Stay Up to Date

Submit your email address to receive the latest industry and Aerospace America news.

The race is on for satellite broadband as companies surge ahead with plans to blanket low-Earth orbit in satellites. The goal: provide global coverage while avoiding the pitfalls that led similar ventures in the 1990s to fail. Success will require each company to mass produce satellites. Cat Hofacker visited one of the firms leading the way.

It’s a breezy January day along the Florida coast as I make my way through the winding roads not far from where the space shuttles launched. It dawns on me that the smartphone in my pocket is connected by cell towers and fiber to the internet, and I’m about to pull into the parking lot of a company that aims to seamlessly change how millions of smartphone users will access this vast repository.

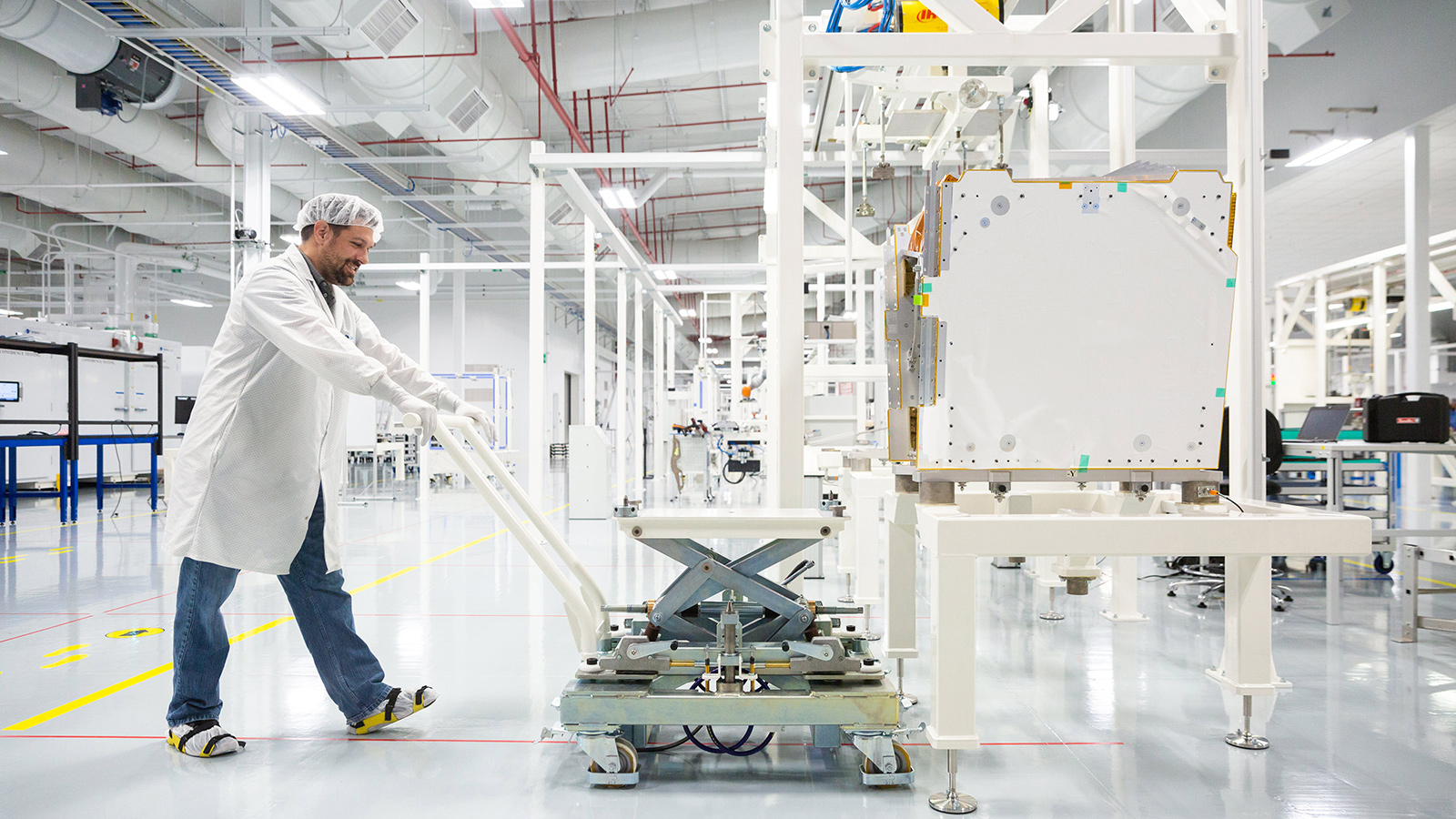

I’m here at OneWeb Satellites, a joint venture of Airbus and communications company OneWeb, which is competing to bring satellite broadband to rural populations and someday perhaps even to places like Florida’s Space Coast. OneWeb Satellites is mass producing satellites for the parent company.

