Space traffic impasse

By Debra Werner|May 2020

Europe and Japan are leading the way toward cleaning Earth orbit of debris; satellite operators around the world must be ready to dodge debris and each other. It’s a chaotic situation that, to some, feels like an abdication of the U.S. government’s traditional leadership role in matters of space at a time when it’s never been more needed. Debra Werner examines the arguments and a potential solution.

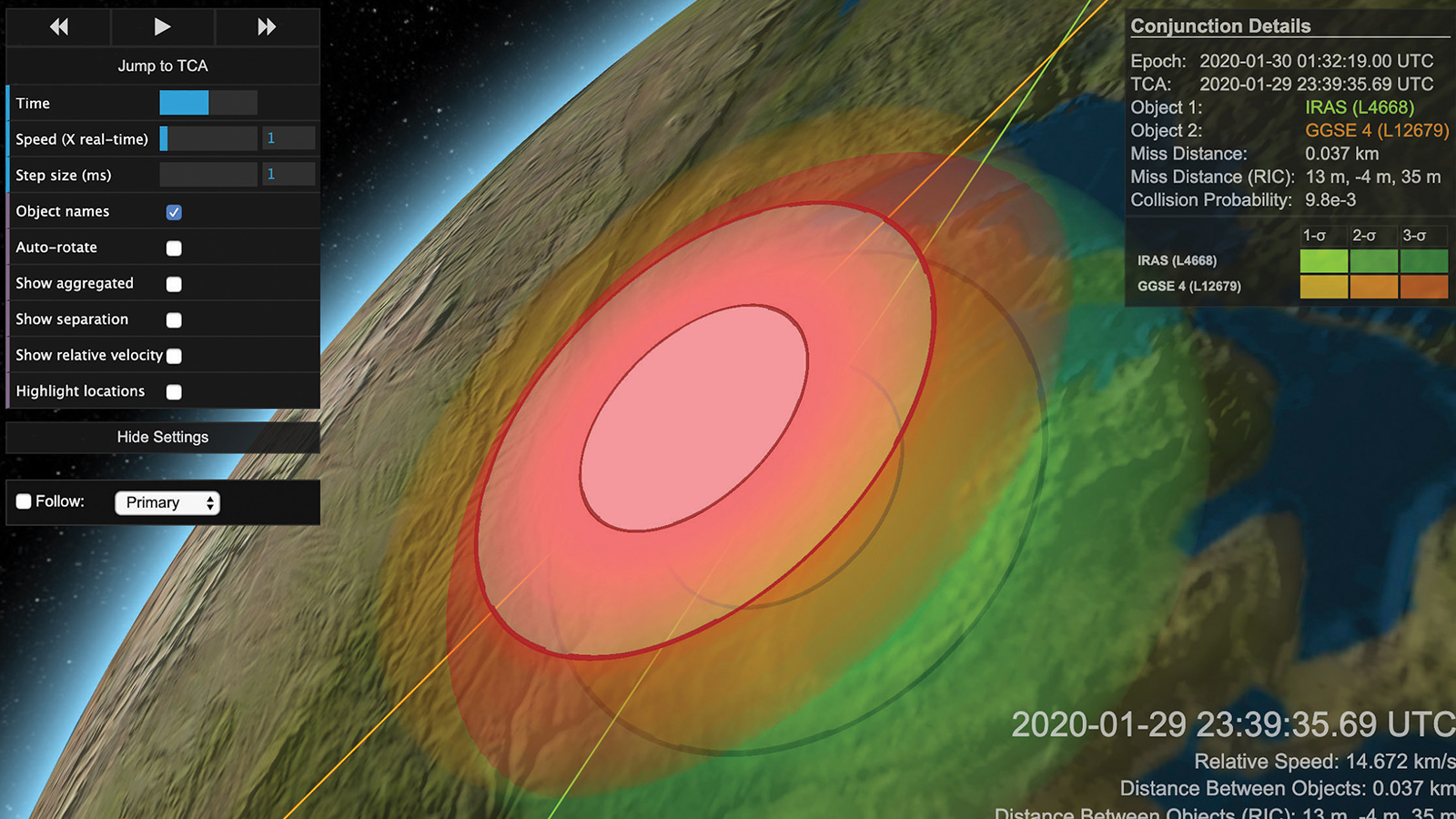

Two satellites abandoned in orbit decades ago by NASA and the U.S. Air Force hurtled toward each other in January at a closing speed of 14.7 kilometers per second or 10 times faster than a bullet from an M16 rifle. A collision could have flung 12,000 satellite fragments into rings of debris along the orbital path of each satellite.

