Broadband for all

By Tom Risen|March 2017

Optimism is tempered by hard realities

If Iridium’s constellation of 66 low-Earth-orbit communications satellites sounds like a lot, try these numbers:

OneWeb, a startup based in the Virginia suburbs of Washington, D.C., plans to launch up to 700 satellites into low-Earth orbit and begin space-based broadband service as early as 2019. Boeing aims to launch 1,300 satellites within six years, and it says it will expand that constellation to 2,900. SpaceX of California told regulators it wants to launch a network of up to 4,425 satellites.

All and all, the International Telecommunication Union, which designates orbital slots for communications satellites, says that it has received 35 filings since 2015 to create broadband constellations, and that more than 25 percent of those filings were related to so-called mega-constellations of up to 4,000 satellites.

The companies want to hook billions of people into broadband internet in parts of the world where today there is no internet and perhaps not even cellular communications. Some think it will be possible to fill broadband gaps in developed countries too, including the U.S., or even to provide a lower-cost alternative to mobile broadband. In essence, the companies are trying to springboard far beyond even what Iridium tried to do in the 1990s with its short-lived plan for equipping millions of consumers with satellite phones. Iridium famously declared bankruptcy in 1999, just a year after activating its network, but re-emerged in 2001 with new investors and a new business plan.

One of those watching today’s promised broadband revolution is Iridium CEO Matt Desch, who has been steering the company into new markets, including creation of an airliner surveillance service called Aireon. When he joined Iridium in 2006, some very smart people thought even 66 satellites was crazy and that it was wasteful to put communications satellites in low-Earth orbit.

“I had to sit and listen to my main competitor in the geostationary space tell me all our satellites were in the wrong places because we provided coverage at places like the poles where only penguins and polar bears live,” Desch recalls. Now, he says, “we look like small fries” compared to the number of satellites other companies are proposing.

Desch has advice for the newcomers in the market. “You have to be prepared for delays,” he warns. “And you need patient capital. You have to be careful about putting too much debt on yourself with people who want to be paid back quickly.”

Confident innovators

The aspiring entrants to satellite broadband feel good about their plans in part because of technical advances in recent years. Engineers can now fit lighter, more powerful electronics into smaller payloads. Lithium ion batteries are more commercially available and pack a charge more efficiently than they used to, including on the Iridium NEXT satellites. Solar cells made of gallium arsenide have also become more effective at converting sunlight to electricity. Gallium nitride power amplifiers, in turn, more efficiently convert electricity into a form that can be used by a satellite’s transceiver. Antennas have greater surface precision than they used to, which enables newer satellites to send and receive broadband signals on higher frequencies. Companies such as Rockwell Collins of Iowa are building actively scanned array antennas for OneWeb that electronically steer radio waves in different directions, unlike previous generations of passive arrays that relied on moving protruding horn antennas to mechanically steer signals. New private launch providers such as SpaceX are also making rockets more available at lower prices to firms, including Iridium.

If it’s built, will they come?

Even if these massive constellations are launched, however, the biggest challenge could be finding enough customers to pay the bills.

Many customers in the developing world may not want high-speed internet badly enough to subscribe, says Marco Caceres, director of space studies for the Teal Group market research firm. “These companies are essentially talking about radically transforming culture, and that doesn’t happen as fast as people often think,” he says.

OneWeb CEO Greg Wyler has heard those questions, but he nevertheless exudes confidence.

“Once internet is available to people their intellectual curiosity kicks in,” he says, suggesting that demand will follow low-cost availability.

He says tech companies and mobile providers for years have sought new ways to provide affordable internet to unconnected people with the hopes of boosting their services to a global scale.

Wyler learned the challenges of building space-based broadband after founding O3b Networks, which he sold last year to Luxembourg-based SES, a firm best known for operating geostationary communications satellites. Wyler came up with the name O3b as shorthand for the “other 3 billion,” a reference to those in Africa, the Middle East, Asia and Latin America who live where fiber optic infrastructure is poor or cell towers are too far away for broadband. Customers of O3b, today mainly in the Pacific islands, are connected to the internet via a cable modem that is routed to the office of their telecom provider. A cell tower linked with the telecom office connects with the O3b satellite, which extends the reach of their network by relaying a broadband signal from a distant internet server. The existing O3b satellites provide coverage that is specific to a certain area, while OneWeb plans to launch hundreds of satellites and take that mission of connectivity to the next level.