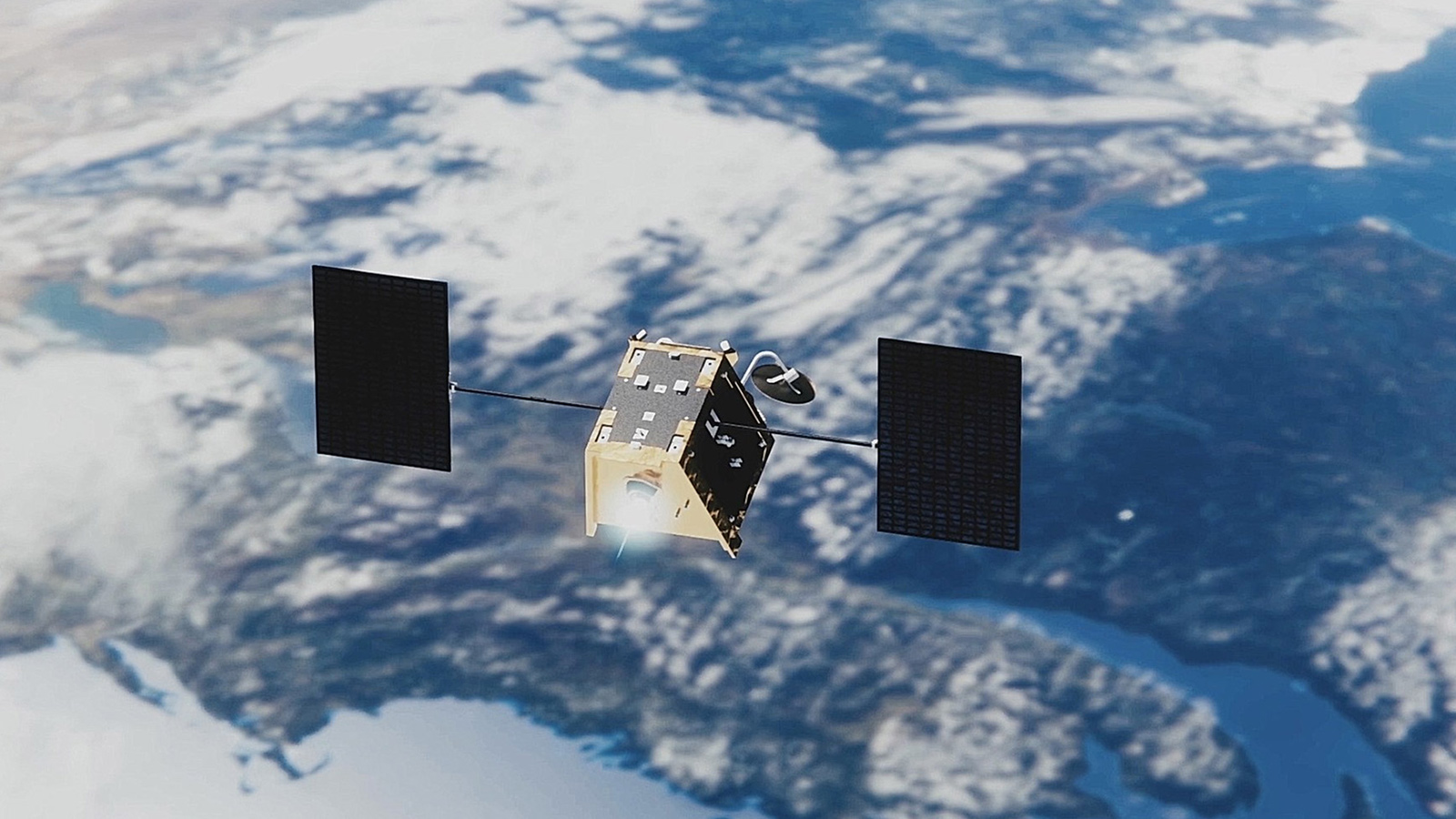

The 240 technicians and engineers inside the Florida factory must churn out two 150-kilogram satellites a day to meet OneWeb’s ambitious goal of erecting a constellation of 648 satellites in low-Earth orbit by 2021. If OneWeb or its satellite-broadband competitors succeed, then the bits and bytes of internet searches would course over a network of satellites and ground stations instead of fiber and cell towers.