Luckily, the possible conjunction turned out to be just a close call, but those with stakes in space know that the next big collision is coming and that it could be more catastrophic than anything to date. “The question is not if, it’s only when,” says Darren McKnight, who tracks space debris and spacecraft anomalies as a technical director for Centauri Group, an engineering and technology company based in Chantilly, Virginia.

For the moment, there’s not much anyone can do about abandoned satellites or rocket upper stages headed for a dead-on-dead collision except warn nearby satellites to move out of harm’s way. In Asia and Europe, companies backed by space agencies are designing orbiting tow trucks to haul old satellites and rockets back into the atmosphere.

Such backing is not happening in the United States, where the Trump administration’s plan to put the Commerce Department in charge of space traffic management remains stalled without adequate funding and authority from Congress. Today, no one in the U.S. government has the job of advocating for expenditures on such future activities as clearing debris from crowded orbits.

Even worse, in this view, the impasse persists despite the fact that U.S. companies are starting to launch the first satellites in what would be a massive wave of tens of thousands of new satellites destined for low-Earth orbit if today’s bold business plans hold together. Those spacecraft would join 2,300 functioning satellites, not to mention 900,000 pieces of debris ranging in size from cornflakes to 8-metric-ton rocket bodies.

Owners and operators of satellites are doing their best to avoid calamity with a combination of collision warnings from the U.S. government and a growing array of privately run radars and services. U.S. leadership on the international stage through creation of a space traffic management agency will be essential, they say, if the United States is to meet its international treaty obligations and manage increasingly congested orbits.

“U.S. space situational awareness and space traffic management services are failing to address global needs,” says Dan Oltrogge, director of the Center for Space Standards and Innovation at Analytical Graphics Inc., the Pennsylvania company that makes software for tracking satellites and visualizing the orbital environment. “Lack of a cohesive, properly resourced U.S. space traffic management program places the U.S. at risk of losing this vital initiative.”

The handoff

Advocates of a space traffic agency have endured years of frustration waiting for Congress and the executive branch to agree. The Trump administration, like the Obama administration before it, has called for the Defense Department to continue identifying and tracking objects in orbit but to assign another agency — an office of the Commerce Department in Trump’s plan — the responsibility to warn satellite operators in the U.S. and abroad about potential collisions. The Obama administration tried to hand off the work to FAA’s Commercial Space Transportation Office.

Trump’s Space Policy Directive 3 in 2018 also instructed the Commerce Department to work with NASA, NOAA and other federal agencies to develop standards and protocols to make it easier to merge radar and telescope observations.

Since the directive was issued, Commerce and Defense Department managers have been preparing for the transition. A Commerce Department liaison official works at the Combined Space Operations Center, or CSpOC, and the U.S. Space Force’s 18th Space Control Squadron, co-located at Vandenberg Air Force Base in California, where personnel from the U.S. military services and industry monitor large screens to identify objects in orbit, chart orbital paths and notify satellite operators of conjunctions. The military operation, originally focused on space surveillance and missile warning, took on the job of spotting conjunctions for most active satellites after Russia’s defunct Cosmos communications crashed into an Iridium telecommunications satellite in 2009, sending at least a thousand of pieces of debris into orbit.

The Commerce Department-CSpOC liaison is learning how the military spots conjunctions and notifies commercial and international satellite operators. Commerce Department personnel also are participating “in exercises, simulations and war games” to better understand how CSpOC pulls in data from government and commercial space telescopes and radars, a Commerce Department spokeswoman said by email.

Before the Commerce Department can take over collision warnings, though, it needs congressional authority to collect and share space situational awareness data, information on objects and activities in orbit. Plus, the Commerce Department will need immunity from lawsuits and funding to expand its staff, says George Nield, former FAA associate administrator for commercial space transportation and an AIAA fellow.

So far, Congress has not provided any of that. The Trump administration requested $10 million in 2020 funding, an increase of $6 million, to merge the Commerce Department’s Office of Space Commerce with NOAA’s Commercial Remote Sensing Office and give the Office of Space Commerce the additional responsibility of managing space traffic.

Congress did not approve the merger or provide additional funding in the Commerce, Justice, Science and Related Agencies Appropriations Act of 2020. Instead, appropriators gave the Office of Space Commerce and the NOAA Commercial Remote Sensing office the same funding they received in 2019: $1.8 million each. Congress did give the Commerce Department $500,000 to hire the National Academy of Public Administration, a Washington nonprofit group, to perform a six-month study on how the government should organize, fund and regulate civil space traffic management work.

Some in Congress have expressed concern about giving regulatory oversight to the Office of Space Commerce, an organization focused on economic growth without expertise in space operations, safety or regulation. Other lawmakers say they haven’t made up their minds which federal agency should take on space traffic management.