By 2022, OneWeb aims to bring online the estimated 2 million schools in the world that have little or no access to the internet, especially those in Africa, Asia and Latin America.

This will take time. “Unless you are ready to go in for the long haul, there is no way you are going to succeed,” Wyler says of satellite broadband.

“You also need a lot of luck,” he says, alluding to unforeseen delays such as satellite malfunctions, extra costs of doing business or even a rocket explosion.

Wyler says his investors, including SoftBank, Qualcomm and Coca-Cola, are patient financiers who are looking for long-term relevancy instead of short-term gain, which will accommodate any potential delays or extra costs. Iridium has been through the long haul, and is now focused mainly on markets other than those of the other proposed low-Earth-orbit constellations. The company was squeezed into bankruptcy partly because terrestrial broadband networks were established faster than many expected when the Iridium business plan was formulated in the 1990s.

Iridium rose from bankruptcy in 2001 with new investors and shifted away from consumer broadband and toward businesses with global reach including the airline, defense and maritime industries. The U.S. military, for instance, saw the opportunity to connect soldiers and commanders by using the global communications network and created the network known as the Distributed Tactical Communications System. Iridium’s 850,000 subscribers include deep-sea fishermen, field scientists, explorers and other travelers in remote areas, but its growth plan is focused on connecting infrastructure, not merely people.

“We don’t really go after the consumer market because the cost-benefit is a different business case that has yet to be proven by OneWeb and others,” Desch says.

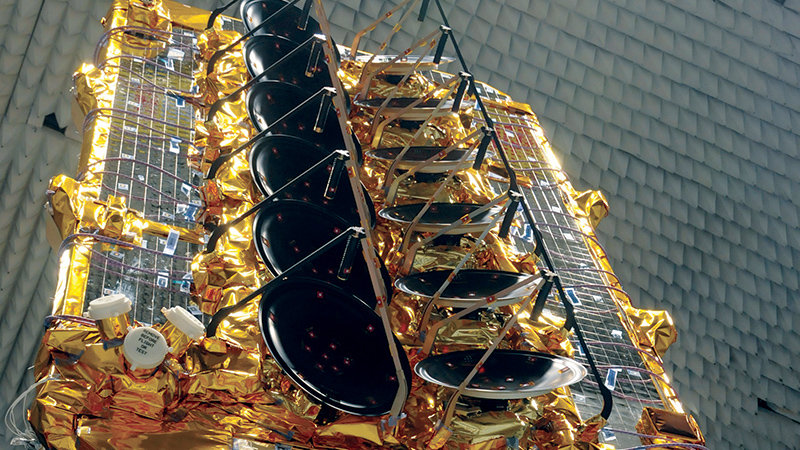

In January, a SpaceX Falcon 9 rocket launched 10 Iridium NEXT broadband satellites in the first of a series of launches through 2018 that will replace Iridium’s existing constellation with 75 new satellites. Iridium announced in mid-February that its second mission of 10 Iridium NEXT satellites is scheduled to launch in mid-June.

Untapped market

The costs of network access are a major reason that nearly half of the approximately 7 billion people in the world have little to no internet connection, according to the International Telecommunication Union. Even in the U.S., 34 million people — or 10 percent of the country — lacked access to broadband-speed internet in 2015, especially in rural areas where it is difficult for providers to build infrastructure, according to the latest report from the Federal Communications Commission.

Tom Stroup, president of the Satellite Industry Association trade group, says geostationary satellite companies are investing in the proposed low-Earth-orbit constellations to boost their network coverage, but that some new entrants to satellite broadband will also compete with each other for the same customers.

Financing will be a major hurdle, but integrating the new business models into a crowded telecom sector will be an ongoing challenge. The proposed Boeing Global Broadband System constellation and OneWeb’s network of satellites would operate similarly. Consumers would connect their cellphones and computers to broadband by linking with a satellite through their service provider’s router. That satellite would in turn relay a broadband signal to the consumer by rebroadcasting it from a nearby cell tower. Keeping these networks running will require licenses from regulators and likely deals with businesses in numerous countries.

How they work

Iridium’s satellites each have cross-link antennas that relay signals among each other, enabling the company to provide global coverage with fewer satellites than those proposed by newcomers to the broadband market. Neither OneWeb nor Boeing will equip their satellites with cross-link communication. Iridium customers, including their existing satellite phone users, will be able to connect to the internet directly from an Iridium NEXT satellite if they buy a portable modem to tap into their network.