OneWeb’s furious production rate is driven by a need to expand the few dozen satellites it has in orbit before the market can be dominated by SpaceX’s Starlink constellation or one envisioned by Ottawa-based Telesat. Retail behemoth Amazon also plans to be a contender in this market, but as of February it was still awaiting FCC approval for its megaconstellation.

Who is in the lead? As of February, OneWeb had launched 40 of its 648 satellites, and SpaceX had launched 300 of its planned initial constellation of 12,000. Telesat’s were still on the drawing board.

Anyone around in the satellite business in the 1990s remembers the low-Earth orbit ventures conceived by telecommunications providers Globalstar, Iridium and others. Aspirations by Globalstar and Iridium to put blocky satellite phones into the hands of consumers were undercut by the terrestrial cell network builders, who rushed in with faster coverage at lower costs with cellphones from a variety of manufacturers, ultimately clearing the way for today’s internet smartphones.

The competition facing the new LEOs is even fiercer, says Carissa Christensen, CEO of Virginia consulting firm Bryce Space and Technology. The terrestrial providers are rushing ahead with plans to connect more remote areas via 5G, the fifth generation of networks for cellular mobile communications. If OneWeb and others are to have a chance at success, they must unlock the quick, affordable and reliable mass production that will help in deploying their constellations quickly.

“I as a business can control manufacturing,” Christensen says. “I can decide when I’m going to do it and how I’m going to do it and where I’m going to do it. I cannot in the same way control demand right there.”

Design to manufacture

The custom-built Florida factory opened July 2019 and since then has been steadily increasing the number of satellites making their way along the assembly lines and into test chambers on the stark white production floor. This year, the technicians and engineers must build approximately 360 satellites to meet OneWeb’s high cadence of 10 launches of 30 to 36 satellites each for global coverage with the 648 satellites by 2021.

Fresh thinking was required to create the tooling and workflow for such a high rate of production.

“Traditionally, you build this complicated satellite and then you go on the floor and you ask the technician, ‘Hey, how can we improve this design to make it easier for you to build or work with?’” Joe Pellegrino, the launch campaign manager at OneWeb Satellites, tells me on the factory floor, where we’re both wearing slippers, hairnets and smocks. He previously built satellites at Boeing and Orbital ATK.

When OneWeb and Airbus joined forces in 2016 to build the Florida manufacturing plant, engineers and executives from both companies devised a new production model that emphasized speed.

“When they sat down and started designing these satellites, they kept manufacturing in their minds from the very beginning — making things easy to assemble, easy to troubleshoot, which is usually the opposite,” Pellegrino says.

The design of the factory flowed from that strategy. Satellites are built in two assembly lines, although these are not the continuously moving conveyor belts that the name implies. Each assembly line consists of “work cells” denoted by yellow tape: one for the propulsion module, another for avionics and a third for the communications payload module. Another cell is shared by both lines for the solar module.

The process starts at one end of the factory, where parts for each module are grouped into kits and wheeled to the appropriate cell.

At the propulsion cell, technicians bolt Hall thrusters and a propellant tank onto a spacecraft panel and pressurize the tank with helium to prevent leaks, although later xenon will be loaded.

Over at avionics, other workers attach a sun sensor, star tracker and onboard computer to a panel. At the solar station, technicians assemble two solar arrays per satellite and deploy them in a preliminary test.

At the payload cell, they install a maze of wires and square tubes. Some are for the Ku-band antennas that will communicate with user terminals such as the small dome antennas that customers will affix to their roofs. Other equipment is for the Ka antennas that will connect to the ground stations, the entry points to the internet.

As each module is completed, a shiny boxlike robot rolls underneath it. These robots, called automated guidance vehicles or AGVs, whirl modules to the other end of the factory for final assembly, their cameras and navigation software following red lines of tape on the floor.

At the final assembly line, technicians attach all the panels together, except for the payload panel. Satellites then head to one of 32 test chambers. In these white, boxy structures, satellites “go through an abbreviated mission to make sure everything’s working as expected,” Pellegrino says.

Later, I sit down with CEO Tony Gingiss. He says the process is similar to auto manufacturing in that technicians work in one location for the most part during assembly. Traditionally, a satellite stays at a fixed spot in a clean room and “you bring all the equipment and all the operators to it” to install the solar panels, thrusters and so on, he says. “Ours is, you really move the equipment through the line.”

The last step in the factory is loading up for launch. Technicians lift each spacecraft onto golden spring-loaded rails, which are then packed into 6-meter-long shipping containers. Two containers fill the back of an 18-wheeler parked right by the open door of the loading zone.