The study is scheduled to be completed in September. Meanwhile, the Trump administration asked Congress for $15 million in its 2021 budget request to hire more staff for the Office of Space Commerce and to work with industry to establish an open architecture data repository. The idea is to create a computer network for space traffic management that draws on government, university and commercial observation of objects in orbit and pairs them with algorithms designed to pinpoint the location of satellites, rockets and debris and to figure out their orbital paths and conjunction risks.

“One of the biggest hurdles in making space transparent and predictable is sharing of observational data,” says Moriba Jah, University of Texas, Austin, associate professor of aerospace engineering and engineering mechanics. “We don’t do that very well,” adds Jah, an AIAA fellow who is helping to plan ASCEND, AIAA’s space conference.

Advocates want the Commerce Department to combine observations from the U.S. military’s space surveillance network with observations of objects in space made by commercially owned sensors.

“Bringing together the operators’ data and observations of their own spacecraft with observation from telescopes and radar, that’s the holy grail,” says Oltrogge of AGI.

Private sector warnings

While the Trump administration and Congress engage in a tug of war over space traffic management oversight, the private sector is increasingly warning satellite operators when and how to maneuver to avoid accidents.

LeoLabs, a Silicon Valley startup, was the first to spot the potential collision of the old satellites in January and to share the news on Twitter. The company operates phased-array radars in Texas, Alaska and New Zealand. Its Kiwi Space Radar built in 2019 on New Zealand’s South Island consists of flat transmit-and-receive panels spanning 1,000 square meters, an area twice the size of a basketball court. The radar continuously emits radio wave pulses and listens for the faint echo of waves bouncing off objects.

These radars feed data into a cloud-based network where software automatically detects the location and direction of anything in orbit softball-size or larger once or twice a day. Within the network, algorithms identify satellites and debris at risk of colliding in the next seven days. LeoLabs allots additional radar time to the objects at risk of collision, observing each one as many as six times a day to further pinpoint its location and orbit.

Another commercial firm heavily involved in space traffic safety is Peraton, the government contractor formed in 2017 from the assets of Harris Corp.’s Government Services business in Herndon, Virginia. NOAA, the Space Force and other government agencies track approximately 300 satellites with the help of Peraton’s OS/Comet software, a tool that helps satellite operators decide when to move their spacecraft to avoid potential collisions and how to ensure maneuvers don’t put one satellite on a collision course with another.

Even during the coronavirus pandemic, Peraton employees are taking social distancing measures while continuing to work alongside personnel from the Defense Department, National Reconnaissance Agency and NASA in mission control centers, says Dean Bellamy, Peraton space strategies senior director and a retired U.S. Air Force colonel.

Before LeoLabs and Peraton got into the business, the world’s largest satellite operators formed the Space Data Association, a nonprofit based on the Isle of Man between England and Ireland to share satellite information. SDA was coincidentally formed in 2009, the same year as the Iridium-Cosmos crash. SDA members predict the future positions of their spacecraft and feed the information along with any planned maneuvers into the group’s database operated by AGI. AGI forwards the information to the 18th Space Control Squadron.

“We realized that we had the best information about our own assets,” says Mark Dickinson, SDA chairman and operations vice president for Inmarsat, the London-based telecommunications satellite fleet operator. SDA’s corporate and government members, including NOAA, NASA and European meteorological satellite operator Eumetsat, control 52% of the working satellites in geostationary orbit and 32% of the working satellites in low- and medium-Earth orbit.

Operators also often track their own satellites in low-Earth orbit with GPS receivers. Planet, the San Francisco Earth-imaging company, also mounts a low-power ultra-high-frequency radio on the 140 shoebox-size satellites in its fleet. The radios act as transponders, revealing each cubesat’s position and the direction it’s pointed, said Robbie Schingler, Planet chief strategy officer, speaking at the Satellite 2020 conference in Washington, D.C., in March.

In geostationary orbit, satellite operators often rely on techniques like ranging, or finding the location of an object by measuring the time it takes for light or radio waves to reach it and travel back. For help analyzing conjunctions and planning maneuvers, they also turn to companies like AGI.

AGI software merges satellite operator ranging measurements with observations from commercial radars and telescopes around the world to better predict where spacecraft will be when, their ephemerides. For SDA, analysts track space objects on large screens and analyze collision risks in the firm’s Commercial Space Operations Center at AGI’s Pennsylvania headquarters. The Space Data Center compares the ephemerides of all SDA member satellites against everything else in the Space Force’s public catalog.

While these commercial products and services help the individual satellite operators who pay for them, experts say a more comprehensive space traffic management system is needed.

