The Office of Management and Budget (OMB) has cut the FY25 spend plan for the Office of Space Commerce (OSC) to $37 million, down from $65 million. This represents a 47% budget reduction from FY24 and eliminates the two-year funding authority Congress provided for OSC to purchase commercial space situational awareness (SSA) data. The loss of this flexibility undermines OSC’s ability to provide spaceflight safety services to the U.S. satellite industry, comparable to how the Federal Aviation Administration ensures air traffic safety for airlines.

Unless Congress provides explicit direction under a Continuing Resolution (CR), this reduction will persist into FY26, limiting OSC’s ability to support U.S. civil, commercial, and national security missions.

The Issue

OMB reduced OSC’s FY25 spend plan to $37M, eliminating purchases of SSA data and support services from U.S. commercial suppliers to ensure safe space operations by private industry and government operators.

What Does This Mean?

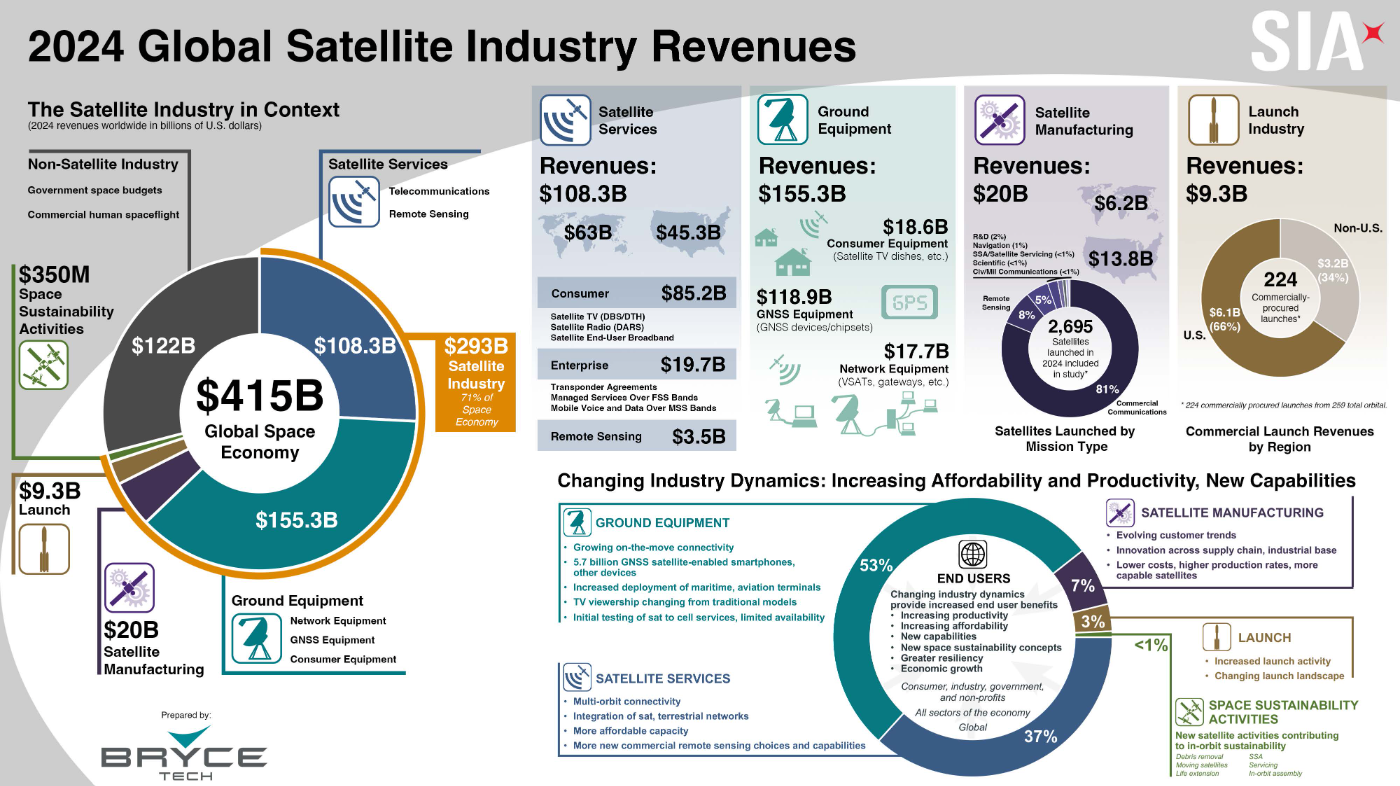

Without two-year funds, OSC cannot purchase commercial SSA data needed to track satellites, monitor debris, and issue timely conjunction warnings. This directly affects safe operations for the more than 10,000 U.S. commercial satellites that today support over $400 billion in annual economic activity. Instead, OSC will be forced to rely primarily on Department of Defense (DoD) data, which is increasingly insufficient for the speed, accuracy, and precision demanded by commercial operators. See Fig. 1.

Fig. 1 Global Satellite Industry Revenues, BryceTech

While OSC would continue limited activities, it will lack resources to integrate commercial data sources, test new data sharing platforms, and refine safety protocols with industry. The result is greater operational risk for U.S. satellite operators and diminished ability to keep pace with international competitors investing in more responsive systems.

Why It Matters

Even at reduced levels, OSC would continue to operate a limited or a “skinny” version of its Traffic Coordination System for Space (TraCSS) based on DoD data. However, this approach does not provide the precision needed for commercial operations. Thus, the likely outcome is that responsibility for routine spaceflight safety shifts back to DoD, diverting resources from its core mission of space warfighting.

At the same time, a less capable U.S. civil system reduces America’s ability to shape the international space traffic management framework. Competitors such as China are tightly integrating their commercial providers into state-directed systems, positioning themselves to set global norms and standards. Without a fully resourced OSC, U.S. industry will operate with greater uncertainty domestically and have less influence internationally.