A large garage door slams shut, and that’s it for the satellites I watched leave the factory. The next day, they were loaded onto an Antonov cargo plane and flown to Kazakhstan to a waiting Soyuz rocket. They blasted into space in early February, pushed into orbit by the spring-loaded rails. Off they flew to reach their 1,200-kilometer orbits. This altitude, though still LEO, is higher than the 1,000 kilometers the Telesat satellites will occupy and the 550 kilometers used by the first phase of the Starlink constellation. The higher altitude means OneWeb needs fewer satellites for global coverage, though the fleet could grow to about 2,000 satellites if demand is high.

The satellites behind me on the assembly line won’t be far behind those launched in February. OneWeb is planning to launch another batch of 34 in March.

Once the initial constellation of 648 satellites is in place, OneWeb the broadband internet provider will be open for business worldwide. Some customers, like schools in remote areas, would connect to the internet with the roof-mounted terminals. Other customers could buy a modem made by OneWeb or a OneWeb-approved supplier and receive internet via an existing provider such as Verizon or Comcast. OneWeb is also designing flat user terminals, resembling Wi-Fi modems, for aircraft and other transportation industries.

OneWeb Satellites has other customers in mind, too. Its co-owner Airbus Defense and Space is in the running to build satellite buses for DARPA’s Blackjack program, a planned demonstration of 20 satellites in LEO to test alternatives to the Pentagon’s geosynchronous missile warning or communications satellites.

The production line in place for the OneWeb satellites should translate well to making other spacecraft, Gingiss says, as long as customers “use it as it is.”

He says you wouldn’t walk into a General Motors factory and ask them to build an entirely different car.

“How much do you think that GM car’s going to cost?” he says. “It’s not going to cost $45,000 or $35,000; it’ll cost millions of dollars.”

That being said, the Florida production lines “could accommodate design variations,” he adds. The company has a second factory in Toulouse, France, which means “lots of flexibility to whether we want to manufacture there, whether we want to manufacture on other days or shifts here [in Florida], whether we want to push everything to one production line here and use the second line for something else.”

Change on the fly

The competition involves more than getting the satellites built right and into space. It’s a battle of business plans, too. Unlike OneWeb, SpaceX wants to be a direct-to-consumer internet provider. Anyone could connect to the Starlink satellites via a user terminal that “looks like a thin, flat round UFO on a stick,” founder Elon Musk detailed in a January tweet.

The terminals will send bits and bytes of users’ internet searches to satellites via phased array antennas that track the satellites as they move across the sky, grabbing onto one after another to maintain an internet connection. Similar terminals exist today, installed on some aircraft and ships, but “such devices traditionally cost on the order of several thousands of dollars,” says Tom Butash, who leads Innovative Aerospace Information Systems, his consulting firm in Virginia. Those prices could limit the number of users in the underserved communities to which Starlink is proposing to bring broadband access.

SpaceX is trying to drive down the price of the terminals, estimating they’ll be around $200. Much more than that, Butash says, and that “relegates the service to enterprises or large organizations that can spread the cost over a large number of users.”

Despite the uncertainty, SpaceX is charging ahead with Starlink, aiming for twice-monthly launches of 60 satellites each this year.

The company declined to discuss how it maintains that high production rate for the satellites, which are built in Redmond, Washington, but a press kit released last May before the first launch offers some clues. Instead of locking in the design as OneWeb has, SpaceX will continuously update future batches of satellites as necessary through a “rapid iteration” approach.

This is evident in the drastic difference between the two Starlink designs already unveiled. The two 400-kilogram test satellites launched in 2018, nicknamed TinTin A and TinTin B, had a cylindrical bus resembling a beer keg sandwiched between two bulky solar arrays, a stark contrast to the “flat-panel design” that debuted a year later for the initial constellation.

The updated satellites are about 227 kilograms with a rectangular bus and single solar panel that unfurls like a paper map upon deployment, a design that took “a couple months” to build, Musk told reporters during a May teleconference.

SpaceX in the press kit described the new look as one that was “significantly more scalable,” a necessity if Starlink is to reach 12,000 satellites, as well as the additional 30,000 SpaceX asked the International Telecommunication Unit to arrange spectrum for in October. It’s also easier to launch, with the flat-panel satellites stacking easily inside the nosecone of the Falcon 9 rocket like so many tabletops.

This approach, SpaceX suggests, could give it an advantage if further changes are necessary. The company is already testing an experimental darkening treatment on one of the satellites launched in early January after the May launch sparked reports of twinkling lines trailing across the night sky visible to the naked eye and complaints from astronomers about streaks of light left on their ground-based telescope detectors.

The full impact of the megaconstellations on night sky observations is yet unknown. OneWeb Satellites’ Gingiss told me in January that visibility to the naked eye is a “nonconcern” for OneWeb’s satellites because of their smaller size and higher orbit than the Starlink spacecraft, but they could still mar telescope images.

