Stay Up to Date

Submit your email address to receive the latest industry and Aerospace America news.

SpaceX has proven that thousands of satellites can be operated without collisions in low-Earth orbit, but that task could become more difficult as Amazon and others deploy their own megaconstellations. Jonathan O’Callaghan explores the factors at play.

In September 2019, when SpaceX had launched barely 500 satellites, the U.S. military found that one of them, Starlink 44, had an unnervingly high collision risk — a chance of 1 in 1,000 — with a European Earth observation satellite called Aeolus. After contacting SpaceX, the European Space Agency raised Aeolus’ orbit by about 350 meters to ensure the two spacecraft would miss each other, while Starlink 44 stayed put.

Despite the happy ending, the situation raised concerns that the arrival of Starlink and other megaconstellations would make collisions an increasingly likely prospect, each of which could produce thousands of new pieces of debris.

“I was one of the people that was doubtful,” recalls Victoria Samson, an expert in space security at the Secure World Foundation, a Washington, D.C.-based nonprofit.

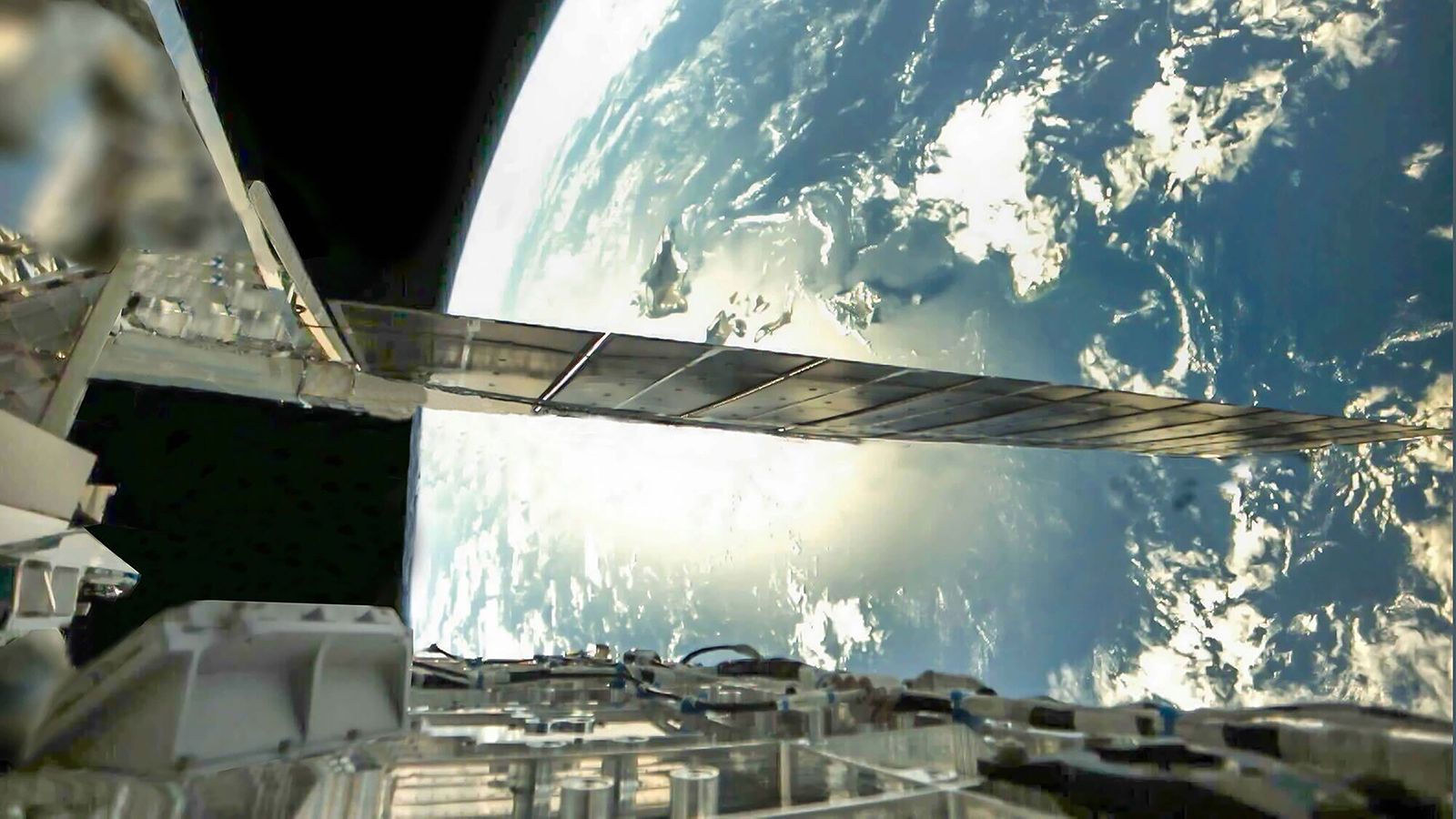

Six years later, those fears have not materialized. As of this writing, SpaceX has encountered no collisions with Starlink, which numbers 8,300 satellites and growing — roughly two-thirds of all the active satellites on orbit.