Risks Under a Continuing Resolution

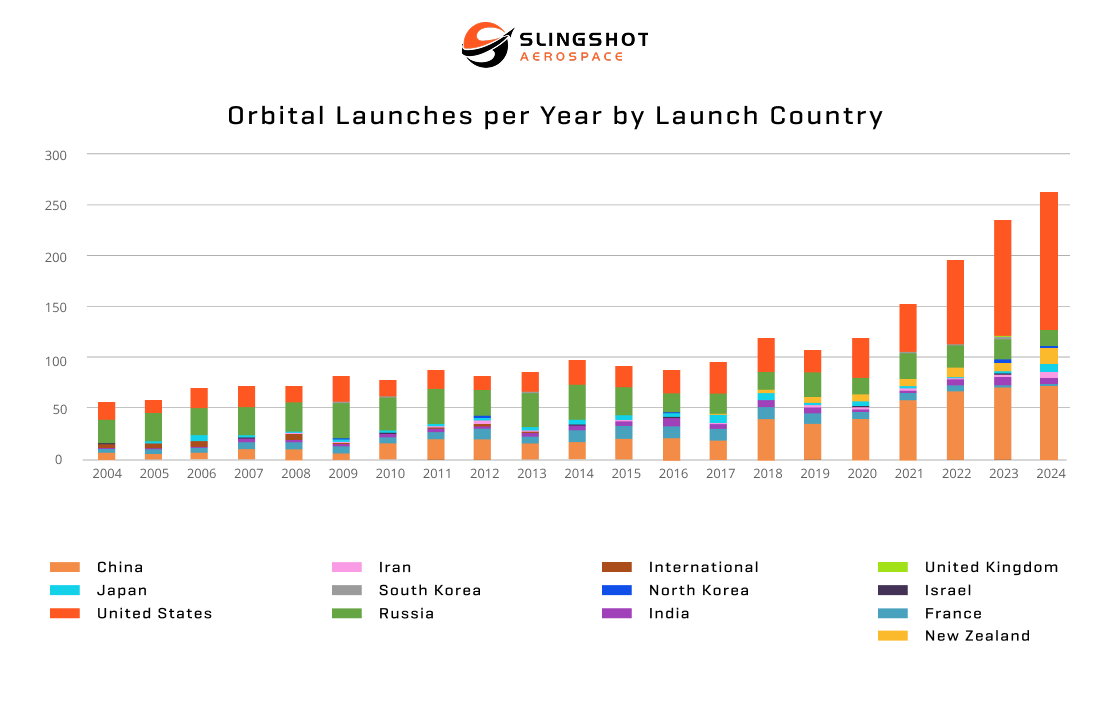

A Continuing Resolution (CR) will maintain funding at the prior-year level but prohibit new starts. Without explicit CR language, the OMB cut will eliminate operational programs in 2025 and terminate a vital SSA tool that was only recently stood up with the help of U.S. industry. The cut comes at a time when American commercial space companies are rapidly expanding their satellite networks beyond 10,000 active spacecraft in orbit, with expected growth to over 20,000 active U.S. spacecraft and 100,000 total spacecraft by 2030. Fig. 2 illustrates orbital launches per year by country.

Fig. 2 Orbital Launches Per Year by Launch Country, Slingshot Aerospace

National Security and Economic Context

The number of active satellites has grown rapidly, from about 5,500 in 2022 to more than 9,000 in 2024, and is projected to exceed 60,000–100,000 by 2030 (GAO, ESA, UK Government). China’s “Thousand Sails” constellation alone aims to deploy over 15,000 satellites by the end of the decade.

The national security implications are twofold:

- If OSC is underfunded, the mission reverts to DoD, diverting attention from space warfighting priorities.

- Without a strong civil capability, the United States loses influence in shaping the international space traffic coordination system, leaving room for China to shape standards in ways that may not align with U.S. commercial or security priorities.

Legislative Options

FY26 Appropriations Fix: Congress can ensure OSC is fully funded in the FY26 Commerce–Justice–Science Appropriations bill, restoring the resources needed to provide civil spaceflight safety services.

FY25 Execution/CR Protection: Since FY25 appropriations are already enacted, the issue now lies with execution. OMB’s plan eliminated OSC’s two years of funding for commercial data purchases. Congress can address this in a CR for FY26 by including explicit language preserving FY24 funding levels for space traffic coordination. This should be framed as continuity of operations, not a new start.