“As we get thousands more objects in space, we have to focus on improving positional knowledge so we can reduce false alarms,” says AGI’s Oltrogge, who is also the program manager for the Space Data Center, the Space Data Association’s cloud-based computing environment, designed and operated by AGI.

Some want a space traffic management network that expands on the Space Data Association’s model of operators sharing what they know about the locations of their own spacecraft. This would require merging data from government and commercial satellite operators with observations from ground-based and satellite telescopes and radars around the world. To determine a single satellite’s precise orbit requires multiple sightings, preferably by different radars and telescopes. Even then, a satellite maneuver, change in solar radiation or increase in drag caused by unfolding solar panels can throw off calculations.

“The only way to get good data is to have operators tell me where they are,” says Dickinson, the SDA chairman.

Operators often have the best information on their own satellites, but they still don’t know the precise location. They narrow it down to an elliptical area called a covariance. The size of the covariance depends on many factors like when and how the object was last detected. News that two satellites are on a collision course really means that the covariances will overlap.

The size of the covariances matter for figuring out the likelihood of a collision. False alarms cause satellite operators to maneuver and burn fuel unnecessarily. “One of the biggest complaints of satellite operators is they don’t know how good the data is,” says Dan Ceperley, LeoLabs co-founder and CEO.

As for the scope of the traffic challenge, the wild card is whether many thousands of new satellites will indeed be launched.

SpaceX is launching 60 satellites at a time into its Starlink global broadband constellation, which could include as many as 42,000 satellites, according to paperwork filed with the International Telecommunications Union, the United Nations agency in Geneva that assigns satellite communications frequencies and orbital slots.

Competitor OneWeb, meanwhile, sent 72 satellites into its constellation before requesting Chapter 11 bankruptcy court protection in March after its primary backer Japanese conglomerate Softbank declined to invest more money in the London-based startup. And Amazon has filed paperwork to operate as many as 3,236 satellites in a constellation called Kuiper.

Flood of conjunction warnings

More satellites in orbit means more potential collisions with other satellites and debris. Today, a typical satellite owner and operator might receive a couple of conjunction warning messages every few days. “In the future, that’s going to increase by at least a factor of 10,” says Andrew Abraham, an engineering manager at the Center for Orbital and Reentry Debris Studies at the Aerospace Corp., a federally funded research company in Los Angeles.

The Aerospace Corp. hopes to reduce the frequency of conjunction warnings by helping satellite operators and regulators better pinpoint the location of spacecraft. The Aerospace Corp. plans to flight test a prototype transponder next year, one roughly the size of a deck of cards. The device would broadcast the identity of its host satellite and precise orbital location. The goal is to create a digital license plate so the satellite isn’t simply “a blob on a radar screen,” says Abraham.

The start of daily operations in March of the Space Fence, a radar with a basketball-court-size receiver array and a tennis-court-size transmitter array on Kwajalein Atoll, one of the Marshall Islands, has added to concerns that the floodgates of conjunction warnings are about to open. Built by Lockheed Martin and operated by the Space Force, the Space Fence’s S-band radar could detect 10 times as many objects in low-Earth orbit as the other radars and telescopes around the world that make up the U.S. military’s Space Surveillance Network.

Government and industry managers also take different views of transparency in terms of information sharing. Because national security, not transparency, is the Space Force’s main objective, it doesn’t reveal the size of satellite covariances or specific observations that prompt conjunction alerts. Without that information, satellite operators have trouble determining whether they need to maneuver and if so, how far.

By contrast, the private sector embraces transparency. When AGI warns operators of potential collisions, it points to extensive data behind its conclusions, including observations of commercial radars and telescopes to supplement the Space Force catalog of expected orbits for satellites and baseball-sized debris or larger.

Similarly, LeoLabs offers customers access to a computer dashboard with multiple daily updates. For the near miss in January, LeoLabs’ dashboard displayed about a one in 100 chance of collision. The dashboard also revealed how radar updates in the days leading up to the close approach highlighted the risk of a collision.

No space agency or company as yet knows how to avert a dead-on-dead collision of large satellites or debris, but startups Astroscale of Tokyo and ClearSpace of Switzerland are building satellites and robotic arms that with adequate lead time might do so. With funding from the European Space Agency, ClearSpace leads a consortium of European companies preparing to catch and drag into the atmosphere a 100-kilogram Vespa rocket payload adapter. Astroscale, meanwhile, has funding from JAXA, the Japan Aerospace Exploration Agency, to inspect a discarded Japanese rocket upper stage as a precursor to a future debris-removal mission.

“Where is the United States government in this? Nowhere because that’s nobody’s job,” says Nield, the former FAA official. “Nobody is responsible for looking at that. That’s why you need a lead agency.”