“It’s been perhaps better than we feared,” says Samson.

But with a handful of companies across the U.S. and China beginning to launch and deploy satellites for their own megaconstellations, experts are bracing for a new era in which several Starlink-sized networks circle Earth. Old worries are re-emerging, in particular the probability that adding tens of thousands additional satellites in low-Earth orbit all but guarantees an increase in collisions, unless governments and companies can devise adequate rules of the road, including ample communication.

The megaconstellation era might not end with satellite broadband, either. There are proposals for erecting such networks to collect solar power and convert it to electricity that is beamed to Earth, as a means of providing clean power to cities and countries. Other ideas center on broader Earth observation fleets like that operated by Planet, or higher-precision navigation services from networks of small satellites.

If all this comes to fruition, managing multiple large constellations operating in close proximity will be “the next big challenge,” says Brian Weeden, a space policy expert at the California-based Aerospace Corp.

Among the concerns is how the two main U.S. operators, SpaceX and Amazon, will coordinate with in-development Chinese megaconstellations. Further complicating the issue, in Weeden’s view, is that these broadband constellations are more than just commercial endeavors. They’re “seen as an important national capability” increasingly relied upon for security and military use, Weeden says, making it all the more important that operators have a way to communicate with one another to deconflict and avoid potential collisions.

And that’s perhaps the biggest hurdle, given how little the U.S. and China have historically communicated about space assets.

“There’s really good coordination between the Western operators,” he says. “The challenge is China.”

Mega numbers

According to SpaceX’s regulatory filings, its Starlink satellites between December 2024 and May 2025 performed 144,404 collision avoidance maneuvers, a number that was unfathomable several years ago when even just a few maneuvers per year for any satellite seemed like a lot.

“It is just incredible,” says Hugh Lewis, a space debris expert at the University of Birmingham in the U.K. “And that’s for a constellation that is one-fifth the size that it’s going to be,” referring to SpaceX’s aim of receiving regulatory approval to grow the constellation from 12,000 to 42,000 satellites.

Before Starlink, the biggest constellations were relatively modest: Think Planet’s fleet of about 200 Earth-imaging satellites, and Iridium’s 66 communications spacecraft. That changed in the mid-2010s when SpaceX and the U.K.-based WorldVu (now known as OneWeb) outlined plans for orbiting thousands of satellites in LEO to beam internet globally. OneWeb launched its first spacecraft in February 2019, and SpaceX followed in May.

Progress since has been rapid on these megaconstellations, a term that generally refers to at least 1,000 spacecraft working together. OneWeb now operates 648 satellites, the second largest constellation, while Starlink as of mid-September surged to 8,300 toward its initial goal of 12,000. Both have avoided collisions so far.

Around 21 megaconstellation proposals have been put forward in the last decade, notes Jonathan McDowell, an astronomer at the Harvard–Smithsonian Center for Astrophysics who tracks launches and satellite activity. Some of these have simply been announcements of intentions to launch thousands of satellites, while others have received regulatory approval from the International Telecommunication Union, or ITU, which allocates spectrum for communication in orbit.

Not all efforts have been genuine. For instance, Rwanda in 2021 submitted a filing to the ITU for a constellation of 337,320 satellites in 27 different orbits, which Samson says may have been motivated by a desire to reserve space in orbit, rather than an actual plan to launch spacecraft.

“People are worried about slots filling up,” she says.

It’s a valid concern, given that several of the serious proposals have secured regulatory approval to launch and operate several thousands of spacecraft. Among them is Amazon’s Project Kuiper, which launched its first operational satellites in April and now has just over 100 in orbit of a planned 3,236 — 1,613 of which must be in orbit by July 2026 to comply with requirements from the U.S. Federal Communications Commission. Amazon did not respond to a request for comment about the deadline and its plans to safely operate the Kuiper satellites.