CR Protection: Include explicit language preserving FY24 funding levels for OSC’s industry engagement and ensure this is framed as continuity of operations, not a new start.

Draft CR Language for Consideration

Section [X]. Notwithstanding any other provision of this Act, the funding made available for the Office of Space Commerce in fiscal year 2025 shall continue at not less than the amount provided in fiscal year 2024 for activities supporting space traffic coordination and provision of spaceflight safety services. Such funds shall be available to ensure continuity of operations and may not be reprogrammed or reduced below fiscal year 2024 levels during the period covered by this continuing resolution.

Conclusion

The OMB reduction to OSC’s FY25 spend plan amounts to a nearly 50% budget cut, eliminating the two-year funds Congress intended to stabilize the program. Without intervention, OSC cannot adequately provide the spaceflight safety services that protect U.S. commercial satellites and support national security. The implications are clear: increased reliance on DoD, reduced service quality for U.S. operators, and a weaker U.S. role in shaping global standards. By maintaining stable funding through appropriations and CR protections, Congress can preserve U.S. leadership in orbital safety at a moment of rapid growth in space activity.

References:

- U.S. Government Accountability Office (GAO). Commercial Space Transportation: FAA Faces Challenges to Certifying and Integrating Space Vehicles into the National Airspace System. GAO-22-105166. (2022).

- European Space Agency (ESA). Around 100,000 satellites are expected to be in orbit by 2030. ESA Multimedia, April 2025.

- UK Government. The Future Space Environment: UK Analysis of Global Satellite Growth. April 2024.

- SatNews / SpaceNews. China’s Thousand Sails Satellite Plan at Phase 2. April 2025.

- Space.com. China launches first set of spacecraft for planned 13,000-satellite broadband constellation. March 2025.

- SIA: 2025 State of the Satellite Industry Report

- State of Satellite Deployments & Orbital Operations, 2023 Report, Slingshot Aerospace