the nature and level of energy coming from signals in different regions. If the signal is too strong, the processor concludes that it’s an attempt to jam the satellite’s signal. The antenna then shapes its beam to decide what location to receive and send transmissions to.

Then there are the signals themselves. The Pentagon plans to shield satellite communications from jammers by transmitting them in a protected tactical waveform, a spectrum-hopping, spreading, and coding scheme that tailors a signal so it can be read only by a corresponding modem or antenna — like encryption with coding. That waveform encoded signal will then hop the transmissions it sends through alternating spectrum frequencies as an extra precaution. This signal encoding waveform could also be extended to protect commercial satellites.

Even so, “When you compare WGS to commercial, I don’t think there is a huge [security] difference,” says Rick Lober, general manager of the Hughes Network Systems division, which connects defense and intelligence agencies with satellite communications. “I think the Pentagon is underestimating the broadband capacity it needs.”

Shifting more military communications traffic to commercial satellites also could have strategy implications for potential adversaries. Actions by China and Russia suggest that each is devising ways to destroy satellites. China launched a missile to destroy one of its own weather satellites in 2007, and Russia in 2015 raised suspicions by maneuvering a satellite close to foreign satellites. Relying on commercial satellites to carry more Pentagon communications would “absolutely” put those satellites at risk of being targeted as military assets, Thompson says, which would place civilian internet services in danger.

The anti-satellite work of China and Russia is one reason Loverro opposed the Air Force’s proposed Transformational Satellite constellation in 2007 when he was executive director of Air Force Space Command’s Space and Missile Systems Center in Los Angeles. The constellation would have sought to handle all the Pentagon’s satellite transmissions, including the sensitive messages now handled by WGS and the even more secure communications to command nuclear weapons. Loverro says there should always be a military-owned satellite for nuclear command and control, but TSAT was too pricy and “destined to fail.” The Obama administration rejected TSAT in 2009 because of its expense.

“It broke Sun Tzu’s warning about not massing all your forces in one place,” Loverro says of TSAT, citing the Chinese general who wrote “The Art of War.”

Broadband coverage gaps, like the one Loverro explained to lawmakers in 2013, create a vulnerability that, in a previous assignment in 1996, Loverro sought to prevent. Working under then-Secretary of Defense William Perry, he built bureaucratic and political support for the idea that became WGS.

The analysis addresses these kinds of everyday communications, rather than communications that must be sent even more securely than WGS and its commercial counterparts can manage. When commanders or White House personnel need maximum satellite jam resistance, they communicate through the Air Force’s nearly completed Advanced Extremely High Frequency constellation in geosynchronous orbit. If jamming is detected on one frequency, transmissions can be hopped to another. Jamming signals transmitted from the ground can be avoided altogether by relaying signals among the satellites and their cross-link antennas until the network finds a safe ground terminal to connect with. The AEHF anti-jamming defenses also encode its signal with a classified version of a waveform that shapes a transmission so that only a friendly antenna or modem can read it.

The AEHF satellites are about the same size as their WGS counterparts, but they are more expensive in part because they have redundant hardware, self-repairing software and extra aluminum shielding to withstand the electromagnetic pulse from a distant nuclear explosion and continue operating. Northrop Grumman is scheduled to build communications technology and processors for six of those Air Force satellites built by Lockheed Martin, five of which have been launched.

A commercial reserve fleet in space

A Pentagon study in 2014 concluded that building and operating a new military-owned communications satellite would be less expensive than leasing bandwidth from companies. Thompson says that study is misleading because today’s bandwidth procurement process is not cost-effective. The Defense Information Systems Agency searches the private sector to lease between 70 and 85 percent of the satellite bandwidth requested by the White House, the Pentagon and defense-related government operations each year, depending on the data traffic demands. A Government Accountability Office report in 2015 called this commercial bandwidth procurement process “fragmented and inefficient.”

“I think our biggest obstacle in making commercial satcom more effective for the Department of Defense is the Department of Defense,” says Thompson. “We haven’t aggressively negotiated for the types of things we need. We generally tend to lease transponders and bandwidth rather than looking at it in a service-based approach, or trying to buy services and capacity that we might apply globally rather than one-by-one.”