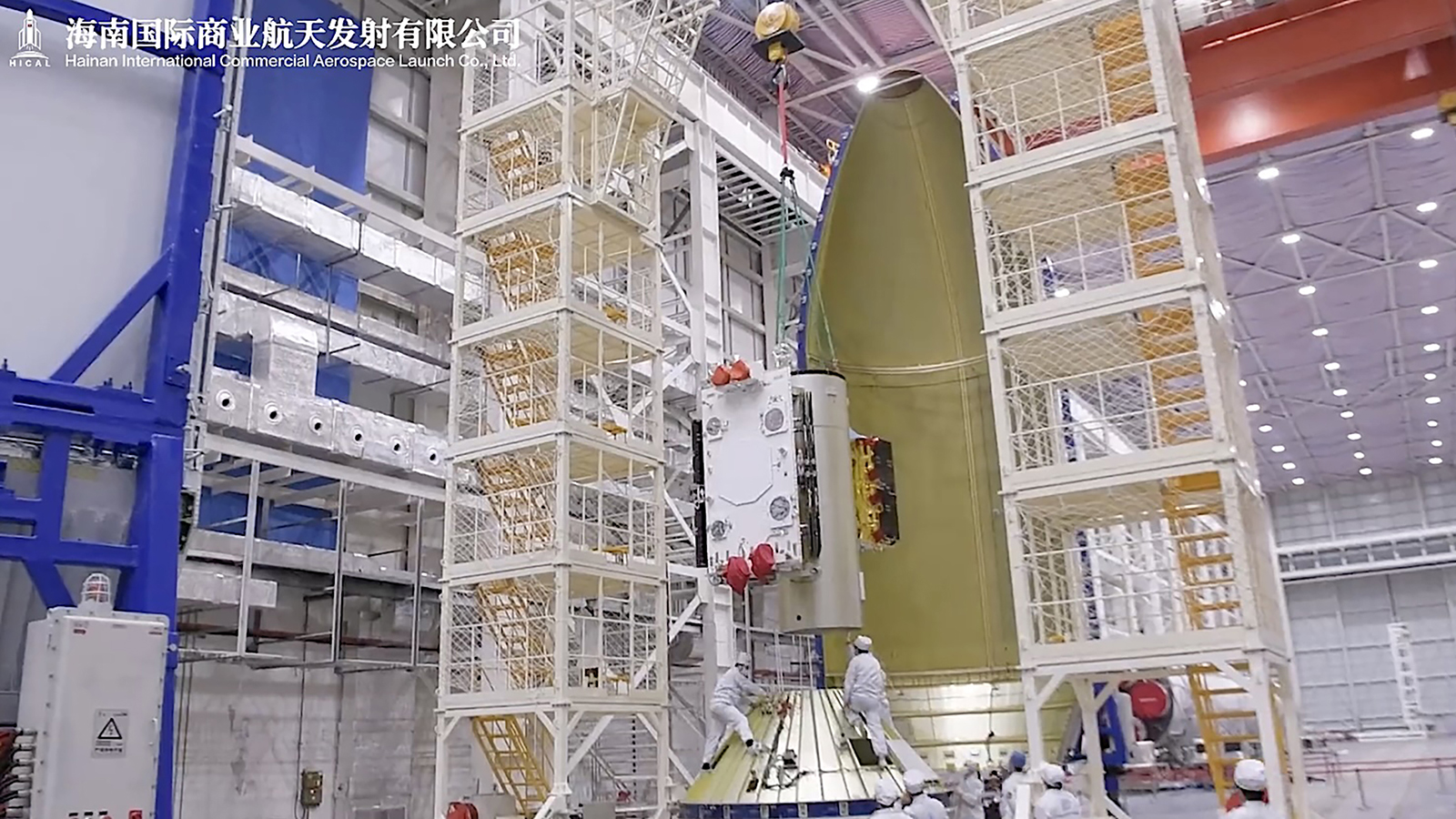

In China, multiple efforts are underway. Since August 2024, Shanghai Spacecom Satellite Technology has launched 90 spacecraft for its Qianfan constellation — which translates to “Thousand Sails” — with plans to eventually orbit 15,000 satellites. China Satellite Network Group plans 13,000 satellites for its Guowang network and has already put up about 80. Geely Holding Group is targeting nearly 6,000 satellites for its Geespace constellation, with about 40 in orbit so far.

Fueling this rapid growth are advances in manufacturing that have allowed operators to rapidly churn out the hundreds and thousands of spacecraft needed to achieve global broadband connectivity and then maintain it as their satellites reach the end of their lives and fall back into the atmosphere. SpaceX has pioneered this approach and says it produces eight Starlinks a day at its factory in Redmond, Washington.

“The reality is if you start launching satellites, you have to maintain the constellation,” says Richard Soden, director of space and satellite solutions at Keysight Technologies, a testing provider in Virginia.

