Stay Up to Date

Submit your email address to receive the latest industry and Aerospace America news.

Germany-based company cites decarbonization and industrial support of rival nations

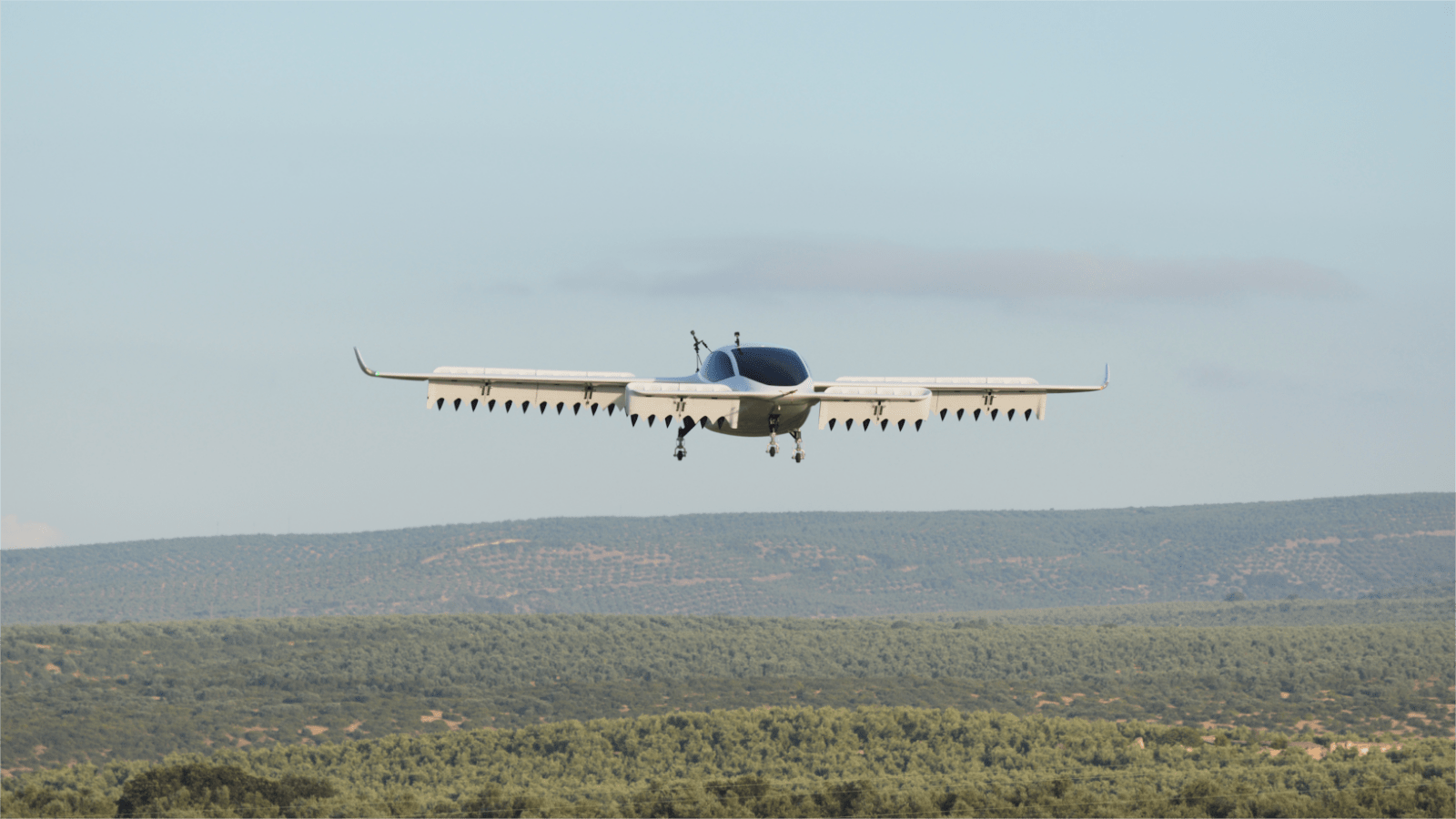

Lilium, the Munich electric aircraft company that all but ran out of cash last month, has retained one of the world’s largest accounting firms, KPMG, in a bid to find a buyer or new investment to bring its ducted-fan Lilium Jets to market.