Numerous companies, NATO and up to 16 governments are contributing research to the analysis of alternatives in hopes it will show how to procure bandwidth on short notice with less expense wherever it is needed, says Air Force Col. George Nagy, who is overseeing the analysis.

Multiple working groups are involved, with a goal of helping the Defense Department “figure out how to be a better customer and a better user of [wideband] services,” Nagy says.

Long satellite lifespans

The Air Force has the time to be thorough. The WGS satellites could operate beyond their 14-year design lives, possibly for decades. In fact, five of the Defense Satellite Communications System satellites that preceded WGS are still operational, even though the oldest spacecraft was launched in 1993. The first WGS satellite was launched in 2007 and reaches the end of its design life in 2021. The 10th and final WGS is scheduled for liftoff in 2019.

Given that outlook, the Air Force has laid out a multiyear schedule to find the right answer for post-WGS communications. Nagy estimates the first phase of the analysis of both military and commercial wideband options will be complete before September 2018. The next two phases will refine those ideas and lead to technical demonstrations in 2019 to show how the proposed connections would operate.

The analysis will examine the hosted payload concept of placing military or government communications antennas and electronics on a commercial satellite that would share its transponder and power source. Intelsat, for instance, launched a GPS signal booster for the FAA on one of its satellites in 2005, and a UHF transmitter for the Australian Defense Force hitched a ride on Intelsat’s IS-22 satellite in 2012 to save the cost of purchasing rockets.

Another option under consideration in the analysis would be to place commercial and military bandwidth in a single network that could tap corporate bandwidth when needed, similar to the Civil Reserve Air Fleet agreement for airlines to transport troops when needed.

Maryland-based Hughes Network Systems, which is contributing to the analysis of alternatives, wants to manage such a network on behalf of the Pentagon. The network would connect commercial and military bandwidth into one full-time resource instead of an emergency afterthought. Doing so would make it easier for commercial technology including drones to operate on military frequencies, and vice versa, says Lober of Hughes.

Marco Caceres, director of space studies for the Teal Group market research firm in Virginia, says successful satellite partnerships between companies and militaries in Europe are debunking the argument that it is better for a military to own its satellites. Paris-based Astrium Services, a subsidiary of the Airbus Group, operates the Skynet satellites for the British government, and Rome-based Telespazio operates the Sicral satellites that provide military communications to France and Italy. Caceres says the U.S. faces less pressure than European countries to partner with companies to save money on satellites because of the Pentagon’s large budget, but those funds could be redirected to incentivize companies with contracts to provide secure satellite bandwidth when needed.

“I would imagine if there are any concerns about satellite security and control they would be alleviated by the operator, because the military would be their preferred customer,” he says.

An open question is whether or how the Pentagon will tap the services soon to be offered by the companies that propose to launch hundreds or even thousands of small communications satellites. These include OneWeb, a startup based in the Virginia suburbs of Washington, D.C., that plans to launch up to 700 satellites, and Boeing, which aims to launch 1,300 satellites within six years with the goal of expanding that constellation to 2,900. Both of these companies are contributing to the Air Force analysis of alternatives.

The Air Force is also seeking ways to improve its procurement of satellite bandwidth through a series of Pathfinder studies that began in 2014. Rebecca Cowen-Hirsch, who seeks government contracts for United Kingdom-based Inmarsat, which is also a participant in the analysis of alternatives, says she is frustrated by the slow progress of the Pathfinder studies and hopes the analysis of alternatives will encourage the Air Force to pool commercial and military bandwidth in one network.

“The challenges lie in cultural impediments rather than technological,” she says. “Building additional WGS satellites would be pressing the easy button.”

Loverro also wants the Air Force to take a leap and view commercial satellites as a full-time defense resource.

“No analysis will ever be able to prove what is fundamentally an economically uncertain prospect,” Loverro says. “You have to go ahead and actually try it.”

"When you compare WGS to commercial, I don’t think there is a huge [security] difference. I think the Pentagon is underestimating the broadband capacity it needs."

Rick Lober, general manager of the Hughes Network division

About Tom Risen

As our staff reporter from 2017-2018, Tom covered breaking news and wrote features. He has reported for U.S. News & World Report, Slate and Atlantic Media.

Related Posts

Stay Up to Date

Submit your email address to receive the latest industry and Aerospace America news.