OneWeb aims to focus on consumer broadband, especially in unconnected and underserved areas. Boeing will seek a wider range of customers by marketing to both commercial and government users.

OneWeb and SpaceX, which described its plans in less detail than other companies, would use many hundreds of satellites that will be about the size of a refrigerator. Specifically, OneWeb’s will weigh up to 150 kilograms before launch and the SpaceX satellites will weigh up to 400 kg. Boeing does not specify the weight of its proposed satellites, but they are widely expected to fall within the small satellite class, meaning less than 500 kg. The new Iridium NEXT satellites are the size of a small car and weigh 800 kg.

Keeping order in orbit

Reliable technology is a key factor not just for consumer convenience but the safety of other objects in orbit. Satellites in low-Earth orbit have exhibited a roughly 10 percent failure rate on average, according to estimates by Desch and Caceres. This raises concerns about a dramatic increase in space debris that could result if thousands of new satellites are launched and even a fraction of them malfunctioned.

Decades of space missions have cluttered orbit with pieces of debris ranging from derelict satellites to flecks of paint. The U.S. Air Force estimates more than 23,000 man-made objects orbit Earth every day, so it keeps a close watch to ensure they don’t collide with other nearby objects. Companies will have to coordinate their orbits to keep their satellites out of harm’s way and prevent low-Earth orbit from becoming a dangerous junkyard.

Wyler says OneWeb’s satellites will use the latest electronics to build redundancies and guard against failures in orbit.

“Space is not a dumping ground for junky satellites,” Wyler says. “We do not intend to have a 10 percent failure rate, or anything near that.”

Low-Earth orbit in particular is becoming crowded in terms of both physical space and airwave frequencies to run broadband networks. The International Telecommunication Union says 25 percent of the 35 filings to create broadband constellations were related to so-called mega-constellations, which typically have more than 800 satellites. Companies filing to create these satellite networks include OneWeb, SpaceX, O3b, Canada-based COMMStellation, and Boeing.

The U.N. communications agency must grant approval for any company to run a satellite broadband network, and the Federal Communications Commission does the same by vetting operations on U.S. airwaves. Iridium gained these permissions in the 1990s before launching its first constellation.

OneWeb in 2012 received approval from the International Telecommunication Union to use spectrum for its broadband network. The U.N. agency requires OneWeb and every other company that receives these permissions to ensure that its signals do not interfere with antennas in the orbits below theirs. If the agency continues this vetting process to plan orbiting slots and spectrum use, then the thousands-strong constellations could be able to broadcast internet without drowning out the signals of neighboring satellites.

Newly appointed FCC Chairman Ajit Pai said during an open meeting of the commission that he aims “to bring digital opportunity to all Americans,” adding that the commission is reviewing requests from companies including Boeing, SpaceX and OneWeb to provide spectrum to serve customers in the U.S.

OneWeb last year began working with companies including Qualcomm to prepare OneWeb’s satellites for launch, including by performing radiation and thermal cycling tests on each of its components in a vacuum chamber. The satellite communications firm has contracts with Arianespace of France to launch its first set of satellites into orbit in March 2018, with 20 other scheduled launches from 2018 through 2020. Caceres says Boeing and SpaceX could be forced to limit their ambitions, because launch capacity is unlikely to grow sufficiently during the next five years. There may not be enough rockets to meet the demands of existing customers and also accommodate the thousands of new broadband satellites.

“When companies come out with huge [proposals like these] the number of satellites usually goes down later on,” he says. “Maybe a few hundred would be more reasonable.”

These firms may also consider merging their broadband efforts to ease the burden of managing thousands of satellites, rather than competing for a wireless consumer market that is still evolving in developing countries, Caceres says.

“I would not be surprised if you had a merger between SpaceX, Google and OneWeb because they are envisioning essentially the same system,” he says.

Partnerships with existing mobile communications companies would also make it easier to sell broadband in the U.S., but it is unclear whether these companies will share airwaves with the satellite firms or seek to claim that increasingly scarce digital real estate for themselves.

SoftBank, the parent company of Sprint that recently announced a $1 billion investment in OneWeb, says it is working with the satellite firm to explore how to bring affordable broadband to rural areas in the U.S.

Whatever lies in store for these constellations, it is clear that getting into space will only be the beginning. ★

“We don’t really go after the consumer market because the cost-benefit is a different business case that has yet to be proven by OneWeb

Iridium CEO Matt Desch

and others.”