OneWeb says it has “taken the concerns from astronomers seriously,” but would not say how design changes to alleviate those concerns might affect production. OneWeb and SpaceX are in the midst of ongoing discussions with astronomers about the impact of their megaconstellations.

Slow and steady

Unlike OneWeb and SpaceX, Ottawa-based operator Telesat plans to outsource its manufacturing. In a few months, the company will choose among Airbus Defense and Space, Maxar Technologies in Colorado and Thales Alenia Space in France to manufacture an initial constellation of 292 satellites the size of small pickup trucks to beam broadband to traveling aircraft, ships at sea and other business customers.

“We believe we’re at kind of a sweet spot in terms of the size and cost and complexity of the satellites that we’re building,” says Erwin Hudson, vice president of Telesat LEO, who’s overseeing the constellation’s development.

Telesat and the contractor teams have spent the last two years developing and testing the “key building blocks” of the satellite, Hudson says, in hopes of streamlining mass production once it begins later this year. For example, apertures on the phased array antennas that send and receive signals between the satellites and user terminals will be 3D-printed, turning “what would have been hundreds of parts into one single part number,” Hudson says.

Robots will help human technicians in assembling the satellites, but Hudson stresses that “we’re not trying to replace [humans]; we’re just trying to get things done quicker, more reliably, more consistently.”

Along with broadband coverage, Telesat envisions another big market for the LEO constellation is helping send traffic over the forthcoming 5G networks, an option OneWeb is also considering. The thinking is that telecom operators will need satellites for backhaul, connecting remote towers or base stations to the core communications network.

High cellular traffic could require more satellites than the initial 292 to handle backhaul, and Hudson says the manufacturing for Telesat LEO could be easily increased to meet that demand. “We can scale up in increments, and there’s different increments, but we’ve got some predefined ways: We can scale up to 500, we can scale up toward 1,000.”

Even with its 2022 entry-to-service date, Telesat is not the slowest-moving company in the market. Amazon last year announced plans for a 3,236-satellite constellation called Project Kuiper that when fully deployed “will provide continuous coverage of the United States and its territories, with the exception of Alaska,” according to a technical analysis submitted with the FCC application.

Details on the timeline for Project Kuiper are scarce, with an Amazon spokesman noting only that “this is a long-term project that will take years to roll out.” According to the FCC application, the constellation can begin “commercial operations” after the first 578 satellites are launched.

“The goal here is broadband everywhere,” Amazon founder Jeff Bezos said last June during the company’s re:MARS conference in Las Vegas.

As far as production, the company opened an approximately 20,000-square-meter facility in Redmond, Washington, last December for research and development. Satellite prototypes will eventually be manufactured there, but the spokesman declined to say if Amazon will build the actual satellites for Kuiper in-house or select an outside manufacturer.

Breaking into the market

No matter their specific plans, each company sees a large market for its constellations. Amazon estimates that Kuiper will serve “tens of millions of people” currently without broadband access, and SpaceX President and COO Gwynne Shotwell said in February that Starlink “is an element of the business that we are likely to spin out and go public.” Industry analysts aren’t as optimistic, given that terrestrial providers such as Verizon and AT&T have expanded their coverage areas since forcing Iridium and Globalstar to emerge from bankruptcy in the mid-2000s with drastically revised business plans.

OneWeb and its competitors “believe they can make [the constellations] profitable, but my belief is if you look at the expanse of their coverage area, you see increasing areas of the world that are covered by 3, 4, and now 5G broadband wireless,” says Virginia consultant Butash. “If you include fiber and cable, the area of lost satellite broadband demand is even greater.”

Asked about the race against terrestrial services and other LEOs, OneWeb Satellites’ Gingiss admits “we have a challenge here,” but he’s confident in the production model his company has built.

“I think there are a lot of people who are going to be able to leverage what we have at a price point and a schedule point and a quality point to do missions that they could have never dreamed of doing,” he says. “Because for the price of what was maybe one or two satellites before, they’ll be able to launch a whole constellation of satellites.”

“When they sat down and started designing these satellites, they kept manufacturing in their minds from the very beginning — making things easy to assemble, easy to troubleshoot, which is usually the opposite.”

Joe Pellegrino, OneWeb Satellites

About cat hofacker

Cat helps guide our coverage and keeps production of the print magazine on schedule. She became associate editor in 2021 after two years as our staff reporter. Cat joined us in 2019 after covering the 2018 congressional midterm elections as an intern for USA Today.

Stay Up to Date

Submit your email address to receive the latest industry and Aerospace America news.