SpaceX has achieved its high production rate by handling all its satellite manufacturing in-house. “They’ve got this vertical integration,” says Soden. “It’s easier to control the supply chain when you control the supply chain.”

Mega potential

While the allure of megaconstellations is severalfold, perhaps most attractive is the possible financial return. In July, SpaceX said it had more than “6 million active customers” paying $80 to $120 a month for Starlink internet, plus $349 upfront for a terminal, which translates to billions in annual revenue. Founder Elon Musk has previously said the system could generate about $30 billion a year.

“Total internet connectivity revenue in the world is about $1 trillion, and we think maybe we can access about 3%,” Musk said in a rare call with reporters prior to the first Starlink launch in 2019.

The second part of the appeal is usability. Starlink will never compete with terrestrial broadband in terms of speed; at best, it offers download speeds of a few hundred megabits per second, compared to gigabits on the ground, with far less total bandwidth. “No one is tearing fiber out to put satellite broadband in instead,” says Tim Farrar, a satellite communications consultant in California.

Instead, the value of satellite broadband is in the places fiber doesn’t reach: rural communities, ships, aircraft and conflict areas, among others. United Airlines, Qatar Airways and Air France have all signed on to equip their fleets with Starlink terminals to offer passengers faster WiFi than ever before. And the service has proven invaluable in war zones including Ukraine, where it has provided a resilient communications backbone.

“Starlink has been an extraordinary success,” says Farrar. “It has made a lot of difference to people’s capabilities to live their lives in remote areas. Six million subscribers is way beyond what anyone has achieved in the past or is likely to achieve in the next few years.”

Other countries have taken note. In addition to China, Russia has said it is developing its own satellite internet constellation, while the European Union has announced IRIS², a secure constellation of about 290 satellites, to launch in the coming years.

“Having a sovereign space internet capability has been a big change,” says Weeden.

Mega conflict

It is the U.S. and China, however, that are racing to develop the biggest constellations — a competition Starlink is dominating for the moment. But as competitors start to launch their spacecraft in earnest, on-orbit navigation will become increasingly challenging.

In the past, when satellites risked close approaches, known as conjunctions, operators phoned or emailed each other directly to decide who would maneuver. That is impossible at Starlink’s level.

“Email is not particularly scalable or responsive,” notes Ian Christensen, director of private sector programs at the Secure World Foundation.

Instead, Starlink relies on automation. The satellites automatically fire their thrusters when collision risks exceed a certain threshold, according to SpaceX’s public filings. And the company has taken pains to note it has surpassed industry standards, initially tightening its trigger from the commonly used 1 in 10,000 chance of collision to 1 in 100,000. SpaceX has further increased that threshold, most recently to 3 in 10 million earlier this year, according to reports filed with the FCC.

“There’s no business case for it,” says Lewis, noting that more frequent maneuvers mean more fuel expended and potentially a shorter lifespan for the satellites. “The only thing I can guess is that it’s a safety issue, to maintain the safety of their constellation at a particular level.”

SpaceX did not respond to a request for comment.

Even so, risks remain. In a paper published last year in the Journal of Space Safety Engineering, Lewis estimated that even with safeguards, the cumulative chance that a constellation the size of Starlink experiences at least one collision per year is greater than 10%.

“It’s inevitable, I think, that we’ll see a collision involving an active satellite in a constellation,” he says.

Even a single collision can create thousands of new debris fragments. In 2009, the active American Iridium-33 satellite and the defunct Russian Kosmos-2251 collided over Siberia, generating 2,000 trackable pieces of debris bigger than a smartphone, about half of which remain in orbit. The fear is that more frequent collisions could generate enough debris to set off a chain reaction that eventually renders LEO unusable — the infamous Kessler Syndrome phenomenon.

Efforts to impose rules for collision avoidance have stalled, with regulators including FCC and the United Nations yet to establish binding standards or rules of the road for safely operating large constellations, in part because of how rapidly the sector has grown.

“It’s hard to have firm rules when you don’t know what the best practices are,” says Weeden.

In the U.S., NOAA’s Office of Space Commerce is working on a possible solution with its TraCSS program. Short for Traffic Coordination System for Space, this surveillance network is intended to provide better data on potential conjunction events between civilian and commercial satellites to avoid collisions. The program, however, faces a somewhat uncertain future after a portion of its fiscal year 2025 budget was rescinded and the Trump administration proposed eliminating funding in its fiscal 2026 budget.