Lilium announced Nov. 5 that its board has authorized the company to file for insolvency, after two subsidiaries did so with a German court last month. The court appointed a restructuring expert to oversee reorganization of the subsidiaries while Lilium continues to pay employees to assemble the first two of its six-passenger electric aircraft. Also, NASDAQ notified Lilium that trading of the company’s shares will be suspended as of Nov. 6.

So far, no clear path to rescue has emerged. Such insolvency proceedings, like the U.S. Chapter 11 bankruptcy, sometimes lead to spinning off parts of a company.

The Lilium Jet technology is “an entire package that cannot be broke up” into components easily, said Sergio Cecutta, a co-founder of SMG Consulting, the Arizona-based company that maintains the AAM Reality Index that tracks electric aircraft companies around the world.

More about advanced air mobility: Receive the True Mobility newsletter in your inbox.

Lilium, founded in 2015, hopes to resume its plan to fly up to six passengers within and between cities to distances of up to 300 kilometers, and calls itself a “pioneer in regional air mobility.” The first flight of a full-sized Lilium Jet was planned to occur next year, powered by thrust from 30 ducted fans positioned along a main wing and canard. The company has flown unoccupied scale models in Spain.

Lilium found itself in financial straits this year after raising and spending about €1.5 billion ($1.6 billion). Its Lilium GmbH subsidiary focuses on administrative services, while the Lilium eAircraft GmbH subsidiary focuses on design, development, production and certification. The company also has sales and business development subsidiaries that so far are not part of the insolvency in the U.S., U.K, Spain and Switzerland, the company told me in an email.

“I do think they still have a chance to come back from this, but where the additional money is going to come from is a big question mark,” Cecutta told me. Whatever happens, he expects the impact of Lilium’s trouble on the broader electric aircraft industry to be limited, because consolidation has always been expected among the many companies pursuing unique designs.

The insolvency of the subsidiaries was announced on Oct. 24 after Lilium failed to secure loan guarantees from the German government. The company noted in a press release that it had been in “advanced discussions” with France for a guarantee of a €219 million loan “to finance a battery factory and an assembly line in the Southwest of France.” Asked for an update on such discussions, the company declined to comment, saying only that any significant developments would be announced formally.

Austin Moeller, director of equity research and senior analyst with Canaccord Genuity, a Vancouver-based financial services company, said Lilium could still find funding from several places, including U.S. investors or from Saudi Arabia, which placed an order in July for 50 Lilium Jets.

That order was not enough to sway the German government or any other investors as of the insolvency announcement in October. There has been “plenty of opportunity” for new investors to step in, Moeller said, and they haven’t yet.

The state of Bavaria, where Munich is the capital, had earlier approved a loan guarantee for Lilium of €50 million, but that was contingent on the German parliament approving a matching amount. A parliamentary budget committee declined to approve that.

In the press release, Lilium noted that competitors in the field, including those in the U.S., have received government backing.

CEO Klaus Roewe tied the technology to Europe’s commitment to “decarbonization of aviation” and said “while there is no guarantee for success in insolvency proceedings, we hope that the Lilium Jet will get a chance for a fresh start after the self-administration process is completed.”

About paul brinkmann

Paul covers advanced air mobility, space launches and more for our website and the quarterly magazine. Paul joined us in 2022 and is based near Kennedy Space Center in Florida. He previously covered aerospace for United Press International and the Orlando Sentinel.

Related Posts

Stay Up to Date

Submit your email address to receive the latest industry and Aerospace America news.