Protecting your innovations

May 2022

Aerospace is a hot market full of groundbreaking aviation and space startups. A surprising number of these companies lack plans to protect their intellectual property. History shows that’s a mistake. Graham Phero, Robert Greene Sterne and Andrew Stevens of Sterne Kessler, an intellectual property law firm in Washington, D.C., explain.

BY GRAHAM PHERO, ROBERT GREENE STERNE AND ANDREW STEVENS

While established corporations in the aviation and space sectors have plans for protecting their intellectual property, too many startups forego the opportunity to protect their critical innovations from competitors and simultaneously enhance efforts to recruit and retain key talent as well as attract investor interest and future funding.

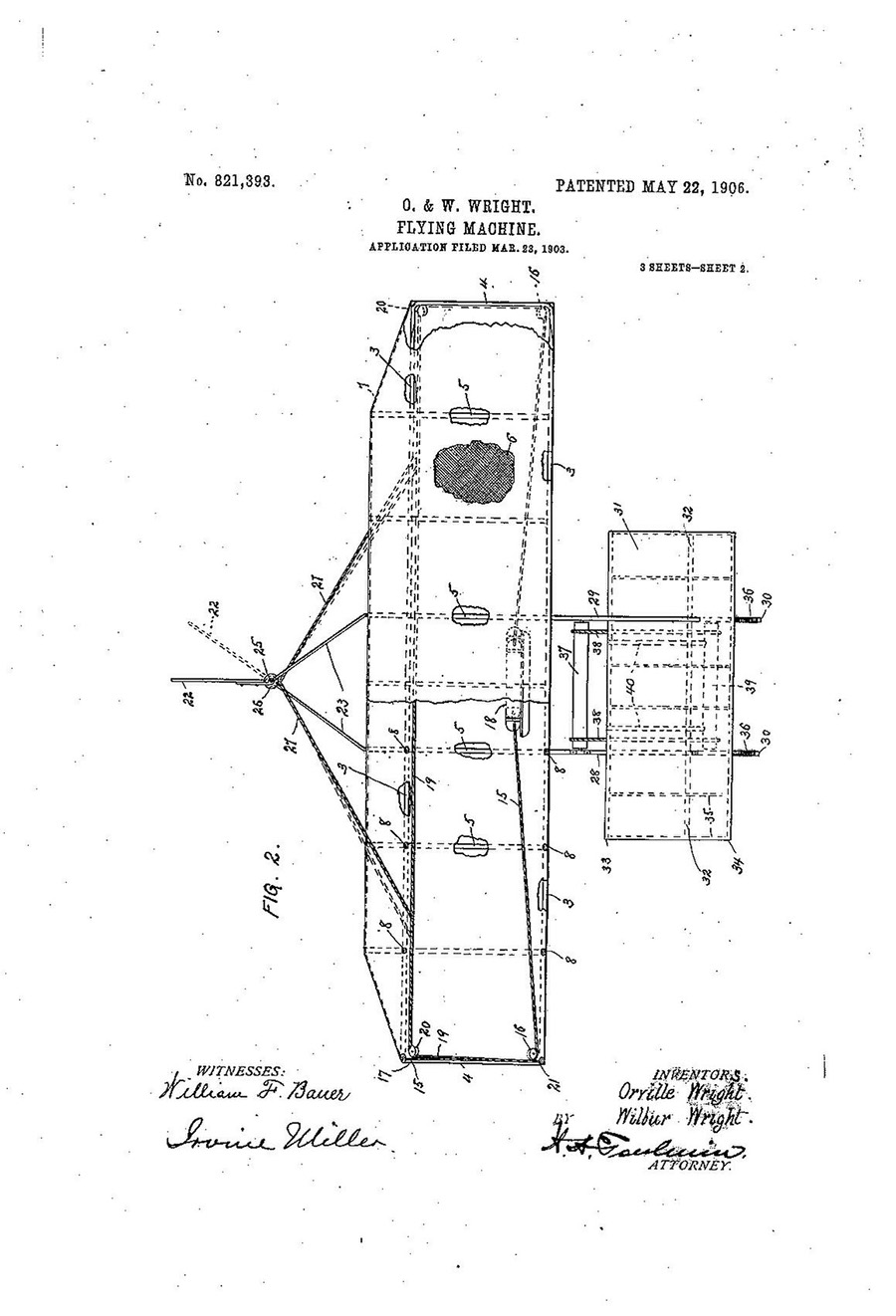

The earliest actors in aviation in the United States quickly realized the value of protecting intellectual property. As efforts turned from development of gliders to powered flight in the late 19th century, aviation scientists and engineers openly collaborated to encourage progress. Self-taught engineer Octave Chanute shared information about his team’s glider flights with the Wright brothers during the run-up to their 1903 powered flight, and both began to commercialize their innovations. The Wright brothers in 1906 were granted U.S. Patent No. 821,393 for a flying machine. While this patent was generally directed toward their unpowered glider, the patent protected key mechanisms for controlling an aircraft in flight, applicable to many early aircraft.

In the next few years, the number of global patent filings in aerospace (mainly in France, Germany, the United Kingdom and the United States) reached around 1,500 per year. This number of patents was not surpassed for most of the 20th century — in fact, with the start of World War I the number of patent filings in aerospace sharply declined and then plateaued. Government spending drove the industry, and corporations confidentially kept many of their innovations as trade secrets or relied on government contracts to protect this intellectual property.

Industry data shows that having a sound intellectual property plan remains valuable today. This is evidenced by established corporations in the aerospace industry. In early 2022, Boeing, with its large patent portfolio, had a valuation of some $150 billion and over 21,000 active U.S. and foreign utility and design patents. Likewise, Lockheed Martin had a valuation of nearly $120 billion and over 5,500 active U.S. and foreign utility and design patents.

Now consider two startups, Astra Space of California and Exodus Space of Colorado. Astra Space provides launch services from Alaska and Florida, delivering payloads of up to 500 kilograms to orbit. In April 2022, and taking into account a failed launch, Astra Space was valued by Yahoo Finance at around $800 million. Despite its innovations, Astra Space had two public U.S. patent filings as of this writing. Exodus Space is in a similar technology space and, while still raising funds, had only three public U.S. patent filings.

