Stay Up to Date

Submit your email address to receive the latest industry and Aerospace America news.

Automation presents challenges and is not expected to happen quickly

As electric air taxi production takes shape over the next two years, don’t expect the production processes to emulate the high level of automation in automobile manufacturing, even as an increasing number of air taxi startups turn to automakers for their expertise in mass production, say executives from two of the leading air taxi companies.

“We are going to have to build in automation over time, so you’re not going to walk into a fully automated plant anytime soon,” Adam Goldstein, the founder and CEO of California-based Archer Aviation, told me in a phone interview.

“Our aircraft won’t be rolling on an automated assembly line, like a car is made, but it will roll out the back door right onto the runway,” Goldstein said. “So, you’ll be able to test fly it and further inspect it right away. That’s why we chose to build our new plant where we did, at Covington [Georgia] Municipal Airport.”

Archer on Jan. 4 became the latest developer of an electric air taxi to reach an agreement with a car company, Amsterdam-based Stellantis — which owns auto brands including Chrysler, Fiat, Jeep and Peugeot. Other examples of such pairings between the two industries include Toyota’s 2020 investment of about $400 million in Joby Aviation, also based in California, and Daimler’s 2017 investment of $40 million in Germany-based Volocopter.

Archer and Stellantis have started to build the plant in Georgia, in a region that already has aerospace and automotive manufacturing, such as the nearby Nisshinbo Automotive plant where car brake parts are made.

“Stellantis has stood up and shut down many plants. That’s why we are working with them,” Goldstein said. “We’re not going to sit here and be arrogant, to believe that we’re smarter than the next guy and not have any production problems like [electric automakers] Rivian and Lucid have had.”

He added: “We understand the FAA side of things and they [Stellantis] know how to build lots of things, quickly.”

Goldstein said Stellantis will eventually take over mass production as Archer’s contract manufacturer. According to Archer’s announcement about the Stellantis agreement, the targeted opening date for the plant is 2024, to build Archer’s electric Midnight air taxi, which are designed to carry four passengers and a pilot. Archer intends to produce 250 Midnights in the first year and 500 in the second year, but still needs to achieve FAA type certification.

Stellantis has pledged to invest $150 million in Archer as certain undisclosed milestones are met.

“It’s not just that they are contributing capital to us, but they’re also allowing us to avoid spending hundreds of millions of dollars to develop mass manufacturing expertise and tools,” Goldstein said.

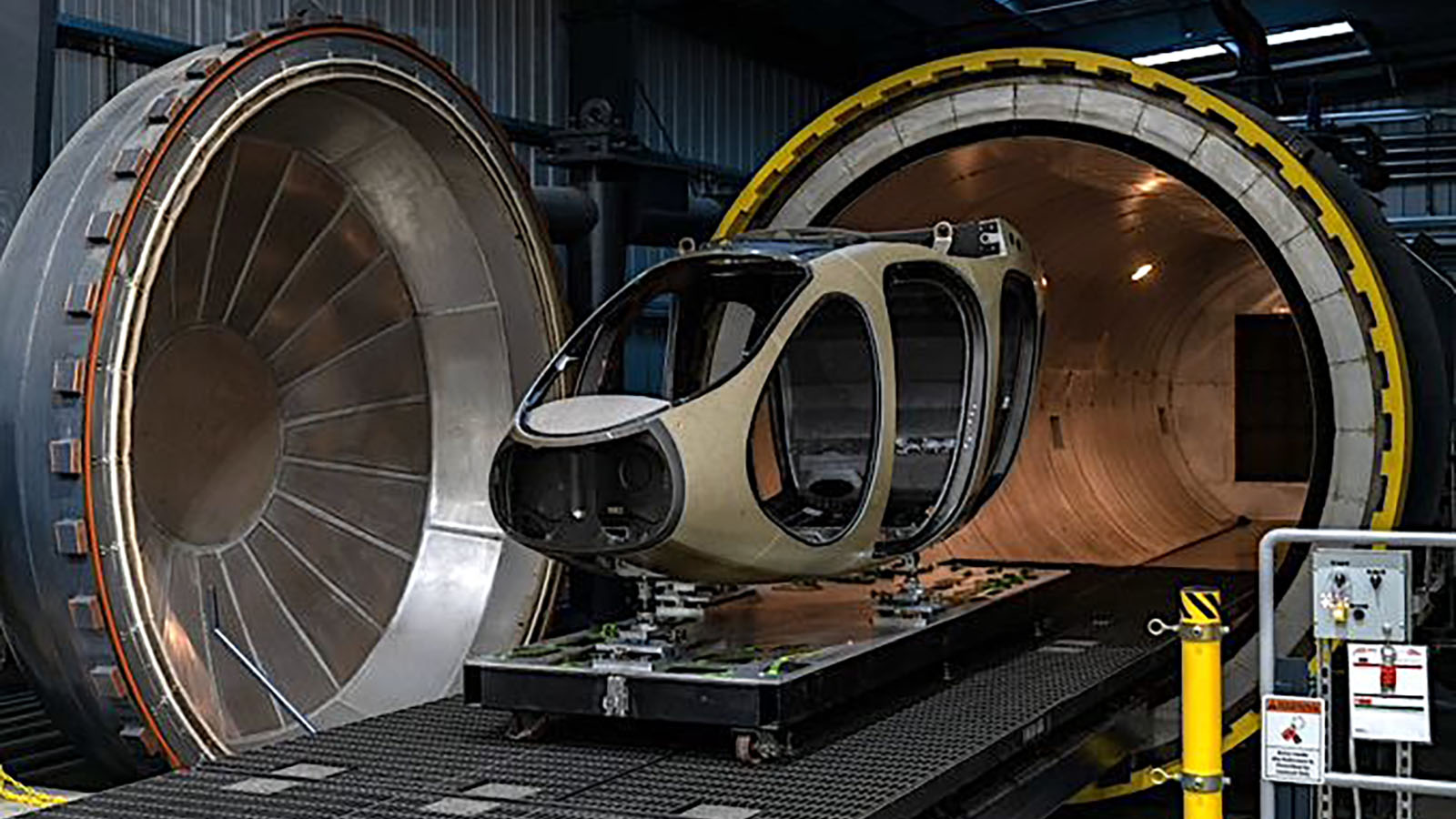

I also checked with Joby about their plans for mass production. The company is currently building pre-production prototypes at its 12,000-square-meter facility in Marina, California.

“The design of our pilot manufacturing facilities draws inspiration from both automotive and aerospace manufacturing, but does not incorporate the level of investment in autonomy you might see in high-rate auto production factories,” Oliver Walker-Jones, head of Joby communication and marketing, told me in an email.

He said the company will try to strike a balance between human expertise and automation, especially in the early stages of production. “For example, we employ both human technicians and robots for fiber placement — depending on the size and geometry of the part — but rely on robots for plasma treating surfaces, applying adhesive and certain inspections.”

In the meantime, Joby is “actively evaluating proposals from a number of states to support the construction of our higher-volume, Phase 1 production facility,” Walker-Jones said.

Get the latest news about advanced air mobility delivered to your inbox every two weeks.

About paul brinkmann

Paul covers advanced air mobility, space launches and more for our website and the quarterly magazine. Paul joined us in 2022 and is based near Kennedy Space Center in Florida. He previously covered aerospace for United Press International and the Orlando Sentinel.

Related Posts

Stay Up to Date

Submit your email address to receive the latest industry and Aerospace America news.