To illustrate the need for TraCSS, program manager Dmitry Poisik, points to the number of predicted conjunction events: “On a bad day, it’s a million predicted just in the next week.”

Some of those will resolve themselves, he notes, meaning a satellite never has to move. But as the size and number of megaconstellations grow, the amount of possible conjunctions will increase.

“It will be exponential,” Poisik says. “Automation is going to be key.”

Neither Amazon nor the operators of the Qianfan and Guowang constellations has said whether they plan to maneuver their satellites via automated avoidance software, like SpaceX. Amazon and Shanghai Spacecom Satellite Technology did not respond to requests for comment, and contact information for the China Satellite Network Group couldn’t be located.

In response to emailed questions, a spokesperson for Geespace said that while the company’s avoidance technology is “not entirely automated,” it has “established a high-precision collision warning and avoidance computation system” that’s “capable of monitoring potential risks in real time and executing avoidance maneuvers via uplink commands.”

As for communicating with other satellites, Geespace “actively maintain[s] communication and information exchange with international space operators, including those in the United States, to jointly ensure orbital safety.”

Mega challenge

The consequences of scaling up satellite numbers go beyond possible collisions. Since 2019, astronomers worldwide have reported that their observations of the night sky have been marred by the bright streaks of traversing Starlinks, especially at dusk and dawn. SpaceX has tried to dim the satellites, applying a darkened coating to some of them so they reflect less sunlight, but results are mixed. A paper published online as a preprint in June found that Starlinks still exceeded limits of acceptable brightness established by the International Astronomical Union.

“Starlink has done a lot of work to make their satellites fainter, and that’s fantastic,” says Samantha Lawler, an astronomer at the University of Regina in Canada, but she notes that the buses of the newer v2 variant are also bigger, “so they’re about the same brightness.”

The newly launched megaconstellations would worsen the issue, with some of the Chinese satellites already appearing particularly bright. The spokesperson for Geespace said its spacecraft “do not have any light-emitting devices and do not produce light themselves, so they will not affect astronomical observations,” but did not address the issue of the satellites reflecting sunlight.

And then there are the possible impacts to Earth’s atmosphere. The frequent rocket launches necessary to deploy and maintain megaconstellations could produce enough emissions to slow the recovery of the ozone layer, according to a Nature paper published in June.

SpaceX estimates that four to five Starlinks reenter the atmosphere every day, and a 2024 study in the journal Geophysical Research Letters estimated that a typical 250-kilogram spacecraft during reentry generates about 30 kilograms of aluminum oxide particles, which may linger in the atmosphere for decades.

There are also concerns that not all these satellites will completely burn up on reentry. Last year, a piece of a Starlink was reported to have fallen on a farm in Canada, though that appears to be the only incident of its kind to date.

Mega communication

The question now is how to operate multiple Starlink-size constellations at the same time over the coming years. While they all won’t be occupying the exact same altitudes and orbital shells, the different satellites will constantly be raising and lowering to reach their intended orbits, passing others on the way.

“Perhaps the satellites that are operating in a shell should remain stationary, and people orbit-raising or lowering should give way to those satellites and go around them,” says Miles Lifson, an expert in orbital carrying capacity at the Aerospace Corp. “One thing we’ve seen is it’s really hard to get a single agreed set of rules that works for everyone.”

In August, the U.S. government issued an advisory on how operators should communicate with China in a conjunction event. It instructed operators to send an email to an address at the Beijing Institute of Telecommunications and Tracking Technology, which tracks satellites in China, that states whether they intend to maneuver, while not revealing any technical or mission-critical information.

“It’s a small step, but it is a step in the right direction,” says Samson, adding that there’s an understanding in the industry “that there needs to be communication between the U.S. and Chinese actors.”

How and whether such guidance will work for operators with thousands of satellites is unclear. Given the number of conjunction events that may occur, sending hundreds of emails a day is likely impractical.

McDowell, the astronomer, says one solution might be to allocate specific orbital slots to different countries, as well as have limits on the number of satellites allowed up to different altitudes, but he notes this is not an idea currently under discussion.

Whatever the chosen solutions, the clock is ticking. Given the current launch cadence, there could be tens of thousands of satellites in orbit within a decade.

“My concern has always been not at the 10,000 level, but at 50,000,” says McDowell. “We’ll find out whether that’s really doable.”

About Jonathan O'Callaghan

Jonathan is a London-based space and science journalist covering commercial spaceflight, space exploration and astrophysics. A regular contributor to Scientific American and New Scientist, his work has also appeared in Forbes, The New York Times and Wired.

Related Posts

Stay Up to Date

Submit your email address to receive the latest industry and Aerospace America news.