SpaceX illustrates a transition case between the extremes of established aerospace corporations and startups. In October, CNBC reported SpaceX at a valuation over $100 billion after a share sale by existing investors in late 2021. Founder Elon Musk once stated that SpaceX had “essentially no patents. … Our primary long-term competition is in China — if we published patents, it would be farcical, because the Chinese would just use them as a recipe book.” However, by 2018, this was no longer the case. SpaceX is now developing its patent portfolio in the satellite area, with some 50 U.S. patent filings directed to antenna systems, satellite constellations and metal honeycomb materials. Meanwhile, like Boeing and Lockheed Martin, SpaceX holds many contracts with NASA, including a Commercial Crew Transportation Capability contract.

The key question for startup corporations is: How can they maintain their innovation edge and grow valuations relative to established competitors? Investors are keen to learn the answers to that very question. And more specifically, what is the time and cost involved for a competitor to enter the technology space and try to take your market share, and what prevents them from doing so? While lead time and know-how go a long way at first, a robust intellectual property plan including patents — a public government-issued monopoly — and trade secrets — a company’s internal treatment of innovations kept confidential — is what sets a company up for long-term success and keeps future competitors at bay. A startup corporation must have an intellectual property plan and execute it as early as possible in order to build and maintain its market lead. Such a plan sets forth a global strategy, timelines, budgets and intellectual property objectives that can then be shared with management and investors.

Patents, for example, offer utility and design protection. Utility patents protect the operational aspects of a technology, while design patents and registrations protect the ornamental aspects. The patent system advances technological developments in industry through public disclosure. In exchange for teaching the public the technical details of an innovation, the government grants that inventor the right to exclude others from making, using, offering for sale or selling the innovation. But it is through that public disclosure that others learn from and improve upon the invention or develop their own alternative designs. Both utility and design patents provide for civil enforcement against competitors and provide predictable licensing opportunities to a patent owner. Patent rights expire 20 years after filing.

Trade secret protection is another important piece of an intellectual property plan in the aerospace industry and often protects a startup’s most valuable assets. Unlike a patent, a trade secret is confidential information that is never shared with the public. A trade secret must be identified and maintained as secret by the company. If the confidential information is improperly obtained by another entity, then the company may seek legal remedy under the relevant state or federal trade secret law. A company can choose to internally maintain documented descriptions of innovations they maintain as trade secrets, and should, but these documents must also remain secret to external entities. Trade secret protection provides for civil and criminal enforcement, can be more cost effective than patent protection and lasts forever — or at least as long as the startup maintains the information as secret. But if the trade secret information is discovered lawfully, the company maintaining that trade secret may be left without means to protect its innovations.

As two sides of the same legal coin, patent and trade secret protection are both used as part of an intellectual property plan to protect corporate assets and gain a competitive advantage. Not all important innovations are most effectively protected the same way using intellectual property procedures. Some innovations can be easily detected when stolen by a competitor, whereas others are nearly impossible to identify when improperly expropriated. By the same token, some innovations can be easily reverse engineered, whereas others are essentially impossible to determine without explanation. These factors must be considered when deciding whether optimal intellectual property protection rests with trade secrets, patents or both in various jurisdictions around the world. Developed and modified as a company’s needs change, an intellectual property plan is the management tool for making these determinations in a disciplined and market-driven manner. Having the intellectual property plan increases the effectiveness of the intellectual property program of the startup, maximizes intellectual property value and minimizes intellectual property risk. The result is a greater return on investment for the intellectual assets of the startup, which inures to the benefit of the shareholders and other stakeholders of the startup.

Given the rapid pace of innovation, startups also have an opportunity to create industry standards that must be followed by others — for example, when executing on a government contract. To the extent innovations resulted in the industry standard, that startup can patent and license their intellectual property to others to generate additional revenue streams.

But before startups can protect their intellectual property, they must first identify that property and determine the proper protection vehicle — all in line with their intellectual property plan. This is where many startups fail. Rather than make a conscious decision, they allow their innovations to linger and often do not pursue any type of protection whatsoever. In the case of trade secrets, many of these startups fail to implement adequate safeguards and instead watch their valuable trade secrets walk out the door through normal attrition and employee turnover. This is because as soon as the trade secret becomes available to the public, through accident, wrongdoing or otherwise, the innovation loses protection. Such inattention can significantly hamstring protection of market share and future revenue streams.

Additionally, patent filings are an externally visible measure of a startup’s innovative culture. So, without the purposeful public disclosure of innovations through patent filings, startups may struggle to hire and retain leading innovators seeking recognition. Thus, startups in the aerospace industry should create and execute on their intellectual property plan in strategic countries using a team of diverse technical and legal specialists. A responsive intellectual property team will recognize the importance of patents, trade secrets, secrecy orders and licensing schemes in and outside the aerospace industry.

And legal experience is needed in all areas of the law, including customs, arms regulation, international organizations and contract law. With this globalized intellectual property plan, startups and their innovations in the aerospace industry will thrive. Without it, startups often pursue protection on less valuable intellectual property assets, or worse, forgo protection altogether.

Related Topics

EconomicsGraham Phero is a director in Sterne Kessler’s mechanical and design practice group. He holds a law degree from George Washington University and a bachelor’s degree in mechanical engineering from Virginia Polytechnic Institute and State University.

Robert Greene Sterne is a founding director of Sterne Kessler. He holds a law degree from the University of Maryland and a bachelor’s degree in electric engineering and a master’s degree in engineering from Tufts University.

Andrew Stevens is an associate in Sterne Kessler’s electronics practice group. Stevens holds a law degree from the University of Florida and a bachelor’s degree in physics and political science from the University